HTC 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

actions against Nokia's asserted patents in London High Court. The Company evaluated that there is no direct relation

between the associated technology used in the Company's devices and patents claimed by Nokia. The Company

believes the lawsuits have limited impact on its financial results or sales activities.

As of March 18, 2013, the date of the accompanying independent Auditors' report, there had been no critical hearing

nor had a court decision been made, except for the above.

e. The Company had shared lawsuit-related costs on the basis of common benefits and agreements between the

Company and its vendors and customers. For 2011 and 2012, companies that the Company shared lawsuit-related

costs with included VIA Technologies Inc. and its subsidiaries.

f. On the basis of its past experience and consultations with its legal counsel, the Company has evaluated the possible

effects of the contingent lawsuits on its business and financial condition, and recognized its estimable cost.

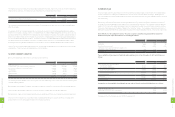

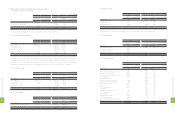

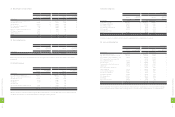

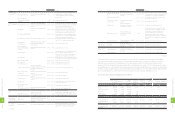

2. The significant financial assets and liabilities denominated in foreign currencies were as follows:

December 31

2011 2012

Foreign Currencies Exchange Rate Foreign Currencies Exchange Rate

Financial assets

Monetary items

USD $3,018,210 30.28 $2,687,730 29.13

EUR 485,148 39.19 301,870 38.42

GBP 44,226 46.73 58,375 47.09

JPY 150,186 0.3906 9,903,351 0.3383

RMB 1,126,526 4.77 1,432,210 4.68

Investments accounted for by the equity method

USD 412,799 30.28 409,395 29.13

SGD 996,626 23.32 1,191,511 23.85

Financial liabilities

Monetary items

USD 3,266,412 30.28 3,122,686 29.13

EUR 590,266 39.19 302,928 38.42

GBP 56,572 46.73 51,689 47.09

JPY 434,508 0.3906 17,002,616 0.3383

RMB 678,211 4.77 702,614 4.68

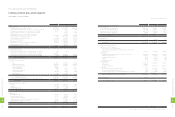

31. OPERATING SEGMENT

The Company has provided the operating segments disclosure in the consolidated financial statements.

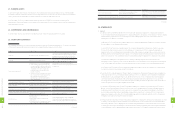

5. INDEPENDENT AUDITORS' REPORT

The Board of Directors and Stockholders

HTC Corporation

We have audited the accompanying consolidated balance sheets of HTC Corporation and subsidiaries (collectively, the

"Company") as of December 31, 2011 and 2012, and the related consolidated statements of income, changes in stockholders'

equity and cash flows for the years then ended, all expressed in New Taiwan dollars. These consolidated financial statements

are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated

financial statements based on our audits.

We conducted our audits in accordance with the Rules Governing the Audit of Financial Statements by Certified Public

Accountants and auditing standards generally accepted in the Republic of China. Those rules and standards require that

we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material

misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial

statements. An audit also includes assessing the accounting principles used and significant estimates made by management,

as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for

our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated

financial position of the Company as of December 31, 2011 and 2012, and the results of their operations and their cash flows

for the years then ended, in conformity with the Guidelines Governing the Preparation of Financial Reports by Securities

Issuers, and accounting principles generally accepted in the Republic of China.

Our audits also comprehended the translation of the 2012 New Taiwan dollar amounts into U.S. dollar amounts and, in

our opinion, such translation has been made in conformity with the basis stated in Note 3. Such U.S. dollar amounts are

presented solely for the convenience of readers.

March 18, 2013

Notice to Readers

The accompanying consolidated financial statements are intended only to present the consolidated financial position, results of operations and cash flows

in accordance with accounting principles and practices generally accepted in the Republic of China and not those of any other jurisdictions. The standards,

procedures and practices to audit such consolidated financial statements are those generally accepted and applied in the Republic of China.

For the convenience of readers, the auditors' report and the accompanying consolidated financial statements have been translated into English from the

original Chinese version prepared and used in the Republic of China. If there is any conflict between the English version and the original Chinese version or

any difference in the interpretation of the two versions, the Chinese-language auditors’ report and consolidated financial statements shall prevail. Also,

as stated in Note 2 to the consolidated financial statements, the additional footnote disclosures that are not required under generally accepted accounting

principles were not translated into English.

1

9

2

8

FINANCIAL INFORMATION

1

9

3

8

FINANCIAL INFORMATION