HTC 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

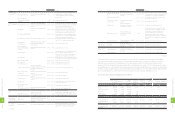

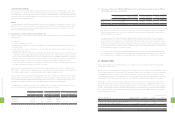

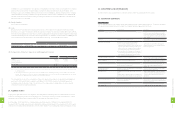

The employee bonus in 2011 and 2012 should be appropriated at 10% and 5%, respectively, of net income before deducting

employee bonus expenses. Accrued bonuses as of December 31, 2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Accrued bonus to employees for the current year $7,238,637 $976,327 $33,517

Cash bonuses approved by the stockholders for prior years - 4,735,748 162,579

$7,238,637 $5,712,075 $196,096

The Company accrued marketing expenses on the basis of related agreements and other factors that would significantly

affect the accruals.

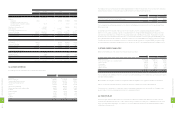

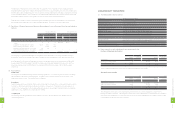

In September 2009, HTC's board of directors resolved to donate to the HTC Cultural and Educational Foundation

NT$300,000 thousand, consisting of (a) the second and third floors of Taipei's R&D headquarters, with these two floors

to be built at an estimated cost of NT$217,800 thousand, and (b) cash of NT$82,200 thousand. This donation excludes

the land, of which the ownership remains with HTC. In June 2012, HTC handed over the foregoing donated building to the

HTC Cultural and Educational Foundation. The actual construction cost was NT$218,636 thousand (US$7,506 thousand).

The difference between the estimated construction cost and the actual construction cost was NT$836 thousand (US$29

thousand) and was recognized as an adjustment on the donation to the HTC Cultural and Educational Foundation in 2012.

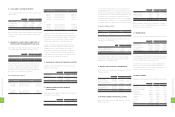

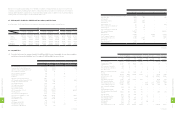

19. OTHER CURRENT LIABILITIES

Other current liabilities as of December 31, 2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Warranty provisions $13,080,394 $8,058,509 $276,649

Provisions for contingent loss on purchase orders 2,052,881 823,005 28,254

Advance receipts 433,072 535,110 18,370

Other payable 512,941 325,701 11,182

Agency receipts 440,862 301,868 10,363

Advance revenues 140,815 102,137 3,506

Others 646,390 848,990 29,146

$17,307,355 $10,995,320 $377,470

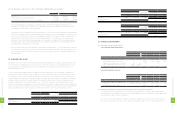

The Company provides warranty service for one year to two years depending on the contract with customers and recognizes

estimable warranty liabilities.

Other payables were payables for patents, and agreed installments payable to the original stockholders of subsidiaries.

Agency receipts were primarily employees' income tax, insurance, royalties and overseas value-added tax.

The provision for contingent loss on purchase orders is estimated after taking into account the effects of changes in the

product market, in inventory management and in the Company's purchases.

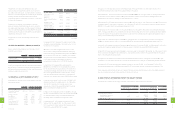

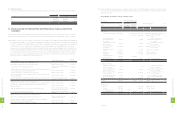

20. PENSION PLAN

The pension plan under the Labor Pension Act (the "LPA") is a defined contribution plan. Based on the LPA, HTC and

Communication Global Certification Inc. ("CGC") make monthly contributions to employees’ individual pension accounts

at 6% of monthly salaries and wages. Such pension costs were NT$351,762 thousand in 2011 and NT$413,458 thousand

(US$14,194 thousand) in 2012.

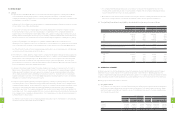

2012

Patents Goodwill Deferred

Pension Cost Other Total

NT$ NT$ NT$ NT$ NT$ US$ (Note 3)

Cost

Balance, beginning of year $11,608,540 $10,905,878 $342 $911,962 $23,426,722 $804,240

Additions

Acquisition 11,464 - - 497,874 509,338 17,486

The difference between the cost of

investment and the Company's share in

investees' net assets

- 45,017 - - 45,017 1,545

Adjustments of acquisition cost - (26,226) - - (26,226) (900)

Reclassification - (5,717,960) - 5,717,960 - -

The changes in deferred pension cost - - (73) - (73) (3)

Disposal of Subsidiary (35,323) (3,485,380) - (5,713,752) (9,234,455) (317,019)

Translation adjustment (345,127) (39,768) - (81,322) (466,217) (16,005)

Balance, end of year 11,239,554 1,681,561 269 1,332,722 14,254,106 489,344

Accumulated amortization

Balance, beginning of year 456,442 - - 316,178 772,620 26,524

Amortization 1,625,124 - - 333,424 1,958,548 67,237

Disposal of Subsidiary (1,893) - - (115,699) (117,592) (4,037)

Translation adjustment (20,793) - - (6,546) (27,339) (938)

Balance, end of year 2,058,880 - - 527,357 2,586,237 88,786

Accumulated impairment losses

Balance, beginning of year - 93,314 - - 93,314 3,203

Impairment losses - 57,621 - - 57,621 1,978

Translation adjustment - (3,740) - - (3,740) (128)

Balance, end of year - 147,195 - - 147,195 5,053

Net book value, end of year $9,180,674 $1,534,366 $269 $805,365 $11,520,674 $395,505

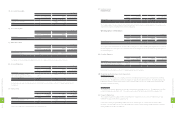

18. ACCRUED EXPENSES

Accrued expenses as of December 31, 2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Marketing $29,104,665 $20,872,536 $716,555

Bonus to employees 7,238,637 5,712,075 196,096

Salaries and performance bonuses 3,433,649 5,619,290 192,910

Materials and molding expenses 1,854,932 1,904,181 65,371

Services 1,324,631 1,020,609 35,038

Import, export and freight 1,397,747 644,432 22,123

Repairs, maintenance and sundry purchase 466,135 573,355 19,683

Insurance 191,931 243,046 8,344

Meals and welfare 193,721 169,711 5,826

Pension cost 123,877 119,833 4,114

Travel 96,085 96,726 3,321

Donation 236,630 - -

Others 508,650 400,699 13,756

$46,171,290 $37,376,493 $1,283,137

2

2

0

8

FINANCIAL INFORMATION

2

2

1

8

FINANCIAL INFORMATION