HTC 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

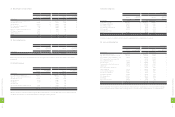

2011 2012

NT$ NT$ US$ (Note 3)

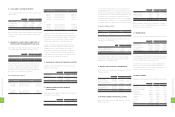

CASH FLOWS FROM FINANCING ACTIVITIES

Decrease in long-term bank loans ($24,376) $- $-

Increase in guarantee deposits received 28,987 17,053 585

Cash dividends (29,891,089) (33,249,085) (1,141,443)

Purchase of treasury stock (16,135,808) (3,700,346) (127,033)

Transfer of treasury stock to employees 4,113,821 - -

Increase (decrease) in minority interest 669,472 (1,459,370) (50,100)

Net cash used in financing activities (41,238,993) (38,391,748) (1,317,991)

EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS (65,975) 665,807 22,857

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS 13,038,647 (33,623,441) (1,154,295)

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR 74,462,861 87,501,508 3,003,932

CASH AND CASH EQUIVALENTS, END OF YEAR $87,501,508 $53,878,067 $1,849,637

SUPPLEMENTAL CASH FLOW INFORMATION

Cash paid during the year

Interest $32,197 $1,715 $59

Income tax $7,877,290 $11,754,892 $403,546

NON-CASH INVESTING AND FINANCING ACTIVITIES

Transfer of retained earnings to stock dividends for distribution $403,934 $- $-

Transfer of assets leased to others to properties $50,828 $- $-

Retirement of treasury stock $8,509,336 $- $-

Transfer of accrued bonus to employees to stock dividends for distribution and

other capital surplus $4,245,851 $- $-

PURCHASE OF PROPERTIES

Cost of properties purchased $8,781,446 $6,921,847 $237,627

Increase in payables for the purchase of equipment (370,264) (659,289) (22,634)

Cash paid for the purchase of properties $8,411,182 $6,262,558 $214,993

ACQUISITION OF SUBSIDIARIES

Net cash outflow on the acquisition of a subsidiary $20,303,485 $45,021 $1,546

(Increase) decrease in other payable (92,756) 128,905 4,424

Cash paid for acquisition of subsidiaries $20,210,729 $173,926 $5,970

CASH RECEIVED FROM THE DISPOSAL OF A SUBSIDIARY

Proceeds of the sale of subsidiary $- $4,369,350 $150,000

Increase in long-term receivable - (4,369,350) (150,000)

Cash received from the disposal of a subsidiary $- $- $-

The accompanying notes are an integral part of the consolidated financial statements.

(Concluded)

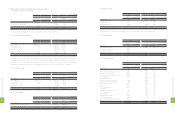

(In Thousands)

2011 2012

NT$ NT$ US$ (Note 3)

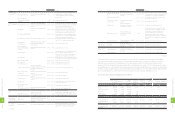

CASH FLOWS FROM OPERATING ACTIVITIES

Net income $62,299,048 $17,589,186 $603,838

Adjustments to reconcile net income to net cash provided by operating activities

Depreciation 1,564,225 2,222,517 76,299

Amortization 836,611 2,037,722 69,955

Compensation cost recognized for the transfer of treasury stock to

employees 1,788,270 - -

Amortization of premium on financial assets 3,349 3,138 108

Prepaid pension cost (24,878) (22,267) (764)

Loss (gain) on equity-method investments 3,961 (387,478) (13,302)

Losses on disposal of properties, net 465 6,395 220

Transfer of properties to expenses 324 30,501 1,047

(Gain) loss on sale of investments, net (29) 165,184 5,671

Unrealized gain on financial assets - (10,467) (359)

Impairment losses 18,608 1,313,353 45,087

Deferred income tax assets (2,504,033) (2,036,274) (69,905)

Net changes in operating assets and liabilities

Financial instruments at fair value through profit or loss 229,037 249,918 8,580

Notes and accounts receivable (2,124,055) 19,885,018 682,654

Other receivables- related parties - 966 33

Inventories (1,995,952) 2,707,400 92,945

Prepayments (3,834,892) (1,412,046) (48,476)

Other current assets (287,655) 195,668 6,717

Other current financial assets (622,371) 215,036 7,382

Other assets - others (7,784,602) 819,971 28,149

Notes and accounts payable 16,372,303 68,467 2,350

Income tax payable 3,751,382 (7,857,294) (269,741)

Accrued expenses 16,823,509 (6,481,923) (222,525)

Other current liabilities 3,994,726 (6,006,993) (206,221)

Net cash provided by operating activities 88,507,351 23,295,698 799,742

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of available-for-sale financial assets (490,000) - -

Proceeds of the sale of available-for-sale financial assets 200,029 829,071 28,462

Repayment of held-to-maturity financial assets - 100,000 3,433

Increase in financial assets carried at cost (2,300,272) (2,292,573) (78,704)

Acquisition of investments accounted for by the equity method (76,214) - -

Acquisition of subsidiaries (20,210,729) (173,926) (5,970)

Purchase of properties (8,411,182) (6,262,558) (214,993)

Proceeds of the sale of properties 580 38,683 1,328

Increase in refundable deposits (34,309) (13,718) (471)

Increase in deferred charges (574,267) (228,537) (7,846)

Loan to related parties - (6,600,093) (226,582)

Decrease (increase) in restricted assets 26,988 (3,580,820) (122,930)

Increase in intangible assets (2,294,360) (509,338) (17,486)

Loss of a subsidiary - (499,389) (17,144)

Net cash used in investing activities (34,163,736) (19,193,198) (658,903)

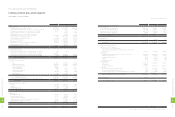

HTC CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

YEARS ENDED DECEMBER 31, 2011 AND 2012

(Continued)

2

0

2

8

FINANCIAL INFORMATION

2

0

3

8

FINANCIAL INFORMATION