Honda 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

benefit pension plan established under the Welfare Pension

Insurance Law. EITF 03-2 requires employers to account for

the separation process of the substitutional portion from the

entire EPF plan (which includes a corporation portion) upon

completion of the transfer to the government of the substitu-

tional portion of the benefit obligation and related plan

assets. The separation process is considered the culmination

of a series of steps in a single settlement transaction. Under

this approach, the difference between the fair value of the

obligation and the assets required to be transferred to the

government should be accounted for and separately

disclosed as a subsidy.

As stipulated in the Japanese Welfare Pension Insurance

Law, the “Honda Employees’ Pension Fund (a confederated

welfare pension fund, the “Fund”)”, of which the Company

and a part of its domestic subsidiaries and affiliates

accounted for under the equity method were members, has

obtained approval from the Japanese Minister of Health,

Labor and Welfare for exemption from benefits obligations

related to past employee service with respect to the substitu-

tional portion of the Fund on July 1, 2005 and completed its

transfer on March 9, 2006. Previously on April 1, 2004, the

Company received approval of exemption from the obligation

for benefits related to future employee services with respect

to the fund. As a result, the Company recognized a gain of

¥228,681 million, which is the difference between the settled

accumulated benefit obligation and the assets transferred to

the government; a gain of ¥56,448 million for the

derecognition of previous accrued salary progression; and

settlement loss of ¥147,113 million for the related unrecog-

nized loss. Collectively, the Company recognized a net gain

of ¥138,016 million for the fiscal year ended March 31, 2006.

The Company and its consolidated subsidiaries adopted

SFAS No.158, “Employers’ Accounting for Defined Benefit

Pension and Other Postretirement Plans—an amendment of

FASB Statements No. 87, 88, 106, and 132(R)” on March 31,

2007, recognized its overfunded or underfunded status as an

asset or liability in its consolidated balance sheets.

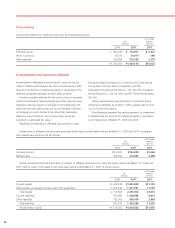

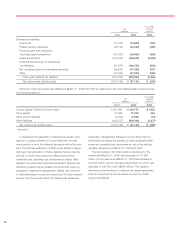

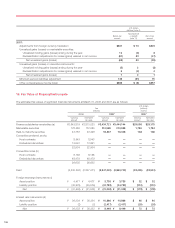

The incremental effect of applying SFAS No. 158 at March 31, 2007, on balance sheet items is as follows:

Yen (millions)

Before After

Application of Application of

SFAS 158 Adjustments SFAS 158

Other assets ¥00,575,851 ¥(011,347 ¥00,587,198

Total assets 12,025,153 11,347 12,036,500

Accrued expenses 847,008 (39,667) 807,341

Total current liabilities 4,327,194 (39,667) 4,287,527

Other liabilities 1,047,374 190,338 1,237,712

Total liabilities 7,280,311 150,671 7,430,982

Accumulated other comprehensive loss, net* (287,842) (139,324) (427,166)

Total stockholders’ equity 4,621,935 (139,324) 4,482,611

U.S. dollars (millions) (note 2)

Before After

Application of Application of

SFAS 158 Adjustments SFAS 158

Other assets $004,878 $(0,096 $004,974

Total assets 101,865 96 101,961

Accrued expenses 7,175 (336) 6,839

Total current liabilities 36,656 (336) 36,320

Other liabilities 8,873 1,612 10,485

Total liabilities 61,672 1,276 62,948

Accumulated other comprehensive loss, net* (2,439) (1,180) (3,619)

Total stockholders’ equity 39,152 (1,180) 37,972

* The incremental effect of applying SFAS No. 158 on accumulated other comprehensive loss, net, includes tax effect of ¥72,881 million ($617 million).