Honda 2007 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

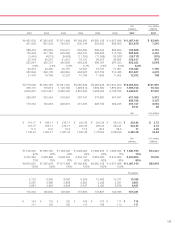

126

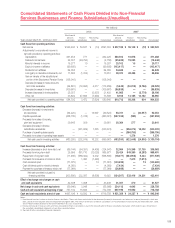

Notes:

(1) The consolidated financial statements as of and for the year

ended March 31, 2007 have been translated into United

States dollars at the rate of ¥118.05 = U.S.$1, the approxi-

mate exchange rate prevailing on the Tokyo Foreign

Exchange Market on March 31, 2007. Those U.S. dollar

amounts presented in the consolidated financial statements

and related notes are included solely for the reader. This

translation should not be construed as a representation that

all the amounts shown could be converted into U.S. dollars.

(2) Net income per common (or American depositary) share

amounts are computed based on Statement of Financial

Accounting Standards (SFAS) No. 128, “Earnings per

Share.” All net income per common (or American deposi-

tary) share data presented prior to fiscal 1998 has been

restated to conform with the provisions of SFAS No. 128.

(3) Effective fiscal 2000, due to the change in method of busi-

ness segment categorization, all prior years’ unit sales

under Sales progress have been restated to reflect the

change: i.e., unit sales of all-terrain vehicles (ATVs) are now

included in Motorcycles, but were previously included in

Power Products.

(4) Previously, revenue from domestic sales of general-purpose

engines to customers who install them in products that are

subsequently exported were recorded as overseas sales.

However, owing to various factors including changes in

transaction formats and contract terms, as of fiscal 2002,

such sales are now recorded as domestic sales. The sales

amount from such sales for fiscal 2002 amounted to ¥5,468

million.

(5) Certain gains and losses on sale and disposal of property,

plant and equipment, which were previously recorded in

other income (expenses), have been reclassified to selling,

general and administrative expenses in the year ended

March 31, 2004. In addition, net realized gains and losses

on interest rate swap contracts not designated as account-

ing hedges by finance subsidiaries, which were previously

recorded in cost of sales, have been reclassified to and

included in other income (expenses)–other. Operating

income prior to fiscal 2003 has been presented to conform

with the reclassifications mentioned above.

(6) On April 26, 2006, the Board of Directors declared a two-

for-one stock split of the Company’s common stock. All

shareholders of record on June 30, 2006 will receive one

additional share of common stock for each share on July 1,

2006. Information pertaining to shares and earnings per

share has been restated in the accompanying consolidated

financial statements and notes to the consolidated financial

statements to reflect this split.

(7) The Company executed a two-for-one stock split for the

Company’s common stock effective July 1, 2006. All per

share information has been adjusted retroactively for all

periods presented to reflect this stock split.

(8) Certain revisions for misclassifications and reclassifications

have been made to the prior years’ consolidated financial

statements to conform to the presentation used for the

fiscal year ended March 31, 2007.

(a) Minority interest in income, which were included in

other expenses-other, has been revised to be disclosed

independently in consolidated statements of income.

(b) The long-term portion of deferred tax liabilities and

deferred tax assets related to the lease transactions of

finance subsidiaries, which were classified in other current

liabilities and deferred income taxes, have been revised to

be classified in other liabilities and other assets,

respectively.

(c) The long-term portion of accrued expenses and prepaid

expenses related to pension benefit plans, which were

included in accrued expenses and other current assets

have been revised to be classified in other liabilities and

other assets, respectively. The long-term portion of

deferred tax liabilities, which were included in other current

liabilities, and deferred tax assets, have also been revised

to classified in other liabilities and other assets.

(d) The long-term portion of prepaid expenses, deferred

income and accrued expenses related to extended vehicle

service contracts of the subsidiaries in the United States,

which were included in other current assets, trade

payables accounts and accrued expenses, respectively,

have been revised to be classified in other liabilities and

other assets. The long-term portion of related deferred tax

liabilities, which were included in other current liabilities,

and deferred income taxes have also been revised to be

classified in other liabilities and other assets.

H