HTC 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

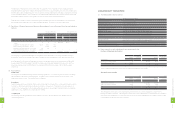

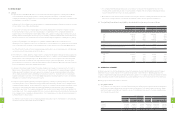

In April 2011, HTC bought land approximately 49 thousand square meters adjacent to its Taoyuan plant for NT$1,770,000

thousand, the price based on the appraisal report, from an unrelated party, to build a complete technology park and meet

future capacity expansion requirements.

The construction of a new office building and factory was completed in June 2012, and a construction amount of

NT$5,615,958 thousand (US$192,796 thousand) was transferred from prepayments for construction in progress to buildings

and structures.

There were no interests capitalized in 2011 and 2012.

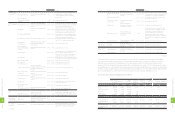

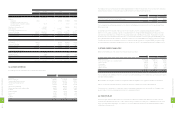

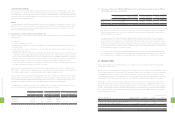

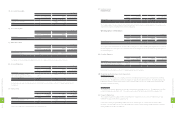

17. INTANGIBLE ASSETS

Movement of intangible assets for 2011 and 2012 were as follows:

2011

Patents Goodwill Deferred

Pension Cost Other Total

NT$ NT$ NT$ NT$ NT$

Cost

Balance, beginning of year $220,943 $569,311 $416 $228,850 $1,019,520

Additions

Acquisition 2,282,409 - 11,951 2,294,360

Difference between the cost of investments and the

Company's share in investees' net assets 9,033,450 10,240,332 603,852 19,877,634

Owned by acquirees 21,527 - 62,929 84,456

Adjustments of acquisition cost - 81,183 - 81,183

The changes in deferred pension cost - - (74) - (74)

Translation adjustment 50,211 15,052 4,380 69,643

Balance, end of year 11,608,540 10,905,878 342 911,962 23,426,722

Accumulated amortization

Balance, beginning of year 12,362 - - - 12,362

Amortization 443,551 - - 330,812 774,363

Owned by acquirees 475 - - 475

Translation adjustment 54 - - (14,634) (14,580)

Balance, end of year 456,442 - - 316,178 772,620

Accumulated impairment losses

Balance, beginning of year - 71,508 - - 71,508

Impairment losses - 18,608 - - 18,608

Translation adjustment - 3,198 - - 3,198

Balance, end of year - 93,314 - - 93,314

Net book value, end of year $11,152,098 $10,812,564 $342 $595784 $22,560,788

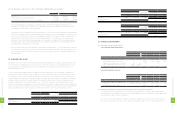

In December 2009, HTC acquired 100% equity interest in Huada Digital Corporation ("Huada"), whose main business is

software services, for NT$245,000 thousand and accounted for this investment by the equity method. In September 2011,

HTC increased this investment by NT$5,000 thousand. As of December 31, 2012, HTC's investment in Huada had amounted

to NT$250,000 thousand. In September 2011, the Fair Trade Commission approved an investment by Chunghwa Telecom

Co., Ltd. ("CHT") in Huada and the registration of this investment was completed in October 2011. After CHT's investment,

HTC's ownership percentage declined from 100% to 50%. In March 2012, Huada held a stockholders' meeting and re-elected

its directors and supervisors. As a result, the investment type was changed to joint venture and the Company continued to

account for this investment by the equity method.

In September 2011, through HTC America Holding Inc., HTC acquired 20% equity interest in SYNCTV Corporation for US$2,500

thousand and accounted for this investment by the equity method. In 2012, the Company determined that the recoverable

amount of this investment was less than its carrying amount and thus recognized an impairment loss of NT$56,687 thousand

(US$1,946 thousand).

In October 2011, HTC acquired, through HTC America Holding Inc., 50.14% equity interest in Beats Electronics, LLC.

("Beats") for US$300,000 thousand. In July 2012, HTC sold back 25% of Beats shares to the founding members of Beats

for US$150,000 thousand with a cost amounting to US$157,144 thousand (including initial investment cost of US$150,000

thousand and an accumulated gain of US$7,144 thousand on equity method investment). This transaction resulted in a loss

on disposal of US$7,144 thousand (NT$214,268 thousand).

Three-year non-recourse secured promissory notes (the "Notes"), totaling US$150,000 thousand (NT$4,369,350 thousand),

were issued by the buying party and accounted for under "long-term receivable". These Notes, payable at the maturity in

three years, bear interest based on LIBOR plus 1% and was secured by pledge of interest obtained by the buying party in

this transaction. After the transaction, HTC indirectly remained 25.14% of the shareholdings in Beats and accounted for this

investment by the equity method.

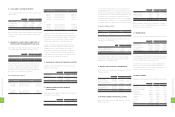

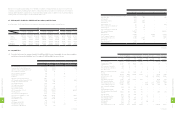

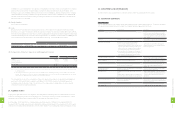

In 2011 and 2012, gain (loss) on equity method investments were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Huada Digital Corporation $- ($9,380) ($322)

SYNCTV Corporation (3,961) (11,979) (411)

Beats Electronics, LLC 408,837 14,035

($3,961) $387,478 $13,302

The financial statements of equity-method investees had been examined by independent auditors, except SYNCTV Corporation.

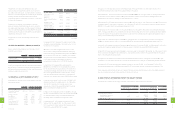

16. PROPERTIES

Properties as of December 31, 2011 and 2012 were as follows:

2011 2012

Carrying Value Cost Accumulated

Depreciation Carrying Value

NT$ NT$ NT$ NT$ US$ (Note 3)

Land $7,614,167 $7,615,546 $- $7,615,546 $261,442

Buildings and structures 4,990,887 11,817,745 1,302,517 10,515,228 360,988

Machinery and equipment 5,907,321 13,308,358 6,980,635 6,327,723 217,231

Computer equipment 353,729 943,107 544,607 398,500 13,680

Transportation equipment 3,922 7,038 4,151 2,887 99

Furniture and fixtures 166,877 452,511 262,857 189,654 6,511

Leased assets 919 2,765 733 2,032 70

Leasehold improvements 343,718 545,705 177,994 367,711 12,624

Prepayments for construction-in-progress and equipment in transit 2,130,938 232,011 - 232,011 7,965

$21,512,478 $34,924,786 $9,273,494 $25,651,292 $880,610

2

1

8

8

FINANCIAL INFORMATION

2

1

9

8

FINANCIAL INFORMATION