HTC 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

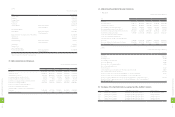

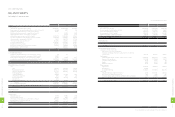

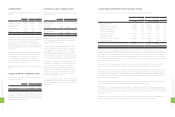

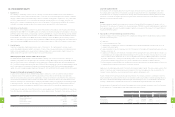

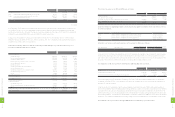

2011 2012

NT$ NT$ US$ (Note 3)

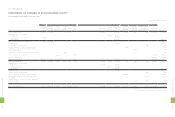

CASH FLOWS FROM FINANCING ACTIVITIES

Decrease in guarantee deposits received - (628) (21)

Cash dividends (29,891,089) (33,249,085) (1,141,443)

Purchase of treasury stock (16,135,808) (3,700,346) (127,033)

Transfer treasury stock to employees 4,113,821 - -

Net cash used in financing activities (41,913,076) (36,950,059) (1,268,497)

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS 12,590,244 (34,365,491) (1,179,769)

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR 66,282,076 78,872,320 2,707,691

CASH AND CASH EQUIVALENTS, END OF YEAR $78,872,320 $44,506,829 $1,527,922

SUPPLEMENTAL CASH FLOW INFORMATION

Cash paid during the year

Interest $10,265 $320 $11

Income tax $6,406,264 $9,570,679 $328,562

NON-CASH INVESTING AND FINANCING ACTIVITIES

Transfer of retained earnings to stock dividends for distribution $403,934 $- $-

Transfer of assets leased to others to properties $50,828 $- $-

Retirement of treasury stock $8,509,336 $- $-

Transfer of accrued bonus to employees to stock dividends for distribution and

other capital surplus $4,245,851 $- $-

INCREASE IN LONG-TERM INVESTMENTS - EQUITY METHOD

Increase in investments accounted for by the equity method $23,145,450 $5,586,458 $191,783

Decrease in payable for purchase of investments 40,880 - -

Cash paid for increase in long-term investments $23,186,330 $5,586,458 $191,783

PURCHASE OF PROPERTIES

Cost of properties purchased $5,359,120 $6,042,237 $207,430

Increase in payable for purchase of equipment (30,185) (770,286) (26,444)

Cash paid for the purchase of properties $5,328,935 $5,271,951 $180,986

The accompanying notes are an integral part of the financial statements.

(Concluded)

(In Thousands)

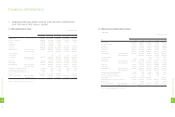

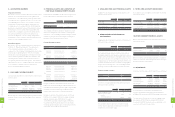

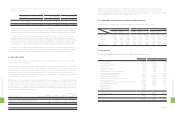

HTC CORPORATION

STATEMENTS OF CASH FLOWS

YEARS ENDED DECEMBER 31, 2011 AND 2012

2011 2012

NT$ NT$ US$ (Note 3)

CASH FLOWS FROM OPERATING ACTIVITIES

Net income $61,975,796 $16,780,968 $576,092

Adjustments to reconcile net income to net cash provided by operating activities

Depreciation 928,774 1,292,949 44,387

Amortization 397,022 524,391 18,002

Compensation cost recognized for the transfer of treasury stock to employees 1,788,270 - -

Distribution of bonuses to employees of subsidiaries (599,510) - -

Amortization of premium on financial assets 3,349 3,138 108

Prepaid pension costs (24,882) (22,184) (762)

Gains on equity-method investments (2,718,362) (617,608) (21,203)

Cash dividends received from equity-method investees 1,786 1,744 60

Transfer of properties to expenses 59 17,411 598

Gains on sale of investments, net (29) (7,695) (264)

Unrealized gain on financial assets - (10,467) (359)

Impairment loss - 45,017 1,546

Deferred income tax assets (1,768,812) (1,197,459) (41,109)

Net changes in operating assets and liabilities

Financial instruments at fair value through profit or loss 193,408 249,918 8,580

Notes and accounts receivable 3,139,262 12,296,013 422,123

Accounts receivable from related parties (4,790,878) 13,509,139 463,769

Other current financial assets (623,399) 180,380 6,192

Other receivables - related parties (42,892) 45,446 1,560

Inventories (3,468,828) 4,867,353 167,096

Prepayments (3,669,657) (585,542) (20,102)

Other current assets (101,225) 348,213 11,954

Other assets - other (5,289,930) 584,684 20,072

Notes and accounts payable 15,152,938 1,276,175 43,811

Accounts payable to related parties 2,292,250 (736,246) (25,275)

Income tax payable 3,236,423 (8,229,084) (282,505)

Accrued expenses 14,946,453 (11,608,359) (398,516)

Other current liabilities 4,753,191 (6,216,347) (213,407)

Net cash provided by operating activities 85,710,577 22,791,948 782,448

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of available-for-sale financial assets (490,000) - -

Proceeds of the sale of available-for-sale financial assets 200,029 739,095 25,373

Repayment of held-to-maturity financial assets - 100,000 3,433

Increase in investments accounted for by the equity method (23,186,330) (5,586,458) (191,783)

Purchase of properties (5,328,935) (5,271,951) (180,986)

Decrease (increase) in refundable deposits 303 (6,053) (208)

Increase in deferred charges (122,413) - -

Loan to related parties - (6,600,093) (226,582)

Increase in restricted assets - (3,581,920) (122,967)

Purchase of intangible assets (2,279,911) - -

Net cash used in investing activities (31,207,257) (20,207,380) (693,720)

(Continued)

1

5

8

8

FINANCIAL INFORMATION

1

5

9

8

FINANCIAL INFORMATION