HTC 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

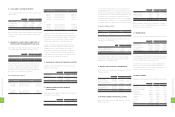

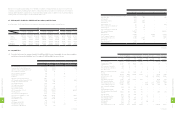

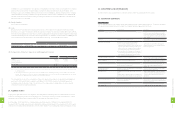

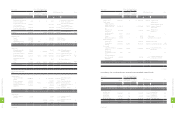

2011 2012

NT$ NT$ US$ (Note 3)

Loss carryforwards $90,371 $138,619 $4,759

Tax credit carryforwards 3,125,027 1,644,674 56,462

Total deferred tax assets 17,394,635 15,051,337 516,713

Less: Valuation allowance (11,132,656) (6,445,409) (221,271)

Total deferred tax assets, net 6,261,979 8,605,928 295,442

Deferred tax liabilities

Unrealized valuation gains on financial instruments (43,668) (2,961) (102)

Unrealized revenue - (14,888) (511)

Unrealized pension cost (30,778) (34,594) (1,187)

Unrealized gain on investment (240,760) (470,743) (16,161)

Unrealized depreciation (25,056) (124,751) (4,283)

Deferred tax liabilities offset against deferred tax assets, net 5,921,717 7,957,991 273,198

Less: Current portion (2,246,196) (3,530,215) (121,193)

Deferred tax assets - non-current $3,675,521 $4,427,776 $152,005

(Concluded)

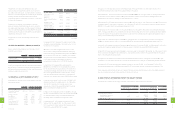

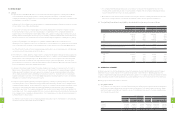

(3) The income taxes in 2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Current income tax $11,581,019 $4,049,011 $139,003

Less: Increase in deferred income tax assets (2,504,033) (738,171) (25,341)

Effect of tax law changes - (1,298,103) (44,564)

Add (deduct): Underestimation (overestimation) of prior year's income tax 47,653 (151,465) (5,200)

Income tax $9,124,639 $1,861,272 $63,898

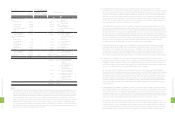

(4) Under the Statute for Upgrading Industries, HTC was granted exemption from corporate income tax for as

follows:

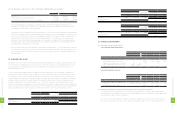

The Year of Occurrence Item Exempt from Corporate Income Tax Exemption Period

2006 Sale of wireless phones or smartphones with 3G or GPS function 2006.12.20-2011.12.19

2007 Sale of wireless phones or smartphones with 3G or GPS function 2007.12.20-2012.12.19

2008 Sale of wireless phones or smartphones with 3.5G function 2010.01.01-2014.12.31

2009 Sale of wireless phones or smartphones with 3.5G function 2015.01.01-2018.09.30

(5) Information on the tax credit carryforwards as of December 31, 2012 was as follows:

Laws and Statutes Tax Credit Source Total Creditable Amount Remaining Creditable Amount Expiry Year

NT$ US$ (Note 3) NT$ US$ (Note 3)

Statute for

Upgrading

Industries

Research and development expenditures $2,375,184 $81,540 $1,644,674 $56,462 2013

Under Article 10 of the Statute for Industrial Innovation ("SII") passed by the Legislative Yuan in April 2010, a profit-

seeking enterprise may deduct up to 15% of its research and development expenditures from its income tax payable for

the fiscal year in which these expenditures are incurred, but this deduction should not exceed 30% of the income tax

payable for that fiscal year. This incentive is effective from January 1, 2010 till December 31, 2019.

As of December 31, 2012, the losses carryforwards of Dashwire, Inc., Inquisitive Minds, Inc., HTC America Content

Services, Inc. and Saffron Digital Inc. that had given rise to deferred income tax assets in the United States and could be

carried forward for 20 years were NT$138,619 thousand (US$4,759 thousand).

