HTC 2012 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

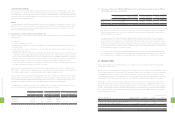

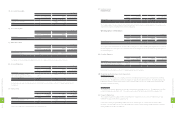

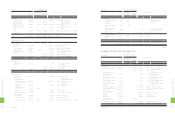

ROC GAAP Effect of the Transition from

ROC GAAP to IFRSs

IFRSs Amount Item Note

Item Amount

Measurement

or Recognition

Inconsistency

Presentation

Difference

NT$ NT$ NT$ NT$ US$ (Note 3)

Long-term investments

Available-for-sale financial

assets - noncurrent $197 $- $- $197 $7 Available-for-sale financial

assets - noncurrent

Financial assets carried at

cost - noncurrent 4,304,907 - - 4,304,907 147,788 Financial assets carried at

cost - noncurrent

Investments accounted

for by the equity method 5,892,168 - - 5,892,168 202,278 Investments accounted

for by the equity method

Total long-term investments 10,197,272 - - 10,197,272 350,073

Properties 25,651,292 - 339,474 25,990,766 892,264 Property, plant and

equipment g), h)

Intangible assets

Patents 9,180,674 - - 9,180,674 315,173 Patents

Goodwill 1,534,366 - - 1,534,366 52,675 Goodwill

Deferred pension cost 269 (269) - - - - d)

Other intangible assets 805,365 - 162,765 968,130 33,236 Other intangible assets g)

Total intangible assets 11,520,674 (269) 162,765 11,683,170 401,084

Other assets

Refundable deposits 190,142 - - 190,142 6,528 Refundable deposits

Deferred charges 897,164 - (897,164) - - Deferred charges g)

Long - term receivable 4,369,350 - - 4,369,350 150,000 Long - term receivable

Deferred income tax

assets - non-current 4,427,776 83,915 4,178,151 8,689,842 298,322 Deferred income tax

assets

b), c),

d)

Restricted assets - non-

current 3,660 - - 3,660 126 Restricted assets

Other 9,687,816 (86,716) 394,925 9,996,025 343,164 Other assets - other d), g),

h)

Total other assets 19,575,908 (2,801) 3,675,912 23,249,019 798,140

Total $206,604,126 ($3,070) $647,936

$207,248,992

$7,114,868

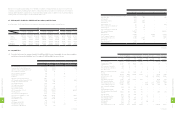

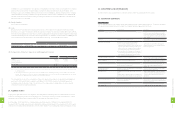

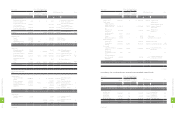

Liabilities and stockholders'

equity

Current liabilities

Notes and accounts

payable $73,618,197 $- $- $73,618,197 $2,527,316 Notes and accounts

payable

Income tax payable 2,713,373 - - 2,713,373 93,150 Current tax liabilities

Accrued expenses 37,376,493 93,451 - 37,469,944 1,286,345 Accrued expenses f)

Payable for purchase of

equipment 1,471,529 - - 1,471,529 50,518 Payable for purchase of

equipment

- - - 8,881,514 8,881,514 304,903 Provisions - current e)

Other current liabilities 10,995,320 - (8,881,514) 2,113,806 72,567 Other current liabilities e)

Total current liabilities 126,174,912 93,451 - 126,268,363 4,334,799

Other liabilities

Guarantee deposits

received 59,999 - - 59,999 2,060 Guarantee deposits

received

- - - 647,936 647,936 22,243 Deferred income tax

liabilities b)

59,999 - 647,936 707,935 24,303

Total liabilities 126,234,911 93,451 647,936 126,976,298 4,359,102

ROC GAAP Effect of the Transition from

ROC GAAP to IFRSs

IFRSs Amount Item Note

Item Amount

Measurement

or Recognition

Inconsistency

Presentation

Difference

NT$ NT$ NT$ NT$ US$ (Note 3)

Stockholders' equity

Common stock $8,520,521 $- $- $8,520,521 $292,510 Common stock

Capital surplus - - Capital surplus

Additional paid-in

capital - issuance of

shares in excess of

par

14,809,608 - - 14,809,608 508,415

Additional paid-in capital

- issuance of shares in

excess of par

Treasury stock

transactions 1,730,458 - - 1,730,458 59,407 Treasury stock

transactions

Long-term equity

investments 18,037 (18,037) - - - i)

Merger 24,423 - - 24,423 838 Merger

Expired stock options 37,068 - - 37,068 1,273 Expired stock options

Retained earnings

Legal reserve 16,471,254 - - 16,471,254 565,459 Legal reserve

Accumulated

earnings 53,677,474 (46,697) - 53,630,777 1,841,147 Accumulated earnings c), d),

f), i), j)

Other equity

Cumulative translation

adjustments (1,057,559) (32,134) - (1,089,693) (37,409) Cumulative translation

adjustments j)

Net loss not

recognized as pension

cost

(347) 347 - - - - d)

Unrealized valuation

gain on financial

instruments

203,768 - - 203,768 6,995 Unrealized valuation gain

on financial instruments

Treasury stock (14,065,490) - -

(14,065,490)

(482,869) Treasury stock

Total stockholders' equity 80,369,215 (96,521) - 80,272,694 2,755,766

Total $206,604,126 ($3,070) $647,936

$207,248,992

$7,114,868

(Concluded)

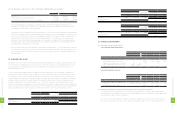

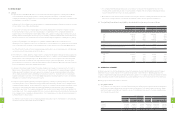

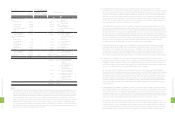

Reconciliation of the consolidated income statement for the year ended December 31, 2012:

ROC GAAP Effect of the Transition from

ROC GAAP to IFRSs

IFRSs Amount Item Note

Item Amount

Measurement

or Recognition

Inconsistency

Presentation

Difference

NT$ NT$ NT$ NT$ US$ (Note 3)

Revenues $289,020,175 $- $-

$289,020,175

$9,922,077 Revenues

Cost of revenues 216,095,098 (5,772) - 216,089,326 7,418,357 Cost of revenues d), f)

Gross profit 72,925,077 5,772 - 72,930,849 2,503,720 Gross profit

Operating expenses Operating expenses

Research and

development 15,489,969 3,170 - 15,493,139 531,880 Research and

development d), f)

General and

administrative 6,227,469 364 - 6,227,833 213,802 General and

administrative d), f)

Selling and marketing 32,387,932 (5,369) - 32,382,563 1,111,695 Selling and marketing d), f)

Total operating expenses 54,105,370 (1,835) - 54,103,535 1,857,377 Total operating expenses

Operating income 18,819,707 7,607 - 18,827,314 646,343 Operating income

(Continued) (Continued)

2

4

4

8

FINANCIAL INFORMATION

2

4

5

8

FINANCIAL INFORMATION