Honda 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

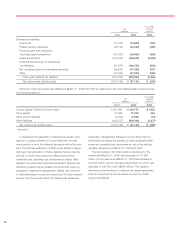

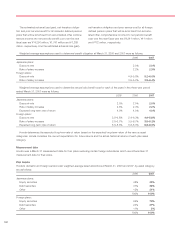

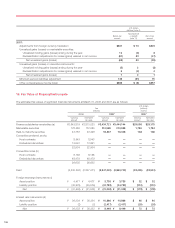

The estimated actuarial loss (gain), net transition obliga-

tion and prior service benefit for all domestic defined pension

plans that will be amortized from accumulated other compre-

hensive income into net periodic benefit cost over the next

fiscal year are ¥14,290 million, ¥1,741 million and ¥7,289

million, respectively. And the estimated actuarial loss (gain),

net transition obligation and prior service cost for all foreign

defined pension plans that will be amortized from accumu-

lated other comprehensive income into net periodic benefit

cost over the next fiscal year are ¥4,341 million, ¥41 million

and ¥772 million, respectively.

Weighted-average assumptions used to determine benefit obligation at March 31, 2006 and 2007 were as follows:

2006 2007

Japanese plans:

Discount rate 2.0% 2.0%

Rate of salary increase 2.2% 2.3%

Foreign plans:

Discount rate 4.9–5.8% 5.2–6.0%

Rate of salary increase 3.5–5.2% 2.9–6.4%

Weighted-average assumptions used to determine net periodic benefit cost for each of the years in the three-year period

ended March 31, 2007 were as follows:

2005 2006 2007

Japanese plans:

Discount rate 2.0% 2.0% 2.0%

Rate of salary increase 2.3% 2.3% 2.2%

Expected long-term rate of return 4.0% 4.0% 4.0%

Foreign plans:

Discount rate 5.8–6.8% 5.4–6.3% 4.9–5.8%

Rate of salary increase 3.5–6.7% 3.5–6.7% 3.5–5.2%

Expected long-term rate of return 6.8–8.5% 6.8–8.0% 6.8–8.0%

Honda determines the expected long-term rate of return based on the expected long-term return of the various asset

categories. Honda considers the current expectations for future returns and the actual historical returns of each plan asset

category.

Measurement date

Honda uses a March 31 measurement date for their plans excluding certain foreign subsidiaries which use a December 31

measurement date for their plans.

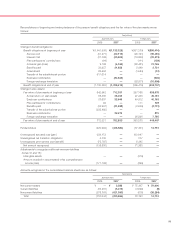

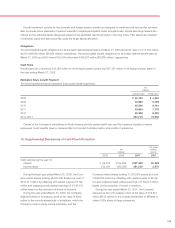

Plan Assets

Honda’s domestic and foreign pension plan weighted-average asset allocations at March 31, 2006 and 2007, by asset category

are as follows:

2006 2007

Japanese plans:

Equity securities 48% 43%

Debt securities 37% 36%

Other 15% 21%

100% 100%

Foreign plans:

Equity securities 65% 70%

Debt securities 24% 27%

Other 11% 3%

100% 100%