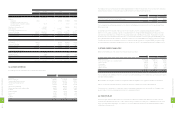

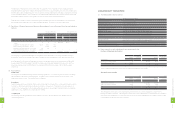

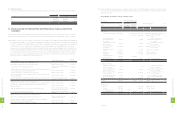

2012

Income Tax Expense

(Benefit) Income Tax Payable Income Tax Receivable Deferred Tax Assets

(Liabilities)

NT$ US$

(Note 3) NT$ US$

(Note 3) NT$ US$

(Note 3) NT$ US$

(Note 3)

HTC Electronics (Shanghai) Co.,

Ltd. ($851) ($29) $73,919 $2,538 $- $- $136,661 $4,692

HTC Malaysia Sdn. Bhd. 2,947 101 - - 992 34 300 10

HTC Innovation Limited (655) (22) - - - - - -

HTC Poland sp. z o.o. 1,189 41 1 - - - 978 34

HTC Iberia S.L. 1,605 55 1,980 68 - - - -

HTC Germany GmbH. 8,127 279 10,329 355 - - - -

HTC Nordic ApS. 3,139 108 581 20 - - (35) (1)

HTC Luxembourg S.a.r.l. 10,107 347 9,709 333 - - - -

HTC FRANCE CORPORATION 504 17 - - 1,129 39 - -

ABAXIA SAS 6,978 240 13,114 450 - - - -

Saffron Digital Inc. (1,614) (55) - - 761 26 2,471 85

HTC Norway AS 147 5 143 5 - - - -

Dashwire, Inc. 24 1 393 13 - - - -

HTC Communication Sweden AB 273 9 66 2 - - - -

HTC Communication Canada, Ltd. 4,282 147 9,240 317 - - 5,113 176

Inquisitive Minds, Inc. 24 1 - - - - - -

HTC Communication

Technologies (SH) 15,559 534 15,131 519 - - - -

FunStream Corporation - - - - 1 - - -

PT. High Tech Computer

Indonesia 3,372 116 3,227 111 - - - -

HTC South Eastern Europe

Limited liability Company (35) (1) 485 17 - - - -

Yoda Co., Ltd. - - - - 1 - - -

HTC Middle East FZ-LLC - - 1,965 67 - - - -

HTC America Content Services,

Inc. 48 2 23 1 - - - -

$1,861,272 $63,898 $2,713,373 $93,150 $61,533 $2,112 $7,957,991 $273,198

(Concluded)

