HTC 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

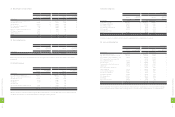

19. PENSION PLAN

The pension plan under the Labor Pension Act ("LPA") is a defined contribution plan. Under the LPA, the Company makes

monthly contributions to employees' individual pension accounts at 6% of monthly salaries and wages. Related pension

costs were NT$350,450 thousand and NT$411,916 thousand (US$14,141 thousand) for the years ended December 31, 2011 and

2012, respectively.

Based on the defined benefit plan under the Labor Standards Law ("LSL"), pension benefits are calculated on the basis of

the length of service and average monthly salaries of the six months before retirement. The Company contributes amounts

equal to 2% of total monthly salaries and wages to a pension fund administered by the pension fund monitoring committee.

The pension fund is deposited in the Bank of Taiwan in the committee’s name. The Company recognized pension costs of

NT$4,125 thousand and NT$3,991 thousand (US$137 thousand) for the years ended December 31, 2011 and 2012, respectively.

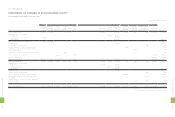

Under SFAS No. 18, "Accounting for Pensions," the pension expense calculated using actuarial method under the

defined benefit pension plan should disclose the following information:

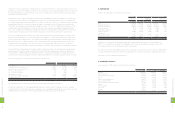

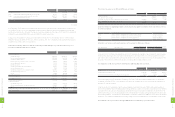

2011 2012

NT$ NT$ US$ (Note 3)

Service cost $5,980 $5,481 $188

Interest cost 6,858 7,313 251

Projected return on plan assets (9,206) (9,893) (340)

Amortization of unrecognized net transition obligation, net - - -

Amortization of net pension benefit 492 1,090 38

Net pension cost $4,124 $3,991 $137

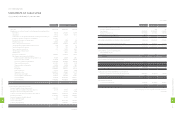

The reconciliations between pension fund status and prepaid pension cost as of December 31, 2011 and 2012 were as

follows:

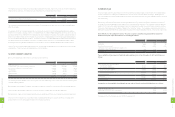

2011 2012

NT$ NT$ US$ (Note 3)

Present actuarial value of benefit obligation

Vested benefit obligation $10,026 $27,671 $950

Non-vested benefit obligation 192,737 188,898 6,485

Accumulated benefit obligation 202,763 216,569 7,435

Additional benefits on future salaries 162,889 161,807 5,555

Projected benefit obligation 365,652 378,376 12,990

Plan assets at fair value (481,685) (512,647) (17,600)

Funded status (116,033) (134,271) (4,610)

Unrecognized pension loss (67,794) (71,740) (2,462)

Prepaid pension cost ($183,827) ($206,011) ($7,072)

Assumptions used in actuarially determining the present value of the projected benefit obligation were as follows:

2011 2012

Weighted-average discount rate 2.00% 1.88%

Assumed rate of increase in future compensation 4.00% 4.00%

Expected long-term rate of return on plan assets 2.00% 1.88%

The payments from the fund amounted to NT$793 thousand in 2011.

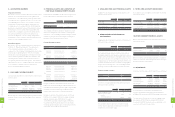

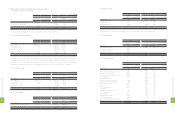

The employee bonus in 2011 and 2012 should be appropriated at 10% and 5%, respectively, of net income before deducting

employee bonus expenses. Accrued bonuses as of December 31, 2011 and 2012 were as follows:

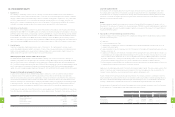

2011 2012

NT$ NT$ US$ (Note 3)

Accrued bonus to employees for current year $7,238,637 $976,327 $33,517

Cash bonuses approved by the stockholders for prior years - 4,735,748 162,579

$7,238,637 $5,712,075 $196,096

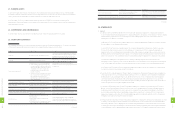

The Company accrued marketing expenses on the basis of related agreements and other factors that would significantly

affect the accruals.

In September 2009, the Company's board of directors resolved to donate to the HTC Cultural and Educational Foundation

NT$300,000 thousand, consisting of (a) the second and third floors of Taipei's R&D headquarters, with these two floors to be

built at an estimated cost of NT$217,800 thousand, and (b) cash of NT$82,200 thousand. This donation excludes the land, of

which the ownership remains with the Company. In June 2012, the Company handed over the foregoing donated building to

the HTC Cultural and Educational Foundation. The actual construction cost was NT$218,636 thousand (US$7,506 thousand).

The difference between the estimated construction cost and the actual construction cost was NT$836 thousand (US$29

thousand) and was recognized as an adjustment on the donation to the HTC Cultural and Educational Foundation in 2012.

Services fees accrued were mainly marketing activities, research and design and business consulting services provided by

related parties. These fees were calculated based on contract duration.

18. OTHER CURRENT LIABILITIES

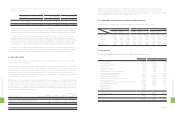

Other current liabilities as of December 31, 2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Warranty provisions $12,755,264 $6,780,712 $232,782

Deferred credits - gain from intercompany transactions 1,151,531 2,354,363 80,826

Provisions for contingent loss on purchase orders 2,052,881 823,005 28,254

Other payables 709,129 461,518 15,844

Agency receipts 388,885 270,073 9,271

Advance receipts 134,748 86,700 2,976

Others 630,563 830,283 28,504

$17,823,001 $11,606,654 $398,457

The Company provides warranty service for one year to two years depending on the contract with customers and recognizes

estimable warranty liabilities.

Other payables were payables for patents, miscellaneous expenses on behalf of overseas sales offices and repair materials.

Agency receipts were primarily employees' income tax, insurance, royalties and overseas value-added tax.

Deferred credits - gains on intercompany transactions were unrealized profit from intercompany downstream transactions.

The provision for contingent loss on purchase orders is estimated after taking into account the effects of changes in the

product market, in inventory management and in the Company's purchases.

1

7

2

8

FINANCIAL INFORMATION

1

7

3

8

FINANCIAL INFORMATION