Honda 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

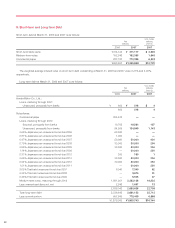

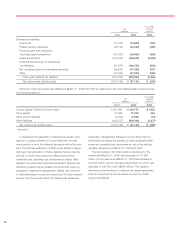

The loans maturing through 2031 and through 2030 are

either secured by property, plant and equipment or subject to

collateralization upon request, and their interest rates range

from 0.69% to 16.17% per annum at March 31, 2007 and

weighted average interest rate on total outstanding long-term

debt at March 31, 2006 and 2007 is 4.35% and 3.96%,

respectively. Property, plant and equipment with a net book

value of approximately ¥22,592 million and ¥23,654 million

($200 million) at March 31, 2006 and 2007, respectively,

were subject to specific mortgages securing indebtedness.

Furthermore, finance subsidiaries-receivables of approxi-

mately ¥8,993 million and ¥1,931 million ($16 million) at

March 31, 2006 and 2007 respectively, were pledged as

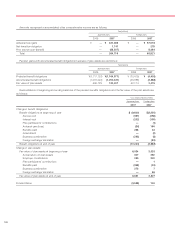

Certain of the Company’s subsidiaries have entered into cur-

rency swap and interest rate swap agreements for hedging

currency and interest rate exposures resulting from the issu-

ance of long-term debt. Fair value of contracts related to

currency swaps and interest rate swaps is included in other

assets/liabilities and/or other current assets/liabilities in the

consolidated balance sheets, as appropriate (see note 16).

Unless a right of setoff exists, the offsetting of assets and

liabilities is not made in the consolidated balance sheets.

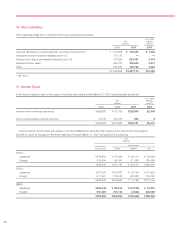

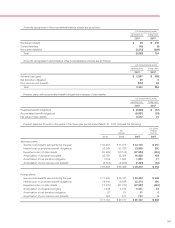

At March 31, 2007, Honda had unused line of credit facili-

ties amounting to ¥1,127,722 million ($9,553 million), of

which ¥390,278 million ($3,306 million) related to commercial

paper programs and ¥737,444 million ($6,247 million) related

to medium-term notes programs. Honda is authorized to

obtain financing at prevailing interest rates under these

programs.

At March 31, 2007, Honda also had committed lines of

credit amounting to ¥840,889 million ($7,123 million), none of

which was in use. The committed lines are used to back up

the commercial paper programs. Borrowings under those

committed lines of credit generally are available at the prime

interest rate.

As is customary in Japan, both short-term and long-term

bank loans are made under general agreements which pro-

vide that security and guarantees for present and future

indebtedness will be given upon request of the bank, and

that the bank shall have the right to offset cash deposits

against obligations that have become due or, in the event of

default, against all obligations due to the bank. Certain

debenture trust agreements provide that Honda must give

additional security upon request of the trustee.

collateral by a financial subsidiary for certain loans.

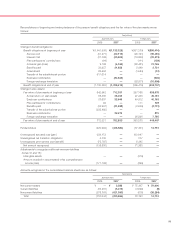

At March 31, 2006, ¥205,573 million of commercial paper

borrowings were classified as long-term, as it is the respec-

tive finance subsidiary’s intention to refinance them on a

long-term basis and it has established the necessary credit

facilities to do so. During fiscal year 2007, management

decided not to classify the commercial paper as long term

since management has no intention of refinancing them on a

long-term basis. The weighted average interest rate on com-

mercial paper at March 31, 2006 was approximately 4.32%.

Medium-term notes are unsecured, and their interest rates

range from 0.63% to 4.66% at March 31, 2006 and from

0.77% to 5.38% at March 31, 2007.

The following schedule shows the maturities of long-term debt for each of the five years following March 31, 2007 and

thereafter:

Ye n

Years ending March 31: (millions)

2008 ¥0,775,409

2009 888,650

2010 485,705

2011 317,979

2012 186,726

After five years 26,683

1,905,743

Total ¥2,681,152