HTC 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

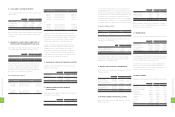

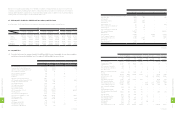

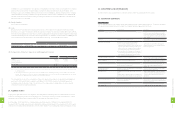

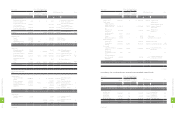

27. RELATED-PARTY TRANSACTIONS

(1) The related parties were as follows:

Related Party Relationship with the Company

Xander International Corp. Chairperson is an immediate relative of HTC's chairperson

VIA Technologies, Inc. Same chairperson as HTC's

Chander Electronics Corp. Same chairperson as HTC's

Way-Lien Technology Co., Ltd. Significant stockholder of HTC

Captec Partners Management Corp. Main director is the chairperson of HTC

WTI Investment International, Ltd. Its significant stockholder in substance is HTC's chairperson

VIABASE CO., LTD. Chairperson of its parent company is the same as HTC's

Faith Hope & Love Limited Its significant stockholder in substance is HTC's chairperson

Wozai Information Technology (Beijing), LLC Its significant stockholder in substance is HTC's chairperson

Openmoko, Inc. Its significant stockholder in substance is HTC's chairperson

VIA Telecom Company Limited Its significant stockholder in substance is HTC's chairperson

Beats Electronics, LLC HTC has lost control of the subsidiary since August 2012, due to partial disposal of its

shares, and accounted for the investment by equity method.

Employees’ Welfare Committee Employees' Welfare Committee of HTC

HTC Cultural and Educational Foundation A non-profit organization with over one third of its total funds donated by the Company

HTC Social Welfare and Charity Foundation A nonprofit organization with over one third of its total funds donated by the Company

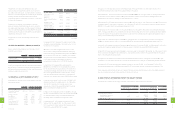

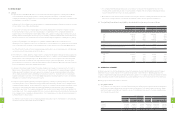

(2) Major transactions with related parties are summarized below:

Purchases of Inventories and Services

2011 2012

Amount % to Total Net

Purchases Amount % to Total Net

Purchases

Related Party NT$ NT$ US$ (Note 3)

VIA Telecom Company Limited $- - $63,675 $2,186 -

Chander Electronics Corp. 172,540 - - - -

$172,540 - $63,675 $2,186 -

Terms of payment and purchase prices for both related and third parties were similar.

Sales and Services Provided

2011 2012

Amount % to Total

Revenues Amount % to Total

Revenues

Related Party NT$ NT$ US$ (Note 3)

Faith Hope & Love Limited $- - $2,236,688 $76,786 1

Employees' Welfare Committee 52,540 - 220,037 7,554 -

Others 2,721 - 6,283 215 -

$55,261 - $2,463,008 $84,555 1

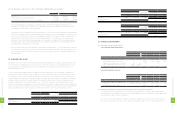

The selling prices for products sold to related parties were similar to those sold to third parties, except for HTC

Employees' Welfare Committee. The selling prices for products sold to Faith Hope & Love Limited have no comparison

with those sold to third parties. The collection terms for products sold to related parties were similar to those for sales

to third parties, except Faith Hope & Love Limited.

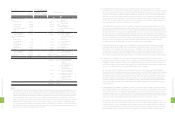

The fair values of financial instruments at fair value through profit or loss or available for sale, hedging derivative

financial instruments and held-to-maturity financial assets are based on quoted market prices in an active market, and

their fair values can be reliably measured. If the securities do not have market prices, fair value is measured on the basis

of other financial information. The Company uses estimates and assumptions that are consistent with information that

market participants would use in setting a price for these securities with no quoted market prices.

Financial assets carried at cost are investments in unquoted shares, which have no quoted prices in an active market

and entail an unreasonably high cost to obtain verifiable fair values. Therefore, no fair value is presented.

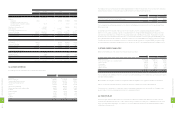

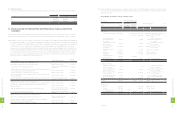

(3) Fair Values of Financial Instruments Based on Quoted Market Prices or Estimates Made through Valuation

Methods

Fair Values Based on

Quoted Market Prices

Fair Values Based on

Estimates Made through Valuation Methods

December 31 December 31

2011 2012 2011 2012

NT$ NT$ US$ (Note 3) NT$ NT$ US$ (Note 3)

Assets

Financial assets at fair value through profit or loss

- current $- $- $- $256,868 $6,950 $238

Available-for-sale financial assets - current 736,031 37,902 1,301 - - -

Held-to-maturity financial assets - current - 101,436 3,482 - - -

Available-for-sale financial assets - non-current 279 197 7 - - -

Held-to-maturity financial assets - non-current 203,783 - - - - -

Financial assets carried at cost - non-current - - - 3,408,654 4,304,907 147,788

The Company recognized unrealized gains of NT$3,824 thousand and NT$6,777 thousand (US$232 thousand) in

stockholders' equity for the changes in fair value of available-for-sale financial assets in 2011 and 2012, respectively.

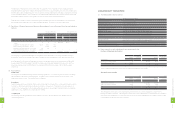

As of December 31, 2011 and 2012, financial assets exposed to fair value interest rate risk amounted to NT$204,597

thousand and NT$101,459 thousand (US$3,483 thousand), respectively, and financial assets exposed to cash flow

interest rate risk amounted to NT$59,356,763 thousand and NT$21,275,356 thousand (US$730,384 thousand),

respectively.

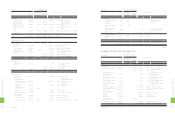

(4) Financial Risks

a. Market risk

The Company uses forward exchange contracts for hedging purposes, i.e., to reduce any adverse effect of exchange

rate fluctuations of accounts receivable/payable. The gains on these contracts compensate for the losses on the

hedged items and vice versa. Thus, market risk is not material.

b. Credit risk

Credit risk represents the potential loss that would be incurred by the Company if the counter-parties breach contracts.

Some factors affecting credit risk are credit risk concentration, components of financial assets and the amounts of

contracts. The counter-parties to the foregoing financial instruments are reputable financial institutions and business

organizations. Thus, credit risk is not expected to be material.

c. Liquidity risk

The Company's operating funds are deemed sufficient to meet the cash flow demand; thus, liquidity risk is not

considered significant.

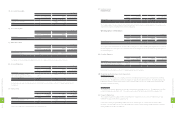

2

3

2

8

FINANCIAL INFORMATION

2

3

3

8

FINANCIAL INFORMATION