HTC 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

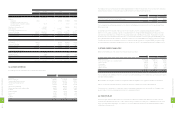

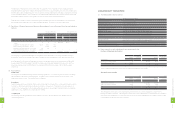

In August 2010, HTC made an investment in WI Harper Fund VII through HTC BVI. As of December 31, 2012, HTC’s

investment had amounted to US$2,790 thousand (NT$81,270 thousand).

In December 2010, HTC invested US$2,500 thousand in NETQIN MOBILE Inc. through HTC BVI. In January 2012, because

the fair value of this investment could be reliably measured and on the basis of the investment holding purpose, HTC

transferred this investment to "available for sale financial assets - current."

In December 2010, HTC made an investment in Luminous Optical Technology Co., Ltd. ("Luminous") through HTC Investment

Corporation and HTC I Investment Corporation. As of December 31, 2012, HTC's investment in Luminous had amounted to

NT$183,000 thousand, and its ownership percentage was 10.02%.

In February 2011, HTC invested US$40,000 thousand in OnLive, Inc. through HTC BVI, and the ownership percentage was

3.79%. In August 2012, OnLive, Inc. declared to have an asset restructuring due to the lack of operating cash and an inability

to raise new capital. HTC assessed that its investment could not be recovered and thus recognized an impairment loss of

US$40,000 thousand (NT$1,199,045 thousand).

In March 2011, HTC made an investment in KKBOX Inc. through HTC BVI. As of December 31, 2012, HTC's investment in

KKBOX Inc. had amounted to US$10,000 thousand (NT$291,290 thousand), and its ownership percentage was 11.11%.

In June 2011, HTC made an investment in TransLink Capital Partners II, L.P. through HTC BVI. As of December 31, 2012, HTC's

investment in TransLink Capital Partners II, L.P. had amounted to US$4,800 thousand (NT$139,819 thousand).

In May 2011, HTC made an investment in Shanghai F-road Commercial Co. through HTC HK Limited. As of December 31, 2012,

HTC's investment in Shanghai F-road Commercial Co., Ltd. had amounted to US$5,500 thousand (NT$160,610 thousand),

and its ownership percentage was 14.21%.

In August 2011, HTC made an investment in Primavera Capital (Cayman) Fund L.L.P. through HTC Investment One (BVI)

Corporation. As of December 31, 2012, HTC's investment had amounted to US$50,921 thousand (NT$1,483,286 thousand).

In August 2012, HTC made an investment in Magnet Systems Inc. through HTC BVI. As of December 31, 2012, HTC’s

investment had amounted to US$35,418 thousand (NT$1,031,702 thousand), and the ownership percentage was 17.10%.

These unquoted equity instruments were not carried at fair value because their fair value could not be reliably measured;

thus, the Company accounted for these investments by the cost method.

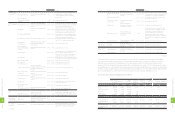

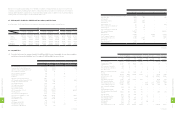

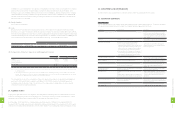

15. INVESTMENTS ACCOUNTED FOR BY THE EQUITY METHOD

Investments accounted for by the equity method as of December 31, 2011 and 2012 were as follows:

2011 2012

Carrying Value Ownership

Percentage Carrying Value Ownership

Percentage

NT$ NT$ US$

(Note 3)

Unquoted equity investments

Huada Digital Corporation $- - $241,309 $8,284 50.00

SYNCTV Corporation 71,732 20.00 56,687 1,946 20.00

Beats Electronics, LLC - - 5,650,859 193,994 25.14

71,732 5,948,855 204,224

Less: Accumulated impairment loss - (56,687) (1,946)

$71,732 $5,892,168 $202,278

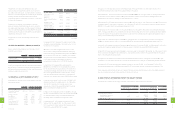

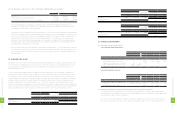

Prepayments for royalty were primarily for discount

purposes and were classified as current or non-current in

accordance with their nature. As of December 31, 2011 and

2012, the non-current prepayments of NT$7,311,781 thousand

and NT$7,327,355 thousand (US$251,548 thousand),

respectively, had been classified as other assets - other (Note

30 has more information).

