Honda 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

earnings in the period when forecasted hedged transactions

affect earnings. When these cash flow hedges prove to be

ineffective, changes in the fair value of the derivatives are

immediately recognized in earnings.

Changes in the fair value of derivative financial instruments

not designated as accounting hedges are recognized in

earnings in the period of the change.

The amount recognized in earnings included in other

income (expenses)—other during the year ended March 31,

2005, 2006 and 2007 are ¥44,905 million gain, ¥55,516 mil-

lion loss and ¥48,485 million ($411 million) loss, respectively.

In relation to this, the Company included gains and losses on

translation of debts of finance subsidiaries denominated in

foreign currencies intended to be hedged of ¥10,667 million

gain, ¥45,046 million gain and ¥8,351 million ($71 million)

loss in other income (expenses)—other during the years

ended March 31, 2005, 2006 and 2007, respectively. In

addition, net realized gains and losses on interest rate swap

contracts not designated as accounting hedges by mainly

finance subsidiaries of ¥28,000 million loss, ¥827 million gain

and ¥3,309 million ($28 million) gain are included in other

income (expenses)—other during the years ended March 31,

2005, 2006 and 2007, respectively. These gains and losses

are presented on a net basis.

Honda doesn’t hold any derivative financial instruments

for trading purposes.

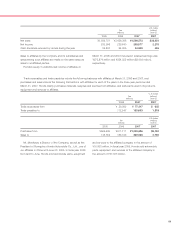

(r) Shipping and Handling Costs

Shipping and handling costs included in selling, general and

administrative expenses for each of the years in the three-

year period ended March 31, 2007 are as follows:

U.S. dollars

Yen (millions)

(millions) (note 2)

2005 2006 2007 2007

¥159,472 ¥181,675 ¥219,361 $1,858

(s) Asset Retirement Liability

Honda applies Financial Accounting Standards Board (FASB)

Interpretation (FIN) No. 47, “Accounting for Conditional Asset

Retirement Obligations—an interpretation of FASB Statement

No.143”. FIN47 clarifies the term conditional asset retirement

obligation as used in SFAS No.143 and requires a liability to

be recorded if the fair value of the obligation can be reason-

ably estimated. Asset retirement obligations covered by this

Interpretation include those for which an entity has a legal

obligation to perform an asset retirement activity, however

the timing and (or) method of settling the obligation are con-

ditional on a future event that may or may not be within the

control of the entity.

(t) New Accounting Pronouncements

In March 2006, the Financial Accounting Standards Board

(FASB) issued Statement of Financial Accounting Standards

(SFAS) No. 156, “Accounting for Servicing of Financial

Assets”. This statement amends SFAS No. 140, “Accounting

for Transfers and Servicing of Financial Assets and Extin-

guishments of Liabilities”, with respect to the accounting for

separately recognized servicing assets and servicing liabili-

ties. SFAS No. 156 gives revised guidance as to when servic-

ing assets and servicing liabilities should be recognized. It

also revises guidance regarding the initial and subsequent

measurement of servicing assets and liabilities. SFAS No.

156 is effective as of the beginning of an entity’s first fiscal

year that begins after September 15, 2006. Management is

currently in process of quantifying the financial impact of

adoption. It is not anticipated that adoption will have a mate-

rial impact on the Company’s financial position or results of

operations.

In June 2006, the Financial Accounting Standards Board

(FASB) issued FASB Interpretation (FIN) No. 48, “Accounting

for Uncertainty in Income Taxes”. This Interpretation clarifies

the accounting for uncertainty in income taxes recognized in

an enterprise’s financial statements in accordance with SFAS

No. 109, “Accounting for Income Taxes”. This Interpretation

prescribes a two step process for the recognition and mea-

surement in the financial statement of a tax position taken or

expected to be taken in a tax return. This statement is effec-

tive as of an entity’s first fiscal year that begins after

December 15, 2006. Management is currently in the process

of quantifying the financial impact of adoption.

In September 2006, the Financial Accounting Standards

Board (FASB) issued Statement of Financial Accounting

Standards (SFAS) No.157, “Fair Value Measurements”. This

statement defines fair value, establishes a framework for

measuring fair value in generally accepted accounting prin-

ciples, and expands disclosures about fair value measure-

ments. This Statement applies under other accounting

pronouncements that require or permit fair value measure-

ments and does not require any new fair value measure-

ments. This statement is effective as of an entity’s first fiscal

year that begins after November 15, 2007, with early adop-

tion encouraged. Management is currently in the process of

determining whether to early adopt this statement and quan-

tifying the financial impact of adoption. It is not anticipated

that adoption will have a material impact on the Company’s

financial position or results of operation.

In September 2006, the Financial Accounting Standards

Board (FASB) issued Statement of Financial Accounting

Standards (SFAS) No. 158, “Employers’ Accounting for

Defined Benefit Pension and Other Postretirement Plans—an