Honda 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

(m) Income Taxes

Income taxes are accounted for under the asset and liability

method. Deferred tax assets and liabilities are recognized for

the future tax consequences attributable to differences

between the financial statement carrying amounts of existing

assets and liabilities and their respective tax bases and oper-

ating loss and tax credit carryforwards. Deferred tax assets

and liabilities are measured using enacted tax rates expected

to apply to taxable income in the years in which those tem-

porary differences are expected to be recovered or settled.

The effect on deferred tax assets and liabilities of a change in

tax rates is recognized in earnings in the period that includes

the enactment date.

(n) Product-Related Expenses

Advertising and sales promotion costs are expensed as

incurred. Advertising expenses for each of the years in the

three-year period ended March 31, 2007 were ¥246,997 mil-

lion, ¥287,901 million and ¥308,409 million ($2,613 million),

respectively. Provisions for estimated costs related to product

warranty are made at the time the products are sold to cus-

tomers or new warranty programs are initiated. Estimated

warranty expenses are provided based on historical warranty

claim experience with consideration given to the expected

level of future warranty costs as well as current information

on repair costs. Included in warranty expenses accruals are

costs for general warranties on vehicles Honda sells and

product recalls.

(o) Basic Net Income per Common Share

Basic net income per common share has been computed by

dividing net income available to common stockholders by the

weighted average number of common shares outstanding

during each year. The weighted average number of common

shares outstanding for the years ended March 31, 2005,

2006 and 2007 was 1,867,535,957, 1,840,799,671 and

1,824,675,228 respectively. There were no potentially dilutive

shares outstanding during the years ended March 31, 2005,

2006 or 2007.

The Company executed a two-for-one stock split for the

Company’s common stock effective July 1, 2006. All per

share information has been adjusted retroactively for all

periods presented to reflect this stock split.

(p) Foreign Currency Translation

Foreign currency financial statement amounts are translated

into Japanese yen on the basis of the year-end rate for all

assets and liabilities and the weighted average rate for the

year for all income and expense amounts. The resulting

translation adjustments are included in accumulated other

comprehensive income (loss) in the stockholders’ equity

section of the consolidated balance sheets.

Foreign currency receivables and payables are translated

at the applicable current rates on the balance sheet date. All

revenues and expenses associated with foreign currencies

are converted at the rates of exchange prevailing when such

transactions occur. The resulting exchange gains or losses

are reflected in other income (expense) in the consolidated

statements of income.

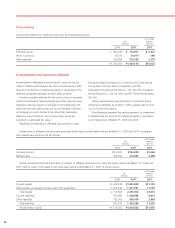

Foreign currency transaction gains (losses) included in

other income (expenses) - other for each of the years in the

three-year period ended March 31, 2007 are as follows:

U.S. dollars

Yen (millions)

(millions) (note 2)

2005 2006 2007 2007

¥(17,146) ¥(38,880) ¥(48,261) $(409)

(q) Derivative Financial Instruments

Honda has entered into foreign exchange agreements and

interest rate agreements to manage currency and interest

rate exposures. These instruments include foreign currency

forward contracts, currency swap agreements, currency

option contracts and interest rate swap agreements.

Honda recognizes at fair value of all derivative financial

instruments in its consolidated balance sheet.

Honda applies hedge accounting for certain foreign

currency forward contracts related to forecasted foreign cur-

rency transactions between the Company and its subsidiar-

ies. These are designated as cash flow hedges on the date

derivative contracts entered into. The Company has a cur-

rency rate risk management policy documented. In addition,

it documents all relationships between derivative financial

instruments designated as cash flow hedges and the relevant

hedged items to identify the relationship between them. The

Company assesses, both at the hedge’s inception and on an

ongoing basis, whether the derivative financial instruments

designated as cash flow hedge are highly effective to offset

changes in cash flows of hedged items.

When it is determined that a derivative financial instrument

is not highly effective as a cash flow hedge, when the

hedged item matures, is sold or is terminated, or when it is

identified that the forecasted transaction is no longer prob-

able, the Company discontinues hedge accounting. To the

extent derivative financial instruments are designated as cash

flow hedges and have been assessed as being highly effec-

tive, changes in their fair value are recognized in other com-

prehensive income (loss). The amounts are reclassified into