Honda 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

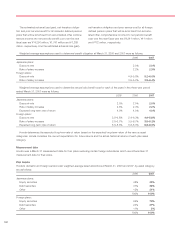

U.S. dollars

(millions) (note 2)

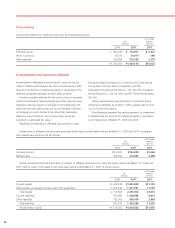

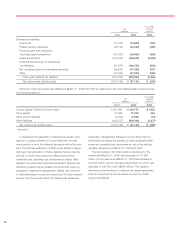

Income taxes

Income before

income taxes Current Deferred Total

2007:

Japanese $1,545 $0,755 $(117) $0,638

Foreign 5,171 1,789 (23) 1,766

$6,716 $2,544 $(140) $2,404

* See note 3.

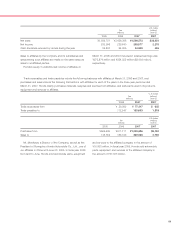

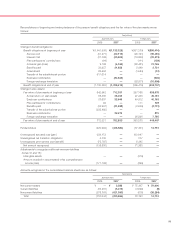

The statutory income tax rate is approximately 40% for each of the years in the three-year period ended March 31, 2007. The

foreign subsidiaries are subject to taxes based on income at rates ranging from 16% to 40%.

The effective tax rate for Honda for each of the years in the three-year period ended March 31, 2007 differs from the

Japanese statutory income tax rate for the following reasons:

2005 2006 2007

Statutory income tax rate 40.0% 40.0% 40.0%

Valuation allowance provided for current year operating losses of subsidiaries 0.5 0.3 0.4

Difference in statutory tax rates of foreign subsidiaries (1.9) (2.3) (3.7)

Reversal of valuation allowance due to utilization of operating loss carryforwards (1.1) (0.8) (0.2)

Research and development credit (2.3) (3.0) (3.3)

Tax authority assessment relating to prior years* 1.8 — —

Other adjustments relating to prior years — 3.1 —

Other 2.9 0.9 2.6

Effective tax rate 39.9% 38.2% 35.8%

* The prior year income taxes in 2005 are due to assessment by the Japanese tax authorities as a result of their transfer pricing audit relating to

the Company’s motorcycle business in Brazil.

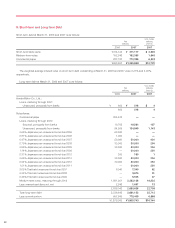

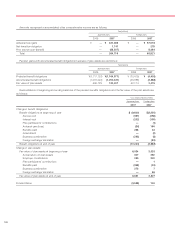

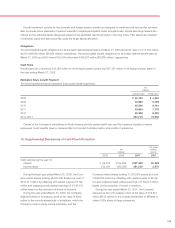

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred tax liabilities

at March 31, 2006 and 2007 are presented below:

U.S. dollars

Yen (millions)

(millions) (note 2)

2006 2007 2007

Deferred tax assets:

Inventories ¥(030,012 ¥0(35,114 $(0,297

Allowance for dealers and customers 141,141 153,328 1,299

Accrued bonus 35,968 40,628 344

Property, plant and equipment 17,817 61,409 520

Foreign tax credit 9,267 10,427 88

Operating loss carryforwards 75,131 39,781 337

Minimum pension liabilities adjustment 68,566 ——

Pension and other postretirement benefits 62,829 210,378 1,782

Other 121,951 141,104 1,196

Total gross deferred tax assets 562,682 692,169 5,863

Less valuation allowance 70,239 35,447 300

Net deferred tax assets 492,443 656,722 5,563