HTC 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

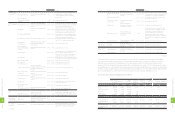

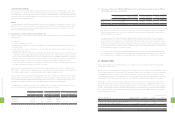

21. STOCKHOLDERS' EQUITY

(1) Capital Stock

HTC's outstanding common stock as of January 1, 2011 amounted to NT$8,176,532 thousand, divided into 817,653

thousand common shares at NT$10 par value. In June 2011, the stockholders approved the transfer of retained earnings

of NT$403,934 thousand and employee bonuses of NT$40,055 thousand to capital stock. Also, in December 2011,

HTC retired 10,000 thousand treasury shares amounting to NT$100,000 thousand. As a result, the amount of HTC's

outstanding common stock as of December 31, 2012 increased to NT$8,520,521 thousand (US$292,510 thousand),

divided into 852,052 thousand common shares at NT$10 (US$0.34) par value.

(2) Global Depositary Receipts

In November 2003, HTC issued 14,400 thousand common shares corresponding to 3,600 thousand units of Global

Depositary Receipts ("GDRs"). For this GDR issuance, HTC's stockholders, including Via Technologies, Inc., also issued

12,878.4 thousand common shares, corresponding to 3,219.6 thousand GDR units. Thus, the entire offering consisted of

6,819.6 thousand GDR units. Taking into account the effect of stock dividends, the GDRs increased to 9,015.1 thousand units

(36,060.5 thousand shares). The holders of these GDRs requested HTC to redeem the GDRs to get HTC's common shares.

As of December 31, 2012, there were 7,820 thousand units of GDRs redeemed, representing 31,280.2 thousand common

shares, and the outstanding GDRs represented 4,780.3 thousand common shares or 0.58% of HTC's common shares.

(3) Capital Surplus

Under the Company Law, capital surplus may be used to offset a deficit. The capital surplus from share issued in

excess of par (additional paid-in capital from issuance of common shares, merger and treasury stock transactions) and

donations may be capitalized once a year within a certain percentage of a company's paid-in capital. However, the

capital surplus from long-term investments may not be used for any purpose.

Additional paid-in capital - issuance of shares in excess of par

The additional paid-in capital was NT$10,777,623 thousand as of January 1, 2011. In June 2011, the bonus to employees

of NT$8,491,704 thousand for 2010 was approved in the stockholders' meeting. Of the approved bonus, NT$4,245,851

thousand was in the form of common stock, consisting of 4,006 thousand common shares at their fair value, which

were distributed in 2011. The difference between par value and fair value of NT$4,205,796 thousand was accounted

for as additional paid-in capital in 2011. In December 2011, the retirement of treasury stock caused a decrease of

NT$173,811 thousand in additional paid-in capital. As a result, the additional paid-in capital as of December 31, 2012 was

NT$14,809,608 thousand (US$508,415 thousand).

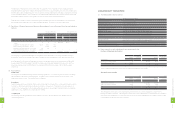

Treasury stock transactions and expired stock options

In June 2011, the Company resolved to transfer treasury shares to employees. In 2011, the number of shares for transfer

to employees was 6,000 thousand, with 5,875 thousand shares exercised. Based on the fair value at the grant date,

NT$1,750,767 thousand was accounted for as capital surplus - treasury stock transactions, and NT$37,503 thousand for the

unexercised 125 thousand shares was accounted for as capital surplus - expired stock options. Also, in December 2011, the

retirement of treasury stock caused decreases of NT$20,309 thousand in treasury stock transactions and NT$435 thousand

in expired stock options. As a result, as of December 31, 2012, capital surpluses were NT$1,730,458 thousand (US$59,407

thousand) from treasury stock transactions and NT$37,068 thousand (US$1,273 thousand) from expired stock options.

The fair values at the grant date for the fifth and sixth stock option buyback were NT$394.105 and NT$210.121,

respectively. These fair values were estimated using the Black-Scholes option valuation model. The inputs to the

model were as follows:

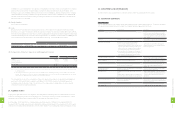

5th Buyback 6th Buyback

Assumption Exercise price (NT$) $598.83 $797.30

Expected dividend yield 3.71% 3.71%

Expected life 1.67 months 1.67 months

Expected price volatility 56.99% 56.99%

Risk-free interest rate 0.7157% 0.7157%

Fair value $394.105 $210.121

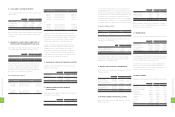

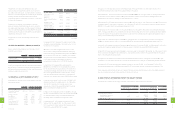

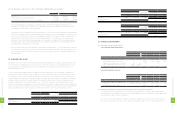

Based on the defined benefit plan under the Labor Standards Law ("LSL"), pension benefits are calculated on the basis of

the length of service and average monthly salaries of the six months before retirement. HTC and CGC contributed amounts

equal to 2% of total monthly salaries and wages to a pension fund administered by the pension fund monitoring committee.

The pension fund is deposited in the Bank of Taiwan in the committee's name. The Company recognized pension costs of

NT$4,217 thousand in 2011 and NT$4,104 thousand (US$141 thousand) in 2012.

H.T.C. (B.V.I.) Corp., HTC Investment Corporation, HTC I Investment Corporation, High Tech Computer Asia Pacific Pte. Ltd.,

HTC Investment One (BVI) Corporation, HTC Holding Cooperatief U.A. and HTC America Holding Inc. have no pension plans.

Under the respective local government regulations, other subsidiaries have defined contribution pension plans covering all

eligible employees. The pension fund contributions were NT$200,330 thousand in 2011 and NT$252,307 thousand (US$8,662

thousand) in 2012.

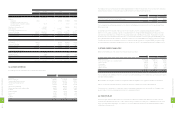

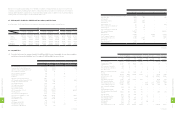

Under SFAS No. 18, "Accounting for Pensions," the pension expense calculated using actuarial method under the defined benefit

pension plan should disclose the following information:

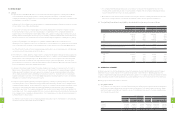

(1) The net pension costs of HTC and CGC under the defined benefit plan in 2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Service cost $5,980 $5,481 $188

Interest cost 6,882 7,341 252

Projected return on plan assets (9,226) (9,917) (340)

Amortization of unrecognized net transition obligation, net 74 74 2

Amortization 507 1,125 39

Net pension cost $4,217 $4,104 $141

(2) The reconciliations between pension fund status and prepaid pension cost as of December 31, 2011 and

2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Present actuarial value of benefit obligation

Vested benefits $10,026 $28,906 $992

Non-vested benefits 193,962 188,993 6,488

Accumulated benefit obligation 203,988 217,899 7,480

Additional benefits on future salaries 163,087 161,977 5,561

Projected benefit obligation 367,075 379,876 13,041

Plan assets at fair value (482,786) (513,954) (17,644)

Funded status (115,711) (134,078) (4,603)

Unrecognized net transitional obligation (342) (269) (9)

Unrecognized pension loss (68,285) (72,257) (2,481)

Additional minimum pension liability 635 615 21

Prepaid pension cost ($183,703) ($205,989) ($7,072)

(3) Assumptions used in actuarially determining the present value of the projected benefit obligations of HTC

and CGC were as follows:

2011 2012

Weighted-average discount rate 2.00% 1.88%

Assumed rate of increase in future compensation 4.00% 4.00%

Expected long-term rate of return on plan assets 2.00% 1.88%

The payments from the fund amounted to NT$793 thousand in 2011.

2

2

2

8

FINANCIAL INFORMATION

2

2

3

8

FINANCIAL INFORMATION