HTC 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

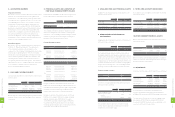

loss on purchase order, bonuses to employees, etc.

Actual results may differ from these estimates.

(3) Current/Non-current Assets and Liabilities

Current assets include cash, cash equivalents, and

those assets held primarily for trading purposes or

to be realized, sold or consumed within one year

from the balance sheet date. All other assets such as

properties and intangible assets are classified as non-

current. Current liabilities are obligations incurred

for trading purposes or to be settled within one year

from the balance sheet date. All other liabilities are

classified as non-current.

(4) Financial Assets/Liabilities at Fair Value

through Profit or Loss

Financial instruments classified as financial assets

or financial liabilities at fair value through profit or

loss ("FVTPL") include financial assets or financial

liabilities held for trading and those designated

as at FVTPL on initial recognition. The Company

recognizes a financial asset or a financial liability on

its balance sheet when the Company becomes a

party to the contractual provisions of the financial

instrument. A financial asset is derecognized when

the Company has lost control of its contractual

rights over the financial asset. A financial liability is

derecognized when the obligation specified in the

relevant contract is discharged, canceled or expired.

Financial instruments at FVTPL are initially measured

at fair value plus transaction costs that are directly

attributable to the acquisition. At each balance sheet

date subsequent to initial recognition, financial assets

or financial liabilities at FVTPL are remeasured at fair

value, with changes in fair value recognized directly

in profit or loss in the year in which they arise. Cash

dividends received (including those received in the

year of investment) are recognized as income for

the year. On derecognition of a financial asset or a

financial liability, the difference between its carrying

amount and the sum of the consideration received

and receivable or consideration paid and payable is

recognized in profit or loss. All regular way purchases

or sales of financial assets are recognized and

derecognized on a trade date basis.

A derivative that does not meet the criteria for

hedge accounting is classified as a financial asset or

a financial liability held for trading. If the fair value of

the derivative is positive, the derivative is recognized

as a financial asset; otherwise, the derivative is

recognized as a financial liability.

Fair values of financial assets and financial liabilities

at the balance sheet date are determined as follows:

publicly traded stocks - at closing prices; open-end

mutual funds - at net asset values; bonds - at prices

quoted by the Taiwan GreTai Securities Market; and

financial assets and financial liabilities without quoted

prices in an active market - at values determined using

valuation techniques.

(5) Available-for-sale Financial Assets

Available-for-sale financial assets are initially measured

at fair value plus transaction costs that are directly

attributable to the acquisition. At each balance sheet

date subsequent to initial recognition, available-for-

sale financial assets are remeasured at fair value, with

changes in fair value recognized in equity until the

financial assets are disposed of, at which time, the

cumulative gain or loss previously recognized in equity

is included in profit or loss for the year. All regular way

purchases or sales of financial assets are recognized

and derecognized on a trade date basis.

The recognition, derecognition and the fair value bases

of available-for-sale financial assets are similar to those

of financial assets at FVTPL.

Cash dividends are recognized upon the stockholders'

resolutions, except for dividends distributed from the

pre-acquisition profit, which are treated as a reduction

of investment cost. Stock dividends are not recognized

as investment income but are recorded as an increase

in the number of shares. The total number of shares

subsequent to the increase is used for the recalculation

of cost per share.

An impairment loss is recognized when there is

objective evidence that the financial asset is impaired.

Any subsequent decrease in impairment loss on an

equity instrument classified as available-for-sale is

recognized directly in equity.

(6) Revenue Recognition, Accounts Receivable and

Allowance for Doubtful Accounts

Revenue from sales of goods is recognized when the

Company has transferred to the buyer the significant

risks and rewards of ownership of the goods, primarily

upon shipment, because the earnings process has been

completed and the economic benefits associated with

the transaction have been realized or are realizable.

The Company does not recognize sales revenue on

materials delivered to subcontractors because this

delivery does not involve a transfer of risks and rewards

of materials ownership.

