HTC 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

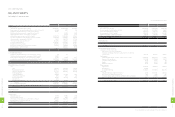

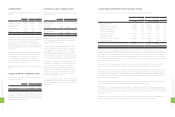

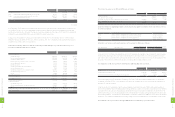

15. INVESTMENTS ACCOUNTED FOR BY THE EQUITY METHOD

Investments accounted for by the equity method as of December 31, 2011 and 2012 were as follows:

2011 2012

Carrying Value Ownership

Percentage Carrying Value Ownership

Percentage

NT$ NT$ US$ (Note 3)

Unquoted equity investments

H.T.C. (B.V.I.) Corp. $2,728,368 100.00 $2842,154 $97,571 100.00

Communication Global Certification Inc. 463,905 100.00 564,482 19,379 100.00

High Tech Computer Asia Pacific Pte. Ltd. 23,140,506 100.00 28,800,997 988,740 100.00

HTC Investment Corporation 301,332 100.00 303,889 10,433 100.00

PT. High Tech Computer Indonesia 62 1.00 62 2 1.00

HTC I Investment Corporation 295,902 100.00 300,106 10,303 100.00

HTC Holding Cooperatief U.A. 13 1.00 13 - 1.00

Huada Digital Corporation

250,689 50.00 241,309 8,284 50.00

HTC Investment One (BVI) Corporation 9,296,786 100.00 8,733,366 299,817 100.00

FunStream Corporation - - 45,047 1,546 100.00

Prepayments for long-term investments 579,485 349,688 12,005

37,057,048 42,181,113 1,448,080

Less: Accumulated impairment loss - (45,017) (1,546)

$37,057,048 $42,136,096 $1,446,534

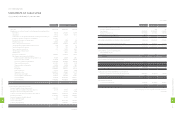

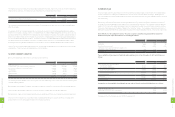

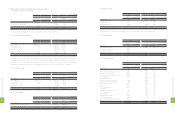

In August 2000, the Company acquired 100% equity interest in H.T.C. (B.V.I.) Corp., whose main business is international

holding investment, and accounted for this investment by the equity method. The Company made new investments in H.T.C.

(B.V.I.) Corp. of US$57,800 thousand in 2011 and US$39,468 thousand in 2012. As of December 31, 2012, the Company's

investment in H.T.C. (B.V.I.) Corp. amounted to US$122,520 thousand. Because the registration of this investment had not

been completed as of December 31, 2012, an amount of US$375 (NT$11,035 thousand) was temporarily accounted for under

"prepayments for long-term investments."

In January 2007, the Company acquired 100% equity interest in Communication Global Certification Inc., whose main

businesses are telecom testing and certification services, and accounted for this investment by the equity method.

In July 2007, the Company acquired 100% equity interest in High Tech Computer Asia Pacific Pte. Ltd. ("High Tech Asia"),

whose main businesses are international holding investment, marketing, repair and after-sales services, and accounted for

this investment by the equity method. The Company increased its investment in High Tech Asia by US$393,316 thousand

in 2011 and by US$115,000 thousand in 2012. As of December 31, 2012, the Company’s investment in High Tech Asia had

amounted to US$714,534 thousand.

In July 2008, the Company acquired 100% equity interest in HTC Investment Corporation, whose main business is general

investing, for NT$300,000 thousand and accounted for this investment by the equity method.

In December 2007, the Company and its subsidiary, High Tech Computer Asia Pacific Pte. Ltd., acquired equity interests of

1% and 99%, respectively, in PT. High Tech Computer Indonesia, whose main businesses are marketing, repair and after-sales

services, for US$2 thousand and US$186 thousand, respectively. As a result, the Company has accounted for this investment

by the equity method.

In September 2009, the Company acquired 100% equity interest in HTC I Investment Corporation, whose main business is

general investing, for NT$295,000 thousand and has accounted for this investment by the equity method.

