Honda 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

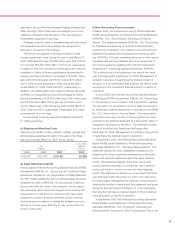

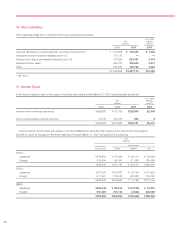

Yen (millions)

2005 2005

Previously After

reported (a) (b) (d) (e) Total revised

Cash flows from operating activities

Adjustments to reconcile net income to

net cash provided by operating activities:

Minority interest in income — 11,559 11,559 11,559

Decrease (increase) in assets:

Other current assets (11,797) 14,332 7,745 22,077 10,280

Other assets (52,198) (14,332) (11,600) (25,932) (78,130)

Increase (decrease) in liabilities:

Trade accounts and notes payable 76,338 (9,850) (9,850) 66,488

Accrued expenses 71,469 (26,239) (4,129) (30,368) 41,101

Other liabilities 19,826 2,722 26,239 17,834 46,795 66,621

Other, net 17,320 (11,559) (11,559) 5,761

Net cash provided by operating activities 782,448 2,722 — — — 2,722 785,170

Cash flows from investing activities:

Payment for purchase of available-for-sale securities (1,608) (95,221) (95,221) (96,829)

Proceeds from sales of available-for-sale securities 13,140 141,113 141,113 154,253

Net cash used in investing activities (843,677) — 45,892 — — 45,892 (797,785)

Cash flows from financing activities:

Cash dividends paid to minority interests — (2,722) (2,722) (2,722)

Net cash provided by financing activities 97,495 (2,722) — — — (2,722) 94,773

Effect of exchange rate changes on

cash and cash equivalents 12,851 (457) (457) 12,394

Net change in cash and cash equivalents 49,117 — 45,435 — — 45,435 94,552

Cash and cash equivalents at beginning of year 724,421 (46,187) (46,187) 678,234

Cash and cash equivalents at end of year 773,538 — (752) — — (752) 772,786

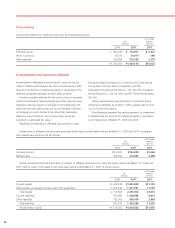

4. Finance Subsidiaries–Receivables and Securitizations

Finance subsidiaries-receivables represent finance receiv-

ables generated by finance subsidiaries. Certain finance

receivables related to sales of inventory are included in trade

receivables and other assets in the consolidated balance

sheets. Finance receivables include wholesale financing to

dealers and retail financing and direct financing leases to

consumers.

The allowance for credit losses is maintained at an

amount management deems adequate to cover estimated

losses on finance receivables. The allowance is based on

management’s evaluation of many factors, including current

economic trends, industry experience, inherent risks in the

portfolio and the borrower’s ability to pay.

Finance subsidiaries of the Company purchase insurance

to cover a substantial amount of the estimated residual value

of vehicles leased to customers. The allowance for losses on

lease residual values is maintained at an amount manage-

ment deems adequate to cover estimated losses on the

uninsured portion of the vehicles’ lease residual values. The

allowance is also based on management’s evaluation of

many factors, including current economic conditions,

industry experience and the finance subsidiaries’ historical

experience with residual value losses.