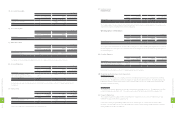

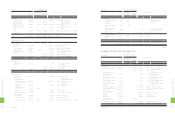

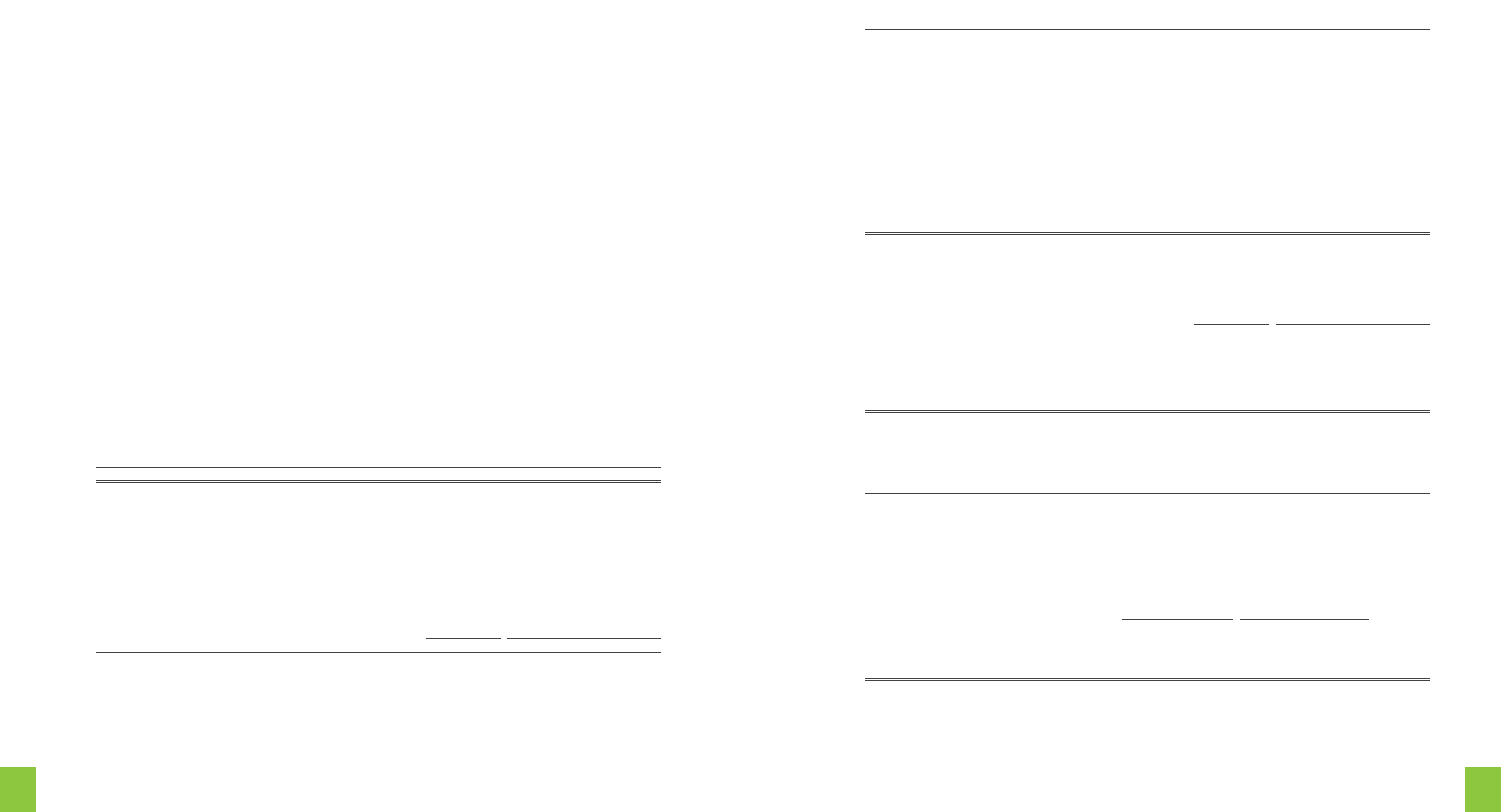

(2) In August 2012, the Legislative Yuan passed the amendment of Article 8 of the "Income Basic Tax Act"

which increased alternative minimum tax rate from 10% to 12%, eective January 1, 2013. The Company

has revaluated deferred tax assets in accordance with the revised article. Deductible temporary

dierences and tax credit carryforwards that had given rise to deferred tax assets as of December 31, 2011

and 2012 were as follows:

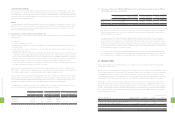

2011 2012

NT$ NT$ US$ (Note 3)

Temporary differences

Unrealized royalties $4,817,745 $5,256,074 $180,441

Unrealized marketing expenses 4,922,310 3,773,168 129,533

Unrealized warranty expense 2,247,065 1,429,433 49,073

Allowance for loss on decline in value of inventory 834,797 950,480 32,630

Unrealized salary and welfare 307,356 413,392 14,192

Unrealized bad-debt expenses 153,749 282,625 9,702

Capitalized expense 69,302 251,698 8,641

Unrealized materials and molding expenses 138,502 147,899 5,077

Unrealized contingent losses on purchase orders 348,990 139,911 4,803

Unrealized sales allowance 71,874 139,088 4,775

Unrealized exchange losses 138,093 42,824 1,470

Other 129,454 441,452 15,155

(Continued)

2

2

8

8

FINANCIAL INFORMATION

2

2

9

8

FINANCIAL INFORMATION