Honda 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

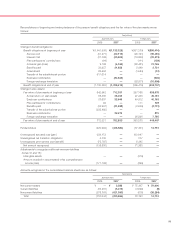

Honda investment policies for the domestic and foreign pension benefit are designed to maximize total returns that are avail-

able to provide future payments of pension benefits to eligible participants under accepted risks. Honda sets target assets allo-

cations for the individual asset categories based on the estimated returns and risks in the long future. Plan assets are invested

in individual equity and debt securities using the target assets allocation.

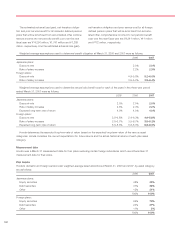

Obligations

The accumulated benefit obligations for all domestic defined benefit plans at March 31, 2006 and 2007 were ¥1,019,764 million

and ¥1,088,890 million ($9,224 million), respectively. The accumulated benefit obligations for all foreign defined benefit plans at

March 31, 2006 and 2007 were ¥303,509 million and ¥340,527 million ($2,885 million), respectively.

Cash flows

Honda expects to contribute ¥33,953 million to its domestic pension plans and ¥37,187 million to its foreign pension plans in

the year ending March 31, 2008.

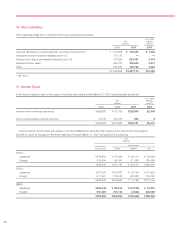

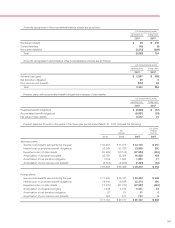

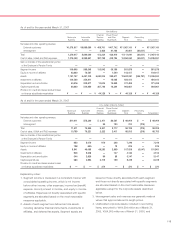

Estimated future benefit Payment

The following table presents estimated future gross benefit payments:

Yen

(millions)

Japanese plans Foreign plans

2008 ¥040,130 ¥04,540

2009 42,885 5,138

2010 45,546 6,144

2011 43,660 7,178

2012 45,339 8,582

2013–2017 250,746 74,946

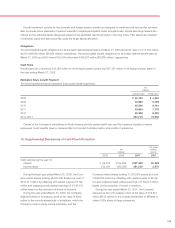

Certain of the Company’s subsidiaries in North America provide certain health care and life insurance benefits to retired

employees. Such benefits have no material effect on Honda’s financial position and results of operations.

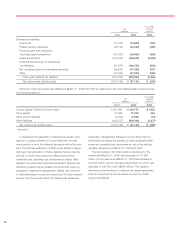

14. Supplemental Disclosures of Cash Flow Information

U.S. dollars

Yen (millions)

(millions) (note 2)

2005 2006 2007 2007

Cash paid during the year for:

Interest ¥099,475 ¥134,609 ¥187,268 $1,586

Income taxes 159,041 282,986 351,225 2,975

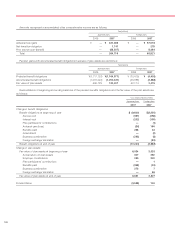

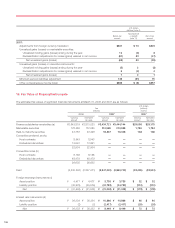

During the fiscal year ended March 31, 2005, the Com-

pany retired shares totaling 46,000,000 shares at a cost of

¥216,371 million by offsetting with capital surplus of ¥190

million and unappropriated retained earnings of ¥ 216,181

million based on the resolution of board of directors.

During the year ended March 31, 2006, the Company

reissued certain of its treasury stock at fair value of ¥802

million to the minority shareholder of subsidiary, which the

Company made a wholly owned subsidiary, and the

Company retired shares totaling 11,000,000 shares at a cost

of ¥66,224 million by offsetting with capital surplus of ¥2 mil-

lion and unappropriated retained earnings of ¥ 66,221 million

based on the resolution of board of directors.

During the year ended March 31, 2007, the Company

reissued certain of its treasury stock at fair value of ¥18,521

million ($155 million) to the outside shareholder of affiliates to

obtain 100% share of these companies.