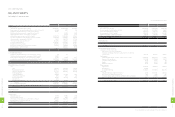

HTC CORPORATION

NOTES TO FINANCIAL STATEMENTS

Years Ended December 31, 2011 and 2012

(In Thousands, Unless Stated Otherwise)

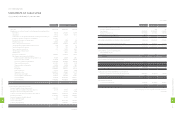

1. ORGANIZATION AND OPERATIONS

HTC Corporation (the "Company") was incorporated on May

15, 1997 under the Company Law of the Republic of China

to design, manufacture, assemble, process, and sell smart

handheld devices and provide after-sales service. In March

2002, the Company’s stock was listed on the Taiwan Stock

Exchange. On November 19, 2003, the Company listed some

of its shares of stock on the Luxembourg Stock Exchange in

the form of global depositary receipts.

The Company had 14,506 and 14,252 employees as of

December 31, 2011 and 2012, respectively.

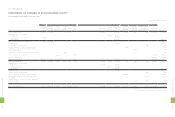

2. SIGNIFICANT ACCOUNTING POLICIES

The financial statements have been prepared in conformity with

the Guidelines Governing the Preparation of Financial Reports

by Securities Issuers, Business Accounting Law, Guidelines

Governing Business Accounting, and accounting principles

generally accepted in the Republic of China ("ROC").

For readers' convenience, the accompanying financial

statements have been translated into English from the original

Chinese version prepared and used in the ROC. If inconsistencies

arise between the English version and the Chinese version or if

differences arise in the interpretations between the two versions,

the Chinese version of the financial statements shall prevail.

However, the accompanying financial statements do not include

the English translation of the additional footnote disclosures

that are not required under ROC generally accepted accounting

principles but are required by the Securities and Futures Bureau

for their oversight purposes.

Significant accounting policies are summarized as follows:

(1) Foreign Currencies

The financial statements of foreign operations are

translated into New Taiwan dollars at the following

exchange rates:

a. Assets and liabilities - at exchange rates prevailing on

the balance sheet date;

b. Stockholders' equity - at historical exchange rates;

c. Dividends - at the exchange rate prevailing on the

dividend declaration date; and

d. Income and expenses - at average exchange rates

for the year.

Exchange differences arising from the translation of

the financial statements of foreign operations are

recognized as a separate component of stockholders'

equity. These exchange differences are recognized as

gain or loss in the year in which the foreign operations

are disposed of.

Non-derivative foreign-currency transactions are

recorded in New Taiwan dollars at the rates of

exchange in effect when the transactions occur.

Exchange differences arising from the settlement of

foreign-currency assets and liabilities are recognized as

gain or loss.

At the balance sheet date, foreign-currency monetary

assets and liabilities are revalued using prevailing

exchange rates and the exchange differences are

recognized in profit or loss.

At the balance sheet date, foreign-currency non-

monetary assets (such as equity instruments) and

liabilities that are measured at fair value are revalued

using prevailing exchange rates, with the exchange

differences treated as follows:

a. Recognized in stockholders' equity if the changes in

fair value are recognized in stockholders' equity; and

b. Recognized in profit and loss if the changes in fair

value is recognized in profit or loss.

Foreign-currency non-monetary assets and liabilities

that are carried at cost continue to be stated at

exchange rates at the trade dates.

If the functional currency of an equity-method

investee is a foreign currency, translation

adjustments will result from the translation of the

investee's financial statements into the reporting

currency of the Company. These adjustments are

accumulated and reported as a separate component

of stockholders' equity.

(2) Accounting Estimates

Under the above guidelines, law and principles, certain

estimates and assumptions have been used for the

allowance for doubtful accounts, allowance for loss

on inventories, depreciation of properties, marketing

expenses, income tax, royalty, pension cost, loss on

pending litigations, product warranties, contingent

1

6

0

8

FINANCIAL INFORMATION

1

6

1

8

FINANCIAL INFORMATION