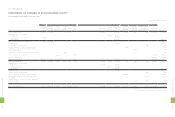

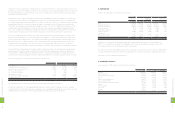

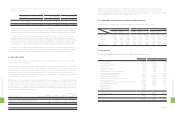

12. PREPAYMENTS

Prepayments as of December 31, 2011 and 2012 were as

follows:

2011 2012

NT$ NT$ US$ (Note 3)

Royalty $5,184,548 $2,436,378 $83,641

Prepayments to suppliers 249,069 852,744 29,275

Software and hardware

maintenance 263,211 673,703 23,128

Molding equipment 188,242 96,859 3,325

Services 548,480 61,171 2,100

Others 39,822 34,094 1,171

$6,473,372 $4,154,949 $142,640

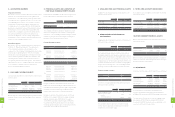

Prepayments for royalty were primarily for discount purposes

and were classified as current or non-current in accordance

with their nature. As of December 31, 2011 and 2012, the

non-current prepayments of NT$5,551,630 thousand and

NT$5,802,491 thousand (US$199,200 thousand), respectively,

had been classified as other assets - other (Note 28 has more

information).

Prepayments to suppliers were primarily for discount purposes

and were classified as current or non-current in accordance

with their nature. As of December 31, 2011 and 2012, non-

current prepayments of NT$2,956,977 thousand and

NT$2,121,432 thousand (US$72,829 thousand) , respectively,

had been classified as other assets - other.

Others were primarily prepaid for rent, travel and insurance

expenses.

13. HELD-TO-MATURITY FINANCIAL ASSETS

Held-to-maturity financial assets as of December 31, 2011

and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Corporate bonds $204,597 $101,459 $3,483

Less: Current portion - (101,459) (3,483)

$204,597 $- $-

In 2010, the Company bought the corporate bonds issued by

Nan Ya Plastics Corporation, and these bonds will mature in

2013 at an effective interest rate of 0.90%. Half of the bonds

had been repaid in November 2012.

14. FINANCIAL ASSETS CARRIED AT COST

Financial assets carried at cost as of December 31, 2011 and

2012 were as follow:

2011 2012

NT$ NT$ US$ (Note 3)

Hua-Chuang Automobile

Information Technical

Center Co., Ltd.

$500,000 $500,000 $17,165

BandRich Inc. 15,861 15,861 545

Answer Online, Inc. 1,192 1,192 41

517,053 517,053 17,751

Less: Accumulated

impairment loss (1,192) (1,192) (41)

$515,861 $515,861 $17,710

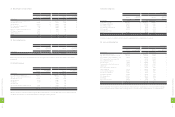

In January 2007, the Company acquired 10% equity interest

in Hua-Chuang Automobile Information Technical Center

Co., Ltd. for NT$500,000 thousand.

On March 1, 2004, the Company merged with IA Style, Inc.,

with the Company as survivor entity, and thus acquired an

1.82% equity interest, amounting to NT$1,192 thousand, in

Answer Online, Inc., an investee of IA Style, Inc. In addition,

the Company determined that the recoverable amount of

this investment in 2010 was less than its carrying amount and

thus recognized an impairment loss of NT$1,192 thousand.

In April 2006, the Company acquired 92% equity interest

in BandRich Inc. for NT$135,000 thousand and accounted

for this investment by the equity method. However, the

Company's ownership percentage declined from 92% to

18.08%; thus, the Company lost its significant influence on

this investee. In July 2010, the Company transferred this

investment to "financial assets carried at cost" using the

book value of NT$15,861 thousand.

These unquoted equity instruments were not carried at fair

value because their fair value could not be reliably measured;

thus, the Company accounted for these investments by the

cost method.

1

6

8

8

FINANCIAL INFORMATION

1

6

9

8

FINANCIAL INFORMATION