Honda 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

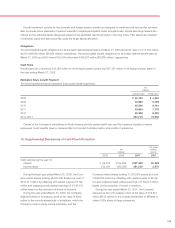

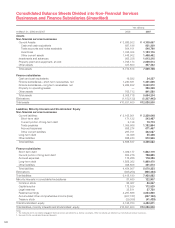

113

As of and for the year ended March 31, 2007

Yen (millions)

Financial Power Product

Motorcycle Automobile Services and Other Segment Reconciling

Business Business Business Businesses Total Items Consolidated

Net sales and other operating revenue:

External customers ¥1,370,617 ¥8,889,080 ¥0,409,701 ¥417,742 ¥11,087,140 ¥000,0(—.¥11,087,140

Intersegment ——3,633 21,168 24,801 (24,801) —

To t a l 1,370,617 8,889,080 413,334 438,910 11,111,941 (24,801) 11,087,140

Cost of sales, SG&A and R&D expenses 1,270,009 8,289,537 297,792 402,724 10,260,062 (24,801) 10,235,261

Gain on transfer of the substitutional portion

of the Employee’s Pension Funds — — —— —— —

Segment income 100,608 599,543 115,542 36,186 851,879 —851,879

Equity in income of affiliates 23,380 78,537 —1,500 103,417 —103,417

Assets 1,161,707 5,437,709 5,694,204 338,671 12,632,291 (595,791) 12,036,500

Investments in affiliates 109,538 359,811 —15,065 484,414 —484,414

Depreciation and amortization 40,576 309,877 10,676 10,359 371,488 —371,488

Capital expenditures 68,880 540,859 367,728 16,394 993,861 —993,861

Provision for credit and lease residual losses

on finance subsidiaries-receivables ¥0,000,0—.¥0,000,0—.¥0,044,128 ¥000,0—.¥00,044,128 ¥000,0(—.¥00,044,128

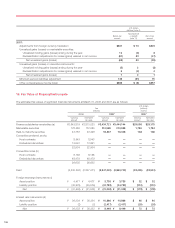

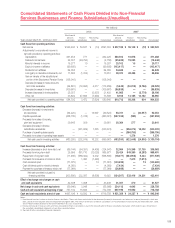

As of and for the year ended March 31, 2007

U.S. dollars (millions) (note2)

Financial Power Product

Motorcycle Automobile Services and Other Segment Reconciling

Business Business Business Businesses Total Items Consolidated

Net sales and other operating revenue:

External customers $11,611 $75,300 $03,471 $3,537 $093,919 $000—.$093,919

Intersegment ——30 180 210 (210) —

To t a l 11,611 75,300 3,501 3,717 94,129 (210) 93,919

Cost of sales, SG&A and R&D expenses 10,759 70,221 2,522 3,411 86,913 (210) 86,703

Gain on transfer of the substitutional portion

of the Employee’s Pension Funds — — —— —— —

Segment income 852 5,079 979 306 7,216 —7,216

Equity in income of affiliates 198 665 —13 876 —876

Assets 9,841 46,063 48,235 2,869 107,008 (5,047) 101,961

Investments in affiliates 928 3,048 —127 4,103 —4,103

Depreciation and amortization 344 2,625 90 88 3,147 —3,147

Capital expenditures 583 4,582 3,115 139 8,419 —8,419

Provision for credit and lease residual losses

on finance subsidiaries-receivables $0

0,

0—.$0

0,

0—.$00,374 — $000,374 $000—.$000,374

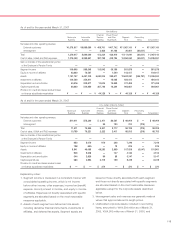

Explanatory notes:

1. Segment income is measured in a consistent manner with

consolidated operating income, which is net income

before other income, other expenses, income tax (benefit)

expense, minority interest in income, and equity in income

of affiliates. Expenses not directly associated with specific

segments are allocated based on the most reasonable

measures applicable.

2. Assets of each segment are defined as total assets,

including derivative financial instruments, investments in

affiliates, and deferred tax assets. Segment assets are

based on those directly associated with each segment

and those not directly associated with specific segments

are allocated based on the most reasonable measures

applicable except for the corporate assets described

below.

3. Intersegment sales and revenues are generally made at

values that approximate arm’s-length prices.

4. Unallocated corporate assets, included in reconciling

items, amounted to ¥464,504 million as of March 31,

2005, ¥354,903 million as of March 31, 2006, and