Prepayments to suppliers were primarily for discount

purposes and were classified as current or non-current in

accordance with their nature. As of December 31, 2011 and

2012, non-current prepayments of NT$2,956,977 thousand

and NT$2,121,432 thousand (US$72,829 thousand) had been

classified as other assets - other.

Prepayments for others were primarily travel and other

expenses.

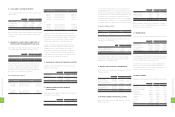

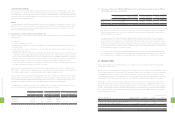

13. HELD-TO-MATURITY FINANCIAL ASSETS

Held-to-maturity financial assets as of December 31, 2011

and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Corporate bonds $204,597 $101,459 $3,483

Less: Current portion - (101,459) (3,483)

$204,597 $- $-

In 2010, the Company bought the corporate bonds issued by

Nan Ya Plastics Corporation, and these bonds will mature in

2013 at an effective interest rate of 0.90%. Half of the bonds

had been repaid in November 2012.

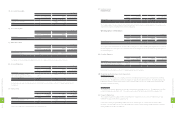

14. FINANCIAL ASSETS CARRIED AT COST

Financial assets carried at cost as of December 31, 2011 and

2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Hua-Chuang Automobile

Information Technical

Center Co., Ltd.

$500,000 $500,000 $17,165

Answer Online, Inc. 1,192 1,192 41

BandRich Inc. 15,861 15,861 545

SoundHound Inc. 67,441 64,880 2,227

GSUO Inc. 242,232 233,032 8,000

Felicis Ventures II LP 68,128 120,157 4,125

WI Harper Fund VII 47,689 81,270 2,790

NETQIN MOBILE Inc. 75,698 - -

2011 2012

NT$ NT$ US$ (Note 3)

Luminous Optical

Technology Co., Ltd. 183,000 183,000 6,283

OnLive, Inc. 1,211,160 - -

KKBOX Inc. 302,790 291,290 10,000

TransLink Capital Partners

II, L.P. 99,921 139,819 4,800

Shanghai F-road

Commercial Co., Ltd. 166,555 160,610 5,514

Primavera Capital

(Cayman) Fund L.L.P. 428,179 1,483,286 50,921

Magnet Systems Inc. - 1,031,702 35,418

3,409,846 4,306,099 147,829

Less: Accumulated

impairment loss (1,192) (1,192) (41)

$3,408,654 $4,304,907 $147,788

(Concluded)

In January 2007, HTC acquired 10% equity interest in Hua-

Chuang Automobile Information Technical Center Co., Ltd.

for NT$500,000 thousand.

On March 1, 2004, HTC merged with IA Style, Inc., with

HTC as survivor entity, and thus acquired an 1.82% equity

interest, amounting to NT$1,192 thousand, in Answer Online,

Inc., an investee of IA Style, Inc. In addition, the Company

determined that the recoverable amount of this investment

in 2010 was less than its carrying amount and thus

recognized an impairment loss of NT$1,192 thousand.

In April 2006, HTC acquired 92% equity interest in

BandRich Inc. for NT$135,000 thousand and accounted

for this investment by the equity method. However, HTC's

ownership percentage declined from 92% to 18.08%; thus,

HTC lost its significant influence on this investee. In July

2010, HTC transferred this investment to "financial assets

carried at cost" using the book value of NT$15,861 thousand.

In July 2009, through H.T.C. (B.V.I.) Corp. ("HTC BVI"), HTC

made an investment in SoundHound Inc. As of December

31, 2012, HTC's investment in SoundHound Inc. had

amounted to US$2,227 thousand (NT$64,880 thousand),

and its ownership percentage was 4.50%.

In May 2010, HTC made an investment in GSUO Inc. through

HTC BVI. As of December 31, 2012, HTC's investment in GSUO

Inc. had amounted to US$8,000 thousand (NT$233,032

thousand), and its ownership percentage was 10.32%.

In September 2010, HTC made an investment in Felicis

Ventures II LP through HTC BVI. As of December 31, 2012,

HTC's investment in Felicis Ventures II LP had amounted to

US$4,125 thousand (NT$120,157 thousand).

(Continued)

2

1

6

8

FINANCIAL INFORMATION

2

1

7

8

FINANCIAL INFORMATION