Honda 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

2. Basis of Translating Financial Statements

The consolidated financial statements are expressed in Japa-

nese yen. However, the consolidated financial statements as

of and for the year ended March 31, 2007 have been trans-

lated into United States dollars at the rate of ¥118.05 =

U.S.$1, the approximate exchange rate prevailing on the

Tokyo Foreign Exchange Market on March 31, 2007. Those

U.S. dollar amounts presented in the consolidated financial

statements and related notes are included solely for the

reader. This translation should not be construed as a repre-

sentation that all the amounts shown could be converted into

U.S. dollars.

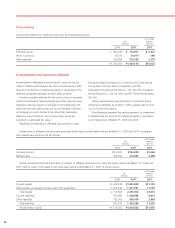

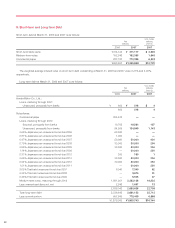

3. Revisions of Classifications

finance subsidiaries, which were classified in other current

liabilities and deferred income taxes, have been revised to be

classified in other liabilities and other assets, respectively.

(d) The long-term portion of accrued expenses and prepaid

expenses related to pension benefit plans, which were

included in accrued expenses and other current assets have

been revised to be classified in other liabilities and other

assets, respectively. The long-term portion of deferred tax

liabilities, which were included in other current liabilities, and

deferred tax assets, have also been revised to classified in

other liabilities and other assets.

(e) The long-term portion of prepaid expenses, deferred

income and accrued expenses related to extended vehicle

service contracts of the subsidiaries in the United States,

which were included in other current assets, trade payables

accounts and accrued expenses, respectively, have been

revised to be classified in other liabilities and other assets.

The long-term portion of related deferred tax liabilities, which

were included in other current liabilities, and deferred income

taxes have also been revised to be classified in other

liabilities and other assets.

(f) Certain consolidated subsidiaries’ assets, which were clas-

sified in investment and advances—other, have been revised

to be classified in other assets.

Certain revisions for misclassifications have been made to

the prior years’ consolidated financial statements.

(a) Minority interest and minority interest in income, which

were included in other liabilities and other expenses-other,

respectively, have been revised to be disclosed indepen-

dently in consolidated balance sheets and consolidated

statements of income. Minority interest in income and cash

dividends paid to minority interests, which were included in

other liabilities and other, net, in cash flows from operating

activities, have been revised to be disclosed independently in

cash flows from operating activities and cash flows from

financing activities, respectively, in the consolidated state-

ments of cash flows.

(b) Auction rate securities, which were classified as cash

equivalents, have been revised to be classified as available-

for-sale securities due within one year, which are included in

other current assets in the consolidated balance sheets.

Payment for purchase of auction rate securities and pro-

ceeds from sales of auction rate securities have been revised

to be classified in payment for purchase of available-for-sale

securities and proceeds from sales of available-for-sale

securities in the consolidated statements of cash flows,

respectively.

(c) The long-term portion of deferred tax liabilities and

deferred tax assets related to the lease transactions of