HTC 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

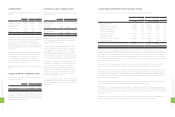

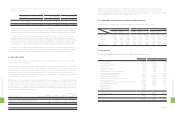

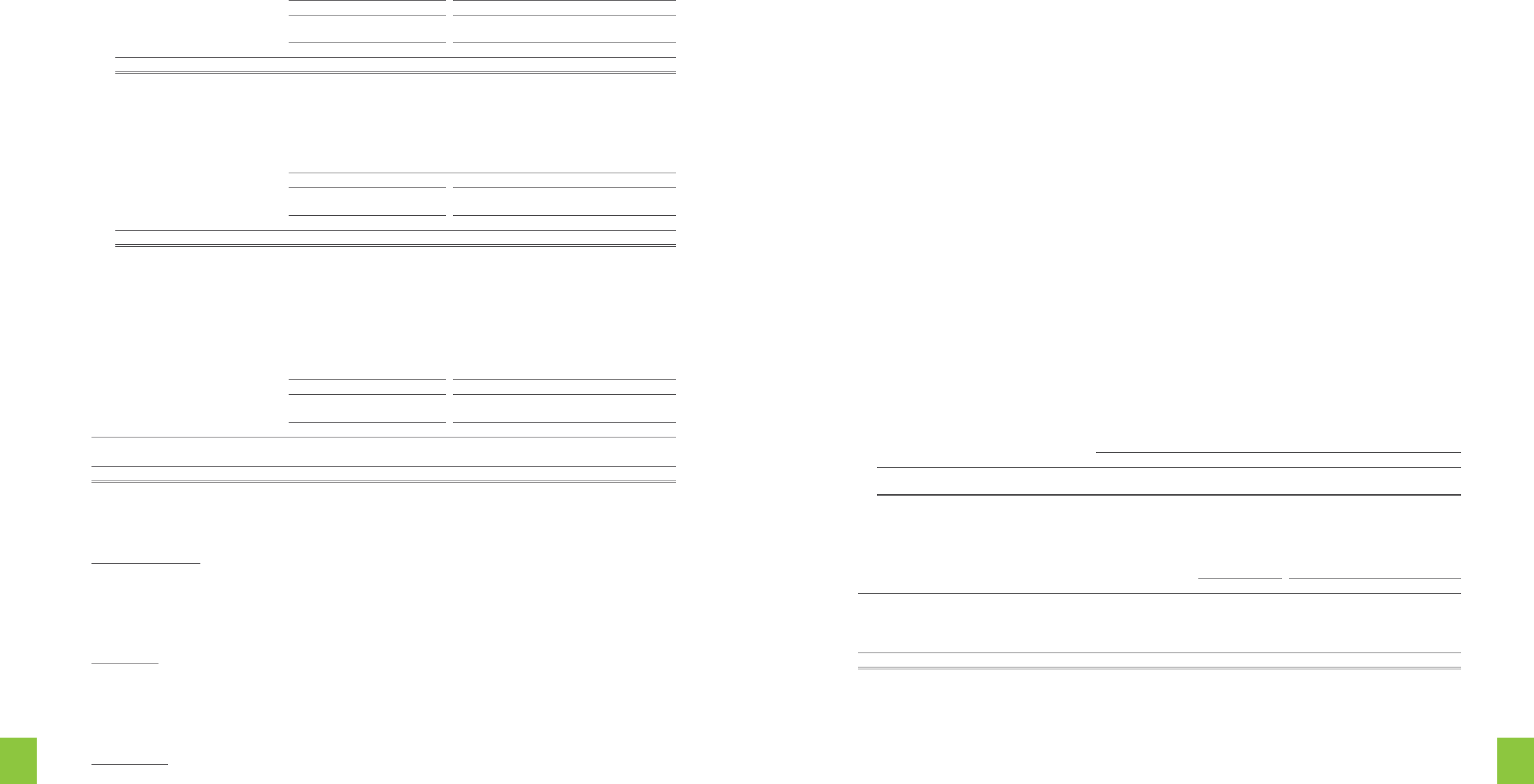

(13) Leasing - Lessee

Rental revenues

December 31

2011 2012

Amount % to Total

Rental Revenues Amount % to Total

Rental Revenues

Related Party NT$ NT$ US$ (Note 3)

Chander Electronics Corp. $920 100 $- $- -

The Company lease the unused parcel of land and building to the aforementioned related parties. The rental

revenue was determined at the prevailing rates in the surrounding area.

Operating expenses - rental expenses

December 31

2011 2012

Amount % to Total

Rental Expenses Amount % to Total

Rental Expenses

Related Party NT$ NT$ US$ (Note 3)

VIA Technologies Inc. $5,209 2 $5,209 $179 5

The Company leased staff dormitory owned by VIA Technologies, Inc. at operating lease agreements. The term of

the lease agreement is from April 2012 to March 2015 and the rental payment was determined at the prevailing rates

in the surrounding area.

