Honda 2007 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

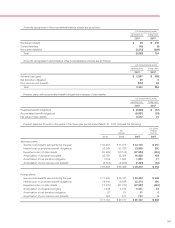

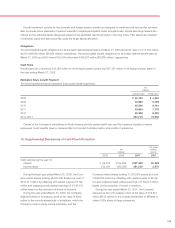

2007, respectively. All amounts recorded in accumulated

other comprehensive income (loss) as year-end are expected

to be recognized in earnings within the next twelve months.

The period that hedges the changes in cash flows related to

the risk of foreign currency rate is at most around two

months.

There are no derivative financial instruments where hedge

accounting has been discontinued due to the forecasted

transaction no longer being probable. The Company

excludes financial instruments’ time value component from

the assessment of hedge effectiveness, of which amount

was ¥421 million loss for the year ended March 31, 2006,

and ¥1,187 million ($10 million) loss for the year ended

March 31, 2007, respectively. There are no derivative

financial instruments that have been assessed as being

ineffectiveness.

Derivative financial instruments not designated as

accounting hedges

Changes in the fair value of derivative financial instruments

not designated as accounting hedges are recognized in

earnings in the period of the change.

Interest rate swap agreements generally involve the

exchange of fixed and floating rate interest payment obliga-

tions without the exchange of the underlying principal

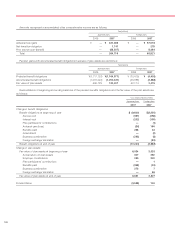

amount. At March 31, 2006 and 2007, the notional principal

amounts of interest rate swap agreements were ¥3,857,748

million and ¥4,198,463 million ($35,565 million), respectively.

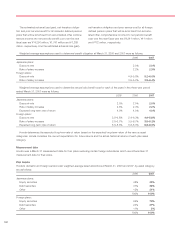

to make future payments in the event of defaults is ¥46,737

million and ¥41,151 million ($349 million), respectively, at

March 31, 2006 and 2007. At March 31, 2007, no amount

has been accrued for any estimated losses under the obliga-

tions, as it is probable that the employees will be able to

make all scheduled payments.

Honda warrants its vehicles for specific periods of time.

Product warranties vary depending upon the nature of the

product, the geographic location of its sale and other factors.

18. Commitments and Contingent Liabilities

At March 31, 2007, Honda had commitments for purchases

of property, plant and equipment of approximately ¥78,027

million ($661 million).

Honda has entered into various guarantee and indemnifi-

cation agreements. At March 31, 2006 and 2007, Honda

has guaranteed ¥46,737 million and ¥41,151 million ($349

million) of bank loan of employees for their housing costs,

respectively. If an employee defaults on his/her loan pay-

ments, Honda is required to perform under the guarantee.

The undiscounted maximum amount of Honda’s obligation

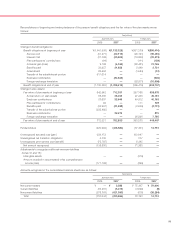

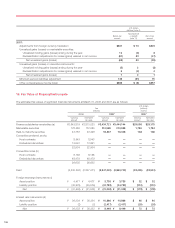

The changes in provisions for those product warranties for each of the years in the two-year period ended March 31, 2007

are as follow:

U.S. dollars

Yen (millions)

(millions) (note 2)

2006 2007 2007

Balance at beginning of year ¥268,429 ¥283,947 $2,405

Warranty claims paid during the period (126,834) (113,454) (961)

Liabilities accrued for warranties issued during the period 125,732 143,280 1,214

Changes in liabilities for pre-existing warranties during the period 332 605 5

Foreign currency translation 16,288 2,725 23

¥283,947 ¥317,103 $2,686

With respect to product liability, personal injury claims or

lawsuits, Honda believes that any judgment that may be

recovered by any plaintiff for general and special damages

and court costs will be adequately covered by Honda’s insur-

ance and reserves. Punitive damages are claimed in certain

of these lawsuits. Honda is also subject to potential liability

under other various lawsuits and claims. In accordance with

Statement of Financial Accounting Standards (SFAS) No. 5,

“Accounting for Contingencies”, Honda has recorded a con-

tingent liability when it is probable that an obligation has

been incurred and the amount of loss can be reasonably

estimated. Honda reviews these pending lawsuits and claims

periodically and adjusts the amounts recorded for these

contingent liabilities, if necessary, by considering the nature

of lawsuits and claims, the progress of the case and the

opinions of legal counsel. Honda does not record liabilities for