Honda 2007 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

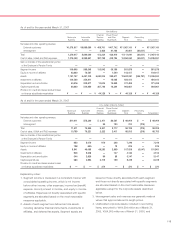

123

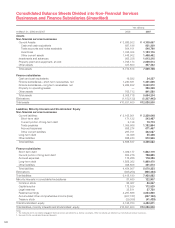

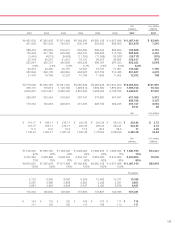

Yen (millions)

2006 2007

Non-financial Non-financial

services Finance Reconciling services Finance Reconciling

Years ended March 31, 2006 and 2007

businesses subsidiaries items Consolidated businesses subsidiaries items Consolidated

Cash flows from operating activities:

Net income

¥(543,200 ¥(053,847 ¥00,0(14) ¥597,033 ¥(537,186 ¥(055,149 ¥00,0(13) ¥0592,322

Adjustments to reconcile net income to

net cash provided by operating activities:

Depreciation

261,454 771 — 262,225 360,812 10,676 —371,488

Deferred income taxes

22,037 (24,793) — (2,756) (35,483) 19,035 —(16,448)

Minority interests in income

15,277 10 — 15,287 20,102 15 —20,117

Equity in income of affiliates

(99,605) — — (99,605) (103,417) ——(103,417)

Dividends from affiliates

64,055 — — 64,055 54,849 ——54,849

Loss (gain) on derivative instruments, net

11,683 (1,332) — 10,351 28,370 28,466 —56,836

Gain on transfer of the substitutional

portion of the Employees’ Pension Funds

(138,016) — — (138,016) ——— —

Decrease (increase) in trade accounts

and notes receivable

(44,881) (72,695) 4,317 (113,259) (5,445) (34,318) (9,766) (49,529)

Decrease (increase) in inventories

(109,661) — — (109,661) (96,839) ——(96,839)

Increase (decrease) in trade payables

25,357 — (3,937) 21,420 41,965 —(3,779) 38,186

Other, net

33,892 47,664 (7,990) 73,566 8,613 14,185 14,162 36,960

Net cash provided by operating activities

584,792 3,472 (7,624) 580,640 810,713 93,208 604 904,525

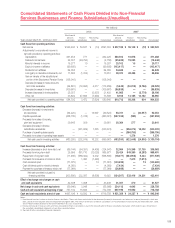

Cash flows from investing activities:

Decrease (increase) in investments

and advances

(64,220) — 14,697 (49,523) 93,311 —(40,957) 52,354

Capital expenditures

(458,705) (1,316) — (460,021) (597,025) (933) —(597,958)

Proceeds from sales of property,

plant and equipment

39,645 306 — 39,951 20,364 277 —20,641

Decrease (increase) in finance

subsidiaries–receivables

— (231,909) 1,535 (230,374) —(256,274) 16,052 (240,222)

Purchase of operating lease assets

—————(366,795) —(366,795)

Proceeds from sales of operating lease assets

—————1,276 —1,276

Net cash used in investing activities

(483,280) (232,919) 16,232 (699,967) (483,350) (622,449) (24,905) (1,130,704)

Cash flows from financing activities:

Increase (decrease) in short-term debt, net

(66,144) (54,391) (4,406) (124,941) 32,964 241,349 31,750 306,063

Proceeds from long-term debt

25,995 851,710 (12,028) 865,677 25,424 949,360 (5,293) 969,491

Repayment of long-term debt

(11,485) (566,422) 9,302 (568,605) (18,077) (664,906) 5,444 (677,539)

Proceeds from issuance of common stock

— 1,490 (1,490) — —7,613 (7,613) —

Cash dividends paid

(71,075) — 14 (71,061) (140,495) —13 (140,482)

Cash dividends paid to minority interests

(4,083) — — (4,083) (7,434) ——(7,434)

Payment for purchase of treasury stock, net

(77,064) — — (77,064) (26,689) ——(26,689)

Net cash provided by (used in)

financing activities

(203,856) 232,387 (8,608) 19,923 (134,307) 533,416 24,301 423,410

Effect of exchange rate changes on cash

and cash equivalents

42,398 1,008 — 43,406 31,057 470 —31,527

Net change in cash and cash equivalents

(59,946) 3,948 — (55,998) 224,113 4,645 —228,758

Cash and cash equivalents at beginning of year

757,142 15,644 — 772,786 697,196 19,592 —716,788

Cash and cash equivalents at end of year

¥(697,196 ¥(019,592 ¥00(0,—.¥716,788 ¥(921,309 ¥(024,237 ¥00,(0—.¥0945,546

Notes:

1. Non-financial services businesses lend to finance subsidiaries. These cash flows are included in the decrease (increase) in investments and advances, increase (decrease) in short-term

debt, proceeds from long-term debt, and repayment of longterm debt. The amount of the loans to finance subsidiaries is a ¥13,242 million increase for the year ended March 31, 2006,

and a ¥48,570 million decrease for the year ended March 31, 2007, respectively.

2. Decrease (increase) in trade accounts and notes receivable for finance subsidiaries is due to the reclassification of finance subsidiaries-receivables which relate to sales of inventory in

the unaudited consolidated statements of cash flows presented above.

3. See note 3 to the consolidated financial statements.

Consolidated Statements of Cash Flows Divided into Non-Financial

Services Businesses and Finance Subsidiaries (Unaudited)