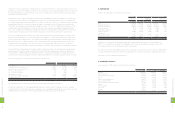

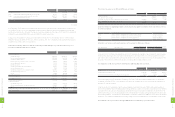

(14) Donation

December 31

2011 2012

Amount % to Total

Donation Expenses Amount % to Total

Donation Expenses

Related Party NT$ NT$ US$ (Note 3)

HTC Cultural and Educational Foundation $150,000 39 $836 $29 14

HTC Social Welfare and Charity Foundation 150,000 39 - - -

$300,000 78 $836 $29 14

Note 17 has more information about HTC Cultural and Educational Foundation.

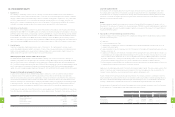

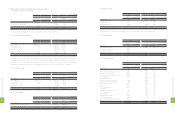

(15) Trademark and Technology License Agreement

Beats Electronics, LLC

To enhance product diversity, the Company entered into a trademark and technology license agreement with Beats

Electronics, LLC. The agreement took effect in August 2011 and will end in December 2016. The royalty expense was

NT$269,565 thousand (US$9,254 thousand) in 2012. As of December 31, 2012, the unpaid royalty was NT$130,960

thousand (US$4,496 thousand).

Dashwire, Inc.

To enhance the product diversity, the Company entered into a technology license agreement with Dashwire, Inc. The

agreement took effect in January 2012 and will end in December 2012. The royalty expense was NT$20,620 thousand

(US$708 thousand) in 2012. The royalty prepayment as of December 31, 2012 was NT$28,999 thousand (US$996

thousand).

Openmoko, Inc.

The Company entered into a platform technology license agreement with Openmoko, Inc. The agreement took effect in

April 2012 and will end in March 2013. The royalty expense was NT$2,136 thousand (US$73 thousand) in 2012.

(16) Property Transaction

The Company bought the auxiliary facilities of buildings from Chander Electronics Corp. for NT$6,555 in 2011 and

NT$55,891 thousand (US$1,919 thousand) in 2012.

The Company bought the machinery from HTC America Innovation Inc. for NT$23,421 thousand (US$804 thousand) in

2012. As of December 31, 2012, there was NT$23,421 thousand (US$804 thousand) unpaid and was accounted for under

"payable for purchase of equipment".

In 2012, the Company bought building equipment from VIA Technologies, Inc. for NT$5,264 thousand (US$181 thousand).

As of December 31, 2012, there was NT$2,127 thousand (US$73 thousand) unpaid and was accounted for under "payable

for purchase of equipment".

S3 Graphics Co, Ltd. ("S3 Graphics") owns patents on key graphics technologies, which can strengthen the Company's

patent portfolio and counteract the patent rights of competitors and potential licensors around the globe. In the meeting

on July 6, 2011, the Board of Directors resolved to invest in S3 Graphics, and in November 2011, the Company obtained

all patents owned by S3 Graphics through the purchase of all the shares of S3 Graphics from VIABASE CO., LTD. and

WTI Investment International, Ltd. by increasing the capital of HTC Investment One (BVI) Corporation by an amount of

US$300,000 thousand.

(17) Patent Litigation

Note 30 has more information.

(18) Loan

On July 19, 2012, the Company's board of directors passed a resolution to offer US$225,000 thousand short-term loan to

Beats Electronics, LLC to support the transition of Beats into a product company. This loan was secured by all the assets of

Beats. Term loan must be repaid in full no later than one year from signing date of loan agreement and the repayment can

be made in full at anytime during the term of the loan or at the repayment date. The calculation of interest is based on LIBOR

plus 1.5%, 3.5%, 5.5% and 7.5% for the first quarter to the fourth quarter, respectively. The loan details were as follows:

2012

Name of Counterparty Account Maximum Balance Ending Balance Interest Rate Interest Revenue

Beats Electronics, LLC Other receivable $6,554,025

(USD225,000)

$6,554,025

(USD225,000) 1.9466%-3.8188% $82,027

(US$2,816)

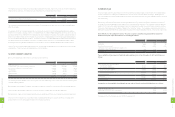

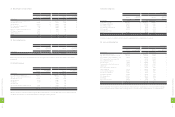

3. Compensation of Directors, Supervisors and Management Personnel

2011 2012

NT$ NT$ US$ (Note 3)

Salaries $106,673 $124,825 $4,285

Incentives (Note a) 67,282 14,186 487

Special compensation - - -

Bonus (Note b) 680,387 - -

$854,342 $139,011 $4,772

Note: a. Due to uncertainty of distribution of part of the incentives for 2012, the disclosure of incentives for 2012 was only for the amount that would be

distributed exactly.

b. The information about bonus to employees for 2012 is not available since the related proposal had not yet been made in the stockholders' meeting.

The compensation of directors, supervisors and management personnel for 2011 included bonuses appropriated from the earnings of 2011, which were

approved by the stockholders in the annual meeting in 2012.

The Company's disclosure of the compensation of directors, supervisors, president, vice president and management

personnel for 2011 and 2012 was in compliance with Order VI-0970053275 issued by the Financial Supervisory Commission

under the Executive Yuan. The disclosure of the compensation included salaries, incentives, special compensation, business

expenses and bonus.

1

8

8

8

FINANCIAL INFORMATION

1

8

9

8

FINANCIAL INFORMATION