HTC 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

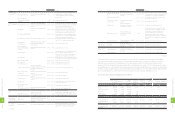

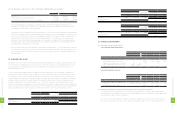

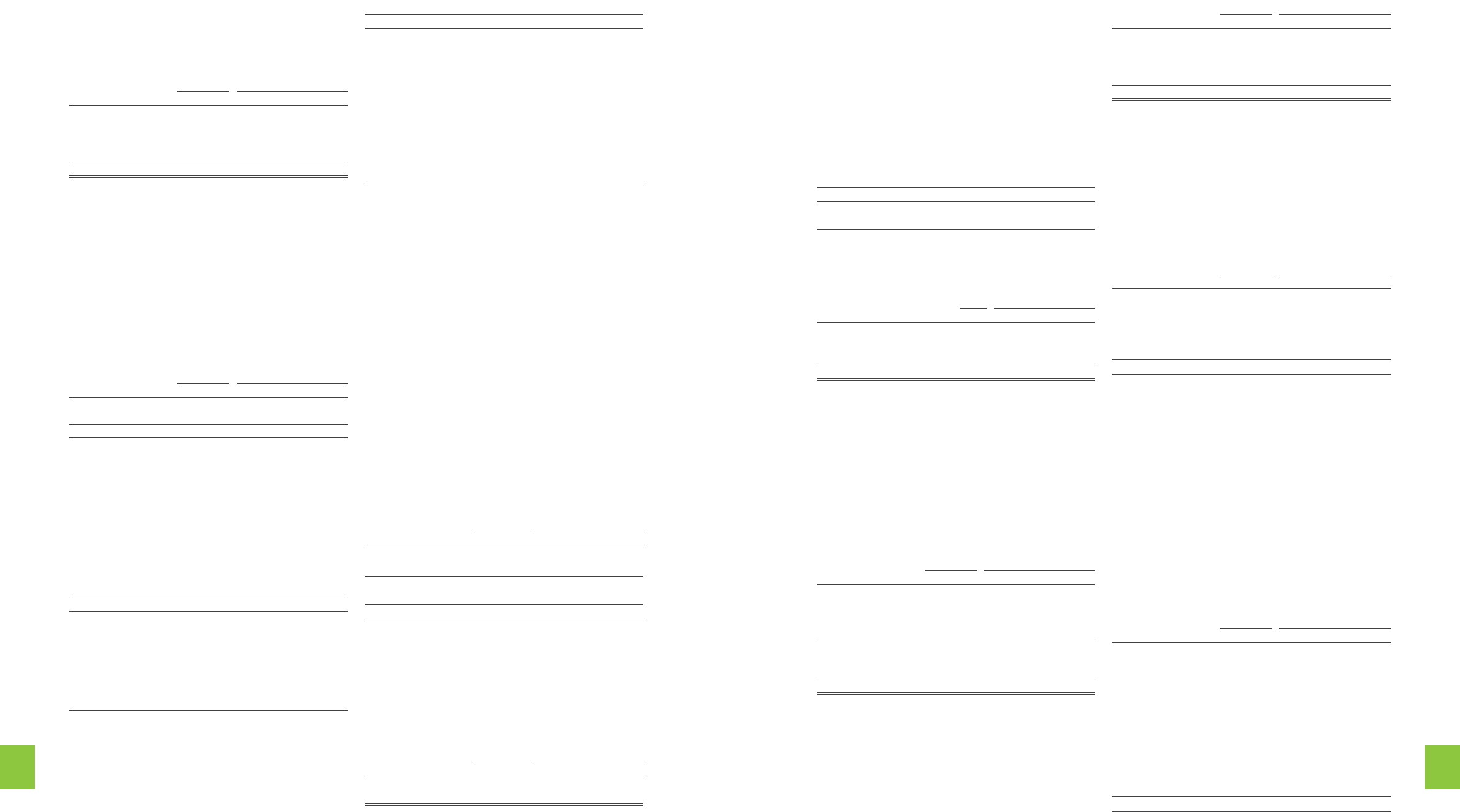

The Company's foreign-currency cash flows derived from

the highly probable forecast transaction may lead to risks on

foreign-currency financial assets and liabilities and estimated

future cash flows due to the exchange rate fluctuations. The

Company assesses the risks may be significant; thus, the

Company entered into derivative contracts to hedge against

foreign-currency exchange risks. The outstanding forward

exchange contracts as of December 31, 2012 were as follows:

Forward exchange contracts

2012

Currency Settlement Period/Date Contract Amount

Buy

USD/JPY 2013.03.28 US$95,356

Movements of hedging derivative financial instruments for

2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Balance, beginning of year $- $- $-

Add: Recognized in profit and loss - 10,467 359

Unrealized valuation gain - 194,052 6,662

Balance, end of year $- $204,519 $7,021

The unrealized valuation gain due to forward exchange

contract was recognized as unrealized gain on financial

instruments in stockholders' equity.

