Honda 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

Japan

In Japan, unit sales rose 8.2%, to 527,000 units from the previ-

ous fiscal year. Sales of snowblowers, compact home-use

cogeneration systems*1, the GX-series engines supplied to

pump and generator manufacturers on an OEM*2 basis

applications increased.

North America

In North America, sales were strong for GCV series engines—

mainly for OEM use in lawn mowers, as well as GX- and GC-

series engines for such OEM applications as generators and

high-pressure washers. Sales of completed equipment

expanded, due to Honda’s introduction of the new HRR lawn

mower, but sales of generators declined as a result of overall

market shrinkage. As a result of these factors, unit sales from

power product grew 9.8% in fiscal year 2007, to 3,103,000

units.

During the year, Honda ranked highest in the electronic fuel-

injected (EFI) four-stroke outboard segment for a third con-

secutive year in the United States according to the customer

satisfaction study*3 conducted by J.D. Power and Associates.

Europe

In Europe, OEM sales of GCV-series engines for lawn mowers

were favorable, as were sales of GX-series engines for OEM

use in generators and construction equipment. As a result, unit

sales grew 10.0%, to 1,625,000 units.

Asia

Unit sales in Asia expanded 6.0%, to 760,000 units, due to

increased sales of pumps and other equipment in China and

India.

Other Regions

In other regions, increased unit sales of GX-series engines for

OEM production, mainly in South Africa, pushed up sales

10.3%, to 406,000 units from the previous fiscal year.

*1: Compact, home-use cogeneration system

Honda has combined its original electromagnetic inverter technologies

with the world’s smallest(i) natural gas engine (GE160V) in an efficient

layout to create a small, lightweight cogeneration unit. Due to its

compactness, the unit can be installed in the home and boasts an

overall energy efficiency of 85%. It also emits approximately 30% less

carbon dioxide than conventional natural gas-powered generators or

hot-water heating units using natural gas.(ii)

(i): A Honda development, the reciprocal gas engine

(ii): Data from Honda test results. Data compares electricity from the grid

with hot-water heating units that use natural gas.

*2: OEM (Original equipment manufacturing)

OEM refers to a manufacturing of products and components supplied

for sale under a third-party brand.

*3: Disclaimer: J.D. Power and Associates 2005–2007 U.S. Marine Engine

Competitive Information StudiesSM. 2007 Study is based on responses

from 12,140 U.S. owners who registered a new boat between June

2005 and May 2006. www.jdpower.com

In fiscal year 2007, Honda introduced two four-stroke outboard

engines, the BF90 and BF75 that underwent a full model

change, responding to needs throughout the world by simulta-

neously addressing demands for high levels of both environ-

mental performance, power performance and fuel efficiency.

Honda also began sales in Japan of the EU55is generator,

which employs electromagnetic inverter technology to supply a

high level of power, but emit a low level of noise, and of the

EU6500is generator in North America. In Japan, we introduced

a compact home-use cogeneration system with improved gen-

eration efficiency which underwent a full model change. We

also launched this model in the United States. In addition,

Honda launched the Punch X compact tiller in Japan, and the

F501 and FE500 compact tillers in Europe which underwent a

full model change. In China, we launched the new EM10000

high-output 10kVA generator, which is compact and equipped

with a newly developed alternator.

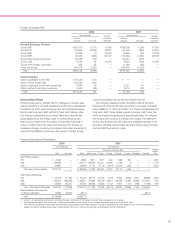

Financial Services Business

Honda offers a variety of financial services to its customers and

dealers, with the aim of supporting sales of Honda products.

These services are provided through finance subsidiaries in

Japan, the United States, Canada, the United Kingdom,

Germany, Brazil and Thailand.

In fiscal year 2007, net sales of our financial services busi-

ness, including intersegment sales within Honda, rose 32.9%,

to ¥413.3 billion from the previous fiscal year, due mainly to a

higher loan balance accompanying the expansion of automo-

bile business in North America, increased net sales in operating

leases, as well as positive currency translation effects. Operat-

ing income also expanded 27.6%, to ¥115.5 billion from the

previous fiscal year, due mainly to the increased profit attribut-

able to higher revenue benefiting from a higher loan balance

and positive currency translation effects, which offset the

negative impact of the increased interest rates. The operating

margin came to 28.0%.

Our finance subsidiaries in North America have historically

accounted for all leases as direct finance leases. However,

starting in the year ended March 31, 2007, some of the leases

which do not qualify for direct financing leases accounting

treatment are accounted for as operating leases. Generally,

direct financing lease revenues and interest income consist of

the recognition of finance lease revenue at inception of the

lease arrangement and subsequent recognition of the interest

income component of total lease payments using the effective

interest method. In comparison, operating lease revenues

include the recognition of the gross lease payment amounts on

a straight line basis over the term of the lease arrangement,

and operating lease vehicles are depreciated to their estimated

residual value on a straight line basis over the term of the lease.

It is not anticipated that the differences in accounting for oper-

ating leases and direct finance leases will have a material net

impact on the Company’s results of operations overall, how-

ever, operating lease revenues and associated depreciation of

leased assets do result in differing presentation and timing

compared to those of direct financing leases.

Finance Subsidiaries-Receivables, Net

Yen (millions)

Years ended March 31 2006 2007 % change

Non-current ¥3,139,591 ¥3,208,778 2.2%

Current 1,700,914 1,935,921 13.8

Total ¥4,840,505 ¥5,144,699 6.3%