Honda 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

To determine the overall allowance for credit loss amount,

receivables are segmented into pools with common character-

istics such as product and collateral types, credit grades, and

original loan terms. For each of these pools, we estimate

losses primarily based on our historic loss experiences, delin-

quency rates, recovery rates and scale and composition of the

portfolio, taking factors into consideration such as changing

economic conditions and changes in operational policies and

procedures.

We believe our allowance for credit losses is a “critical

accounting estimate” because it requires us to make assump-

tions about inherently uncertain items such as future economic

trends, quality of finance subsidiaries-receivables and other

factors. We review the adequacy of the allowance for credit

losses, and the allowance for credit losses is maintained at an

amount that we deem sufficient to cover the estimated credit

losses incurred on our owned portfolio of finance receivables.

However, actual losses may differ from the original estimates as

a result of actual results varying from those assumed in our

estimates.

As an example of the sensitivity of the allowance calculation,

the following scenario demonstrates the impact that a deviation

in one of the primary factors estimated as a part of our allow-

ance calculation would have on the provision and allowance for

credit losses. If we had experienced a 10% increase in net

credit losses during fiscal 2007 in our North America portfolio,

the provision for fiscal 2007 and the allowance balance at the

end of fiscal 2007 would have increased by approximately ¥5.5

billion and ¥2.8 billion, respectively. Note that this sensitivity

analysis may be asymmetric, and are specific to the base

conditions in fiscal 2007.

Additional Narrative of the Change in Credit Loss as Below

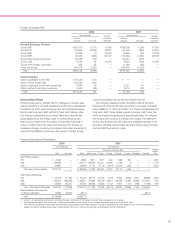

The following table shows information related to our credit loss experience in our North America portfolio:

Yen (billions)

Fiscal years ended March 31 2005 2006 2007

Charge-offs (net of recoveries) ¥0,023.1 ¥0,022.8 ¥0,026.2

Provision for credit losses 31.7 27.4 25.5

Allowance for credit losses 29.2 30.1 28.7

Ending receivable balance 3,613.6 4,166.5 4,351.8

Average receivable balance, net 3,333.5 3,938.2 4,330.8

Charge-offs as a % of average receivable balance 0.70% 0.58% 0.61%

Allowance as a % of ending receivable balance 0.81% 0.72% 0.66%

Fiscal Year 2007 Compared with Fiscal Year 2006

Net charge-offs in our North American portfolio increased by

¥3.4 billion, or 15%. Higher originations of finance receivables

due to business expansion in fiscal year 2006 compared to fis-

cal year 2005 resulted in higher charge-offs in fiscal year 2007.

The provision for credit losses decreased by ¥1.9 billion, or

7% and the allowance for credit losses decreased by ¥1.4 bil-

lion, or 5%. The decreases were due to lower estimates of

losses incurred as of March 31, 2007 even though finance

receivables increased.

(Losses on Lease Residual Values)

End-customers of leased vehicles typically have an option to

buy the leased vehicle for the contractual residual value of the

vehicle or to return the vehicle to our finance subsidiaries

through the dealer at the end of the lease term. Likewise, deal-

ers have the option to buy the vehicle returned by the cus-

tomer or to return the vehicle to our finance subsidiaries. The

likelihood that the leased vehicle will be purchased varies

depending on the difference between the actual market value

of the vehicle at the end of the lease term and the contractual

value determined at the inception of the lease. Our finance

subsidiaries in North America have historically accounted for all

leases as direct finance leases. However, starting in the year

ended March 31, 2007, some of the leases which do not

qualify for direct financing leases accounting treatment are

accounted for as operating leases.

We initially determine the contract residual values by using

our estimate of future used vehicle values, taking into consider-

ation data obtained from third parties. We are exposed to risk

of loss on the disposition of returned lease vehicles when the

proceeds from the sale of the vehicles are less than the con-

tractual residual values at the end of the lease term. We peri-

odically review the estimate of residual values. Downward

adjustments are made for declines in estimated residual values

that are deemed to be other-than-temporary. For direct financ-

ing leases, our finance subsidiaries in North America purchase

insurance to cover a portion of the estimated residual value.

The adjustments on the uninsured portion of the vehicle’s

residual value are recognized as a loss in the period in which

the estimate changed. For vehicle leases accounted for as

operating leases, adjustments to estimated residual values

result in changes to the remaining depreciation expense to be

recognized prospectively on a straight-line basis over the

remaining term of the lease.

The primary components in estimating losses on lease

residual values are the expected frequency of returns, or the

percentage of leased vehicles we expect to be returned by

customers at the end of the lease term, and the expected loss

severity, or the expected difference between the residual value

and the amount we receive through sales of returned vehicles

plus proceeds from insurance, if any. We estimate losses on

lease residual values by evaluating several different factors,

including trends in historical and projected used vehicle values

and general economic measures.