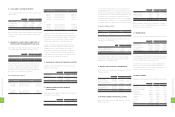

9. NOTES AND ACCOUNTS RECEIVABLE

Notes and accounts receivable as of December 31, 2011 and

2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Notes receivable $755,450 $- $-

Accounts receivable 65,518,876 43,118,861 1,480,272

Accounts receivable from

related parties 473 221,050 7,589

66,274,799 43,339,911 1,487,861

Less: Allowance for

doubtful accounts (1,555,008) (2,086,085) (71,615)

$64,719,791 $41,253,826 $1,416,246

10. OTHER CURRENT FINANCIAL ASSETS

Other current financial assets as of December 31, 2011 and

2012 were as follows:

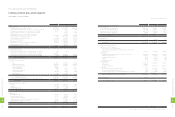

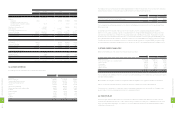

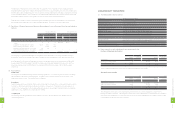

5. CASH AND CASH EQUIVALENTS

Cash and cash equivalents as of December 31, 2011 and 2012

were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Cash on hand $6,436 $15,433 $530

Checking accounts 9,709 12,134 417

Demand deposits 28,197,300 36,224,664 1,243,594

Time deposits 59,288,063 17,625,836 605,096

$87,501,508 $53,878,067 $1,849,637

On time deposits, interest rates ranged from 0.15% to 1.345%

and from 0.20% to 1.05% as of December 31, 2011 and 2012,

respectively.

6. FINANCIAL ASSETS AND LIABILITIES AT

FAIR VALUE THROUGH PROFIT OR LOSS

Financial assets and liabilities at fair value through profit or

loss as of December 31, 2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Derivatives - financial

assets

Exchange contracts $256,868 $6,950 $238

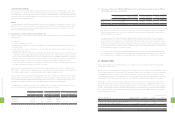

The Company entered into derivative transactions in 2011

and 2012 to manage exposures related to exchange rate

fluctuations. Outstanding forward exchange contracts

that did not meet the criteria for hedge accounting as of

December 31, 2011 and 2012 were as follows:

Forward Exchange Contracts

2011

Currency Settlement Period/Date Contract Amount

Buy

USD/CAD 2012.01.11-2012.02.22 USD28,010

USD/RMB 2012.01.04-2012.01.31 USD105,000

Sell

EUR/USD 2012.01.04-2012.03.30 EUR339,000

GBP/USD 2012.01.11-2012.02.22 GBP17,100

2012

Currency Settlement Period/Date Contract Amount

Sell

EUR/USD 2013.01.11-2013.03.27 EUR146,000

GBP/USD 2013.01.09-2013.03.20 GBP20,700

USD/NTD 2013.01.17-2013.02.20 USD70,000

USD/RMB 2013.01.09-2013.01.30 USD78,000

Buy

USD/RMB 2013.01.09-2013.01.30 USD106,000

USD/JPY 2013.01.09-2013.03.08 USD97,437

USD/CAD 2013.01.09-2013.02.22 USD22,158

USD/NTD 2013.01.07-2013.02.21 USD270,000

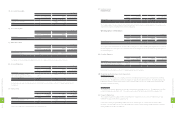

Net gain on derivative financial instruments in 2011 was

NT$172,501 thousand, including a realized settlement loss of

NT$84,367 thousand and a valuation gain of NT$256,868

thousand, which were classified as exchange loss and

valuation gain, respectively, on financial instruments.

Net gain on derivative financial instruments in 2012 was

NT$356,010 thousand (US$12,222 thousand), including

a realized settlement gain of NT$349,060 thousand

(US$11,984 thousand) and a valuation gain of NT$6,950

thousand (US$238 thousand), which were classified as

exchange gain and valuation gain on financial instruments,

respectively. Note 26 has more information.

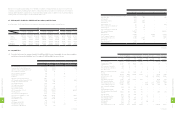

7. AVAILABLE-FOR-SALE FINANCIAL ASSETS

Available-for-sale financial assets as of December 31, 2011

and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Quoted stocks $279 $38,099 $1,308

Mutual funds 736,031 - -

736,310 38,099 1,308

Less: Current portion (736,031) (37,902) (1,301)

$279 $197 $7

8. HEDGING DERIVATIVE FINANCIAL

INSTRUMENTS

Hedging derivative financial instruments as of December 31,

2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Hedging derivative assets $- $204,519 $7,021

2011 2012

NT$ NT$ US$ (Note 3)

Other receivables $1,128,238 $1,121,912 $38,515

Agency payments 249,644 39,097 1,342

Interest receivable 23,261 8,067 277

Others 3,802 3,014 104

$1,404,945 $1,172,090 $40,238

Other receivables were primarily prepayments on behalf of

vendors or customers, withholding income tax of employees'

bonuses, and other compensation.

11. INVENTORIES

Inventories as of December 31, 2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Finished goods $2,189,984 $3,310,521 $113,650

Work-in-process 4,320,763 1,902,733 65,321

Semi-finished goods 4,547,374 5,635,374 193,463

Raw materials 17,251,140 12,663,961 434,754

Inventory in transit 121,329 296,788 10,189

$28,430,590 $23,809,377 $817,377

As of December 31, 2011 and 2012, the allowance for inventory

devaluation was NT$4,930,857 thousand and NT$4,936,776

thousand (US$169,480 thousand), respectively.

The write-down of inventories to their net realizable value

amounting to NT$3,381,137 thousand and NT$2,154,419

thousand (US$73,961 thousand) were recognized as cost of

revenues in 2011 and 2012, respectively.

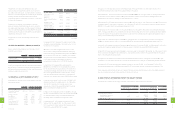

12. PREPAYMENTS

Prepayments as of December 31, 2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Royalty $5,210,204 $2,609,254 $89,576

Prepayments to suppliers 299,105 854,799 29,345

Software and hardware

maintenance 311,416 716,695 24,604

Net input VAT 320,544 434,521 14,917

Molding equipment 188,242 96,859 3,325

Marketing 43,200 79,892 2,743

Service 7,209 62,877 2,159

Insurance 8,384 31,625 1,086

Rental 15,488 31,552 1,083

Others 103,724 47,740 1,639

$6,507,516 $4,965,814 $170,477

2

1

4

8

FINANCIAL INFORMATION

2

1

5

8

FINANCIAL INFORMATION