Honda 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

80

60

40

20

0

01 02 03 04 05 06

FFVs (only Brazil)

Gasoline vehicles

(Thousands

of units)

Honda’s Unit Sales

(Year)

3,000

2,000

1,000

0

01 02 03 04 05 06

Brazil

Argentina

Venezuela

Chile

Colombia

Equador

Peru

Honda’s share

6

4

2

0

Source: Global Insight

The South American Automobile

Market

(Including Commercial Vehicles)

(Thousands

of units) (%)

Thailand

Indonesia

Malaysia

The Philippines

0 400200 600500300100 700

05

06

05

06

05

06

05

06

Source: Global Insight

Honda

Other manufacturers

Total Honda Unit Sales in Key

ASEAN Countries (Year)

(Thousands of units)

Automobile Business

ePolitical Uncertainty and Natural Disaster Affects Demand in the

ASEAN Market

In the key ASEAN countries, such factors as soaring gasoline prices and

rising interest rates, as well as political instability in Thailand, caused the

automobile market to shrink.

In Indonesia, Honda’s sales in fiscal 2007 fell compared with the preced-

ing year affected by its economical situation, but strong sales performance

by the new Civic prompted year-on-year increases in Honda’s sales in

Thailand and Malaysia. Introduced into each of these markets in the second

half of fiscal 2007, the new CR-V registered brisk sales. To expand localized

production, in April 2007 we began the production in Thailand of camshafts,

connecting rods, crankshafts and other engine parts that require

sophisticated technologies.

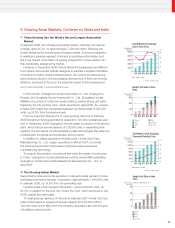

5. Expanding Market Demand and the Growth of

Alternative Fuel (Ethanol) Vehicles in Brazil

Brazil, the largest market in South America, is experiencing robust economic

growth. Buoyed by such factors as rising incomes and falling interest rates,

total demand in calendar 2006 (excluding large trucks and buses), reached

approximately 1,830,000 units, up 13.1% from the previous year. As market

expansion is expected to continue, we anticipate total demand growth in

calendar 2007 of more than 15%, to 2,110,000 units.

In fiscal 2007, Honda’s unit sales rose 18.0%, to 67,000 units. Sales of

the new Civic, which went on sale in April 2006, were extremely favorable.

The Expanding Market for Flexible Fuel Vehicles (FFVs)

Following the first oil shock in the latter 1970s, the Brazilian government

began promoting ethanol fuels as an alternative to petroleum fuels. The mar-

ket for FFVs, which can run on a mixture of ethanol and gasoline—and is

less expensive than gasoline—has expanded to the point where as of March

2007, more than 80% of passenger cars were FFVs. In November 2006,

Honda introduced the Civic FFV, followed by the Fit FFV in December.

In fiscal 2008, we expect favorable sales of the Civic and the sale of FFVs

to raise unit sales approximately 25% from the previous year and are

expanding supply capacity in preparation. In January 2007, Honda raised

annual production capacity from 50,000 units to 80,000 units. Midway

through calendar 2007, we expect to further raise this level to 100,000 units.

100

80

60

40

20

003 04 05 06

82.8%

07

Mar.

(%)

Source: ANFAVEA

Percentage of Vehicles in Brazil that are FFVs

FFV

Gasoline

Passenger cars + commercial vehicles

(Excluding large trucks and buses)