Honda 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

amendment of FASB Statements No. 87, 88, 106, and

132(R)”. This statement amends SFAS No. 87, “Employers’

Accounting for Pensions”, SFAS No. 88, “Employers’

Accounting for Settlements and Curtailments of Defined

Benefit Pension and for Termination Benefits”, SFAS No. 106,

“Employers’ Accounting for Postretirement Benefits Other

Than Pensions”, and SFAS No. 132(R), “Employers’ Disclo-

sures about Pensions and Other Postretirement Benefits”.

This statement requires an employer to recognize the

overfunded or underfunded status as an asset or liability in its

statement of financial position and to recognize changes in

that funded status in comprehensive income in the year in

which the changes occur. This statement replaces SFAS No.

87’s requirement to report at least minimum pension liability

measured as excess at the accumulated benefit obligation

over the fair value at the plan assets. The Company and its

consolidated subsidiaries adopted SFAS No.158 on March

31, 2007. Detailed information about the impact of the adop-

tion of SFAS No. 158 is provided in note 13 to the accompa-

nying consolidated financial statements.

This statement also changes the date at which benefit

obligations are to be measured to the date of the year-end

statement of financial position. The measurement provisions

of this statement are effective for fiscal years ending after

December 15, 2008.

In February 2007, the Financial Accounting Standards

Board (FASB) issued Statement of Financial Accounting

Standards (SFAS) No. 159, “The Fair Value Option for Finan-

cial Assets and Financial Liabilities—including an amendment

of SFAS No.115”. This statement permits entities to choose

to measure at fair value many financial instruments and cer-

tain other items that are not currently required to be mea-

sured at fair value. Subsequent changes in fair value for

designated items will be required to be reported in earnings

in the current period. The statement also establishes presen-

tation and disclosure requirements for similar types of assets

and liabilities measured at fair value. The statement is effec-

tive for financial statements issued for fiscal years beginning

after November 15, 2007, with early adoption being permit-

ted. Management is currently in process of determining

whether to early adopt this statement and quantifying the

financial impact of adoption.

(u) Cumulative Effect of Prior Year Adjustments

In September 2006, the Securities and Exchange Com-

mission (SEC) issued Staff Accounting Bulletin No. 108,

“Considering the Effects of Prior Year Misstatements when

Quantifying Misstatements in Current Year Financial State-

ments” (“SAB No. 108”). SAB No. 108 provides interpretive

guidance on how the effects of the carryover or reversal of

prior year misstatements should be considered in quantifying

current year misstatements for the purpose of materiality

assessment. SAB No. 108 requires that registrants quantify a

current year misstatement using an approach that considers

both the impact of prior year misstatements that remain on

the balance sheet and those that were recorded in the cur-

rent year income statement. The Company historically quan-

tified misstatements and assessed materiality based on a

current year income statement approach. The transition pro-

visions of SAB No. 108 permit the Company to adjust for the

cumulative effect on retained earnings of immaterial errors

related to prior years.

The Company adopted SAB No. 108 effective beginning

of the fiscal year ended March 31, 2007, and adjusted the

items described below in the accompanying consolidated

financial statements as of the beginning of the fiscal year

ended March 31, 2007 to correct the prior year misstate-

ments, which were considered to be immaterial to the con-

solidated statements of income and consolidated balance

sheets in prior years under the income statement approach.

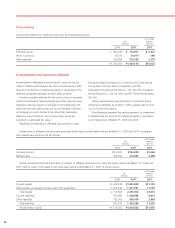

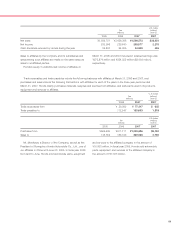

The net impact of these adjustments decreased the

Company’s beginning retained earnings and beginning accu-

mulated other comprehensive loss for 2007 by ¥62,640 mil-

lion ($530 million), net of tax effect of ¥31,235 million ($265

million), and ¥18,149 million ($153 million), respectively, for

the items described below and incremental effects on the

consolidated balance sheet are shown in the table below:

1. The Company and its certain domestic subsidiaries in

Japan historically calculated depreciation of property, plant

and equipment, using a salvage value determined as 5% of

the acquisition cost. However, since the sales proceeds

received for the liquidated assets and their economical value

at the end of its useful life historically have been nominal, the

Company and its certain domestic subsidiaries assessed the

adequacy of the salvage value and concluded that they

should have calculated depreciation using the salvage value

of ¥1 for its properly, plant and equipment. The Company

and its certain domestic subsidiaries recalculated deprecia-

tion expenses retrospectively considering the corrected

salvage value. The reassessment indicated that an accumu-

lated overstatement of property, plant and equipment in the

consolidated financial statements had occured.

2. Equity in income of affiliates should be recognized based

on affiliates’consolidated financial statements in accordance

with U.S. generally accepted accounting principles. However,

the Company historically recognized equity in income of affili-

ates based on the results of operations of the parent-only

financial statements of the affiliates, as the Company