Honda 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

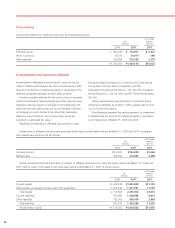

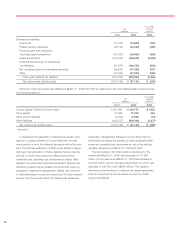

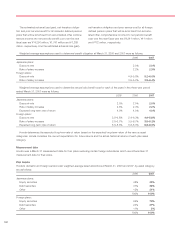

U.S. dollars

Yen (millions)

(millions) (note 2)

2006 2007 2007

Deferred tax liabilities:

Inventories (11,018) (13,650) (116)

Prepaid pension expenses (29,019) (34,422) (292)

Property, plant and equipment,

excluding lease transactions (67,263) (59,680) (506)

Lease transactions (357,578) (405,516) (3,435)

Undistributed earnings of subsidiaries

and affiliates (81,675) (106,273) (900)

Net unrealized gains on marketable securities (44,580) (41,039) (347)

Other (52,059) (27,262) (230)

Total gross deferred tax liabilities (643,192) (687,842) (5,826)

Net deferred tax (liability) asset ¥(150,749) ¥0(31,120) $0,(263)

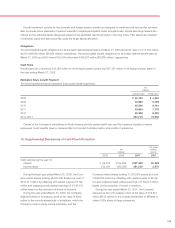

Deferred income tax assets and liabilities at March 31, 2006 and 2007 are reflected in the consolidated balance sheets under

the following captions:

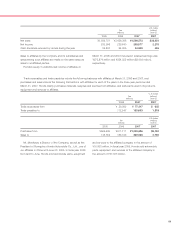

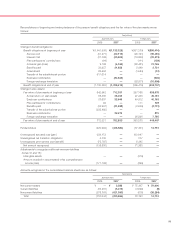

U.S. dollars

Yen (millions)

(millions) (note 2)

2006* 2007 2007

Current assets—Deferred income taxes ¥(221,294 ¥(215,172 $(1,823

Other assets 37,686 71,583 606

Other current liabilities (3,002) (1,827) (15)

Other liabilities (406,727) (316,048) (2,677)

Net deferred tax (liability) asset ¥(150,749) ¥0(31,120) $0,(263)

* See note 3.

In assessing the realizability of deferred tax assets, man-

agement considers whether it is more likely than not that

some portion or all of the deferred tax assets will not be real-

ized. The ultimate realization of deferred tax assets is depen-

dent upon the generation of future taxable income over the

periods in which those temporary differences become

deductible and operating loss carryforwards utilized. Man-

agement considered the scheduled reversal of deferred tax

liabilities, projected future taxable income and tax planning

strategies in making this assessment. Based upon the level

of historical taxable income and projections for future taxable

income over the periods which the deferred tax assets are

deductible, management believes it is more likely than not

that Honda will realize the benefits of these deductible differ-

ences and operating loss carryforwards, net of the existing

valuation allowances at March 31, 2006 and 2007.

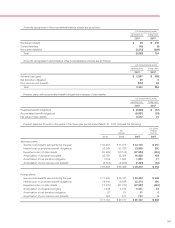

The net change in the total valuation allowance for the

years ended March 31, 2005 was decrease of ¥11,989

million, for the year ended March 31, 2006 was increase of

¥10,502 million, and for the year ended March 31, 2007 was

decrease of ¥34,792 million ($295 million). The valuation

allowance primarily relates to deferred tax assets associated

with net operating loss carryforwards incurred by certain

foreign subsidiaries.