HTC 2012 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

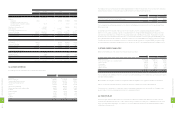

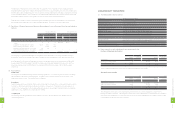

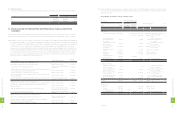

(2) Major Customers

Revenues in 2011 and 2012, from transactions with a single external customer that were 10 percent or more were as follows:

2011 2012

Customer NT$ NT$ US$ (Note 3)

A $75,243,879 $20,487,411 $703,334

B 47,541,529 16,636,181 571,121

C 63,091,960 11,210,923 384,871

$185,877,368 $48,334,515 $1,659,326

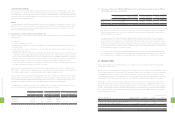

33. PRE-DISCLOSURE FOR THE ADOPTION OF INTERNATIONAL FINANCIAL REPORTING

STANDARDS

Under Rule No. 0990004943 issued by the Financial Supervisory Commission ("FSC") on February 2, 2010, the Company

discloses the following information on the adoption of the International Financial Reporting Standards ("IFRSs") as follows:

(1) On May 14, 2009, the FSC announced the "Framework for the Adoption of International Financial Reporting Standards by

the Companies in the ROC." In this framework, starting 2013, companies with shares listed on the Taiwan Stock Exchange

("TWSE") or traded on the Taiwan GreTai Securities Market or Emerging Stock Market should prepare their consolidated

financial statements in accordance with the Guidelines Governing the Preparation of Financial Reports by Securities

Issuers and the International Financial Reporting Standards, International Accounting Standards, and the Interpretations

as well as related guidance translated by the Accounting Research and Development Foundation and issued by the FSC.

To comply with this framework, the Company has set up a project team and made a plan to adopt the IFRSs. Leading

the implementation of this plan is Mr. James Chen, HTC's vice president. The main contents of the plan, schedule and

status of execution as of December 31, 2012 are as follows:

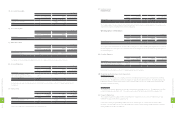

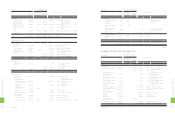

Contents of Plan Responsible Department Status of

Execution

Assessment phase: January 1, 2010 to December 31, 2011

Make a plan to adopt the IFRSs and set up a project team. Finance and accounting Completed

Conduct phase I internal training of employees. Finance and accounting and Talent

management Completed

Compare and analyze the differences between the existing accounting policies and

the accounting policies to be adopted under IFRSs. Finance and accounting Completed

Assess the adjustments of the existing accounting policies. Finance and accounting Completed

Assess the applicability of IFRS 1 - "First-time Adoption of International Financial

Reporting Standards." Finance and accounting Completed

Assess the adjustments of the related information technology system and internal

control.

Finance and accounting, Internal

audit and Information technology Completed

Preparation phase: January 1, 2011 to December 31, 2012

Determine how to adjust the existing accounting policies in accordance with IFRSs. Finance and accounting Completed

Determine how to apply the "First-time Adoption of International Financial

Reporting Standards" Finance and accounting Completed

Adjust the related information technology system and internal control. Finance and accounting, Internal

audit and Information technology Completed

Conduct phase II internal training of employees. Finance and accounting and Talent

management Completed

Implementation phase: January 1, 2012 to December 31, 2013

Make a test run of the adjusted information technology system. Finance and accounting and

Information technology Completed

Gather information to prepare the opening balance sheets and comparative

financial statements in conformity with IFRSs. Finance and accounting In progress

Prepare financial statements in conformity with IFRSs. Finance and accounting In progress

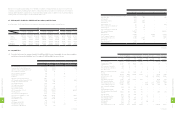

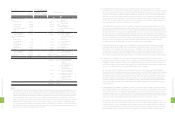

(2) Significant differences identified by the Company as of December 31, 2012 that may arise between current accounting

policies under R.O.C. GAAP and the ones under IFRSs that will be used in the preparation of financial statements in the

future are as follows:

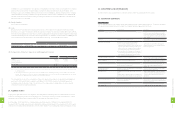

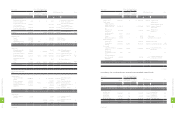

Reconciliation of its balance sheet as of January 1, 2012:

ROC GAAP Effect of the Transition from

ROC GAAP to IFRSs

IFRSs Amount Item Note

Item Amount

Measurement

or Recognition

Inconsistency

Presentation

Difference

NT$ NT$ NT$ NT$ US$ (Note 3)

Assets

Current assets

Cash and cash equivalents $87,501,508 $-

($25,474,750)

$62,026,758 $2,129,382 Cash and cash equivalents a)

- - - 25,474,750 25,474,750 874,549 Other financial assets -

current a)

Financial assets at fair

value through profit or

loss - current

256,868 - - 256,868 8,818

Financial assets at fair

value through profit or

loss - current

Available-for-sale financial

assets - current 736,031 - - 736,031 25,268 Available-for-sale financial

assets - current

Notes and accounts

receivable, net 64,719,791 - - 64,719,791 2,221,834 Notes and accounts

receivable, net

Other financial assets -

current 1,405,911 - - 1,405,911 48,265 Other receivables

Inventories 28,430,590 - - 28,430,590 976,024 Inventories

Prepayments 6,507,516 - - 6,507,516 223,403 Prepayments

Deferred income tax

assets - current 2,246,196 - (2,246,196) - - - b)

Other current assets 1,055,480 - - 1,055,480 36,235 Other current assets

Total current assets 192,859,891 - (2,246,196) 190,613,695 6,543,778

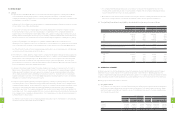

Long-term investments

Available-for-sale financial

assets - non-current 279 - - 279 10 Available-for-sale financial

assets - non-current

Held-to-maturity financial

assets - non-current 204,597 - - 204,597 7,024 Held-to-maturity financial

assets - non-current

Financial assets carried at

cost - non-current 3,408,654 - - 3,408,654 117,019 Financial assets carried at

cost - non-current

Investments accounted for

by the equity method 71,732 - - 71,732 2,463 Investments accounted

for by the equity method

Total long-term investments 3,685,262 - - 3,685,262 126,516

Properties 21,512,478 - 203,155 21,715,633 745,499 Property, plant and

equipment g), h)

Intangible assets

Patents 11,152,098 - - 11,152,098 382,852 Patents

Goodwill 10,812,564 - - 10,812,564 371,196 Goodwill

Deferred pension cost 342 (342) - - - - d)

Other intangible assets 595,784 - 207,033 802,817 27,560 Other intangible assets g)

Total intangible assets 22,560,788 (342) 207,033 22,767,479 781,608

(Continued)

2

4

0

8

FINANCIAL INFORMATION

2

4

1

8

FINANCIAL INFORMATION