Honda 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

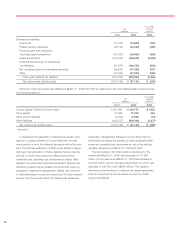

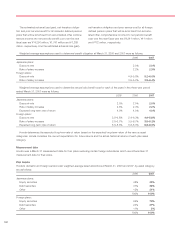

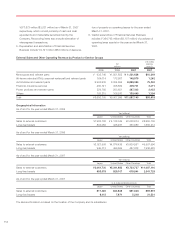

U.S. dollars

(millions) (note 2)

Tax (expense)

Before-tax or benefit Net-of-tax

amount (note 11) amount

2007:

Adjustments from foreign currency translation $807 $(13 $820

Unrealized gains (losses) on marketable securities:

Unrealized holding gains (losses) arising during the year 12 (3) 8

Reclassification adjustments for losses (gains) realized in net income (81) 33 (47)

Net unrealized gains (losses) (69) 30 (39)

Unrealized gains (losses) on derivative instruments:

Unrealized holding gains (losses) arising during the year (5) 2 (3)

Reclassification adjustments for losses (gains) realized in net income 6 (2) 4

Net unrealized gains (losses) 101

Minimum pension liabilities adjustment 126 (51) 75

Other comprehensive income (loss) $865 $0(8) $857

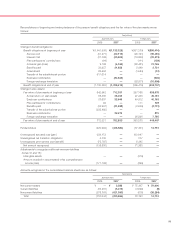

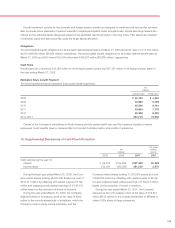

16. Fair Value of Financial Instruments

The estimated fair values of significant financial instruments at March 31, 2006 and 2007 are as follows:

U.S. dollars

Yen (millions)

(millions) (note 2)

2006 2007 2007

Carrying Estimated Carrying Estimated Carrying Estimated

amount fair value amount fair value amount fair value

Finance subsidiaries–receivables (a) ¥2,843,819 ¥2,813,023 ¥3,434,721 ¥3,444,144 $29,095 $29,175

Marketable securities 172,385 172,385 210,598 210,598 1,784 1,784

Held-to-maturity securities 43,767 43,428 16,337 16,348 138 138

Convertible preferred stocks

Host contracts 8,943 8,943 —— ——

Embedded derivatives 13,991 13,991 —— ——

22,934 22,934 —— ——

Convertible notes (b)

Host contracts 8,156 8,156 —— ——

Embedded derivatives 48,479 48,479 —— ——

56,635 56,635 —— ——

Debt (3,230,202) (3,237,471) (3,947,020) (3,960,743) (33,435) (33,551)

Foreign exchange instruments (c)

Asset position ¥0,004,477 ¥0,004,477 ¥0,003,735 ¥0,003,735 $00,032 $00,032

Liability position (35,979) (35,979) (24,783) (24,783) (210) (210)

Net ¥00(31,502) ¥00(31,502) ¥00(21,048) ¥00(21,048) $00(178) $00(178)

Interest rate instruments (d)

Asset position ¥0,036,334 ¥0,036,334 ¥0,010,866 ¥0,010,866 $00,092 $00,092

Liability position (2) (2) (2,417) (2,417) (20) (20)

Net ¥0,036,332 ¥0,036,332 ¥0,008,449 ¥0,008,449 $00(072 $00(072