HTC 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

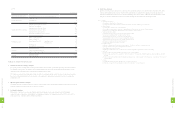

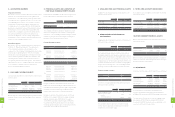

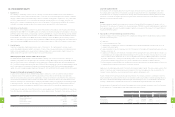

7. AVAILABLE-FOR-SALE FINANCIAL ASSETS

Available-for-sale financial assets as of December 31, 2011

and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Mutual funds $736,031 $- $-

Domestic quoted stocks 279 197 7

736,310 197 7

Less: Current portion (736,031) - -

$279 $197 $7

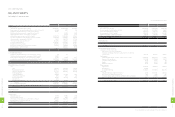

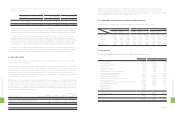

8. HEDGING DERIVATIVE FINANCIAL

INSTRUMENTS

Hedging derivative financial instruments as of December 31,

2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Hedging derivative assets $- $204,519 $7,021

The Company's foreign-currency cash flows derived from

the highly probable forecast transaction may lead to risks on

foreign-currency financial assets and liabilities and estimated

future cash flows due to the exchange rate fluctuations. The

Company assesses the risks may be significant; therefore, the

Company entered into derivative contracts to hedge against

foreign-currency exchange risks. The outstanding forward

exchange contract as of December 31, 2012 was as follows:

Forward exchange contracts

2012

Currency Settlement Period/Date Contract Amount

Buy

USD/JPY 2013.03.28 USD95,356

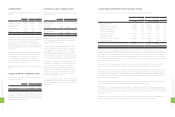

Movements of hedging derivative financial instruments for

2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Balance, beginning of year $- $- $-

Add: Recognized in profit

and loss - 10,467 359

Unrealized valuation

loss - 194,052 6,662

Balance, end of year $- $204,519 $7,021

The unrealized valuation gain due to forward exchange

contract was recognized as unrealized gain on financial

instruments in stockholders' equity.

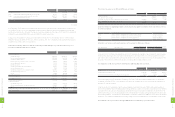

9. NOTES AND ACCOUNTS RECEIVABLE

Notes and accounts receivable as of December 31, 2011 and

2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Notes receivable $755,450 $- $-

Accounts receivable 32,838,334 21,802,849 748,493

33,593,784 21,802,849 748,493

Less: Allowance for

doubtful accounts (1,554,008) (2,059,086) (70,689)

$32,039,776 $19,743,763 $677,804

10. OTHER CURRENT FINANCIAL ASSETS

Other current financial assets as of December 31, 2011 and

2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Other receivables $1,036,838 $1,083,595 $37,200

Interest receivable 19,927 6,738 231

Agency payments 248,085 34,137 1,172

$1,304,850 $1,124,470 $38,603

Other receivables were primarily prepayments on behalf of

vendors or customers, withholding income tax of employees'

bonuses, and other compensation.

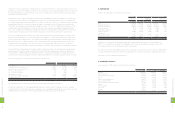

11. INVENTORIES

Inventories as of December 31, 2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Finished goods $675,712 $764,667 $26,251

Work-in-process 3,766,461 1,940,584 66,620

Semi-finished goods 4,083,050 3,954,056 135,743

Raw materials 16,788,114 13,652,134 468,679

Goods in transit 75,983 210,526 7,227

$25,389,320 $20,521,967 $704,520

As of December 31, 2011 and 2012, the allowances for

inventory devaluation were NT$4,631,195 thousand and

NT$3,880,363 thousand (US$133,213 thousand), respectively.

The write-down of inventories to their net realizable value

amounting to NT$3,197,362 thousand and NT$1,211,554

thousand (US$41,593 thousand) were recognized as cost of

revenues in 2011 and 2012, respectively.

4. ACCOUNTING CHANGES

Financial Instruments

On January 1, 2011, the Company adopted the newly revised

SFAS No. 34 - "Financial Instruments: Recognition and

Measurement." The main revisions include (1) finance lease

receivables are now covered by SFAS No. 34; (2) the scope

of the applicability of SFAS No. 34 to insurance contracts

is amended; (3) loans and receivables originated by the

Company are now covered by SFAS No. 34; (4) additional

guidelines on impairment testing of financial assets carried

at amortized cost when a debtor has financial difficulties

and the terms of obligations have been modified; and (5)

accounting treatment by a debtor for modifications in

the terms of obligations. This accounting change had no

material effect on the Company's financial statements as of

and for the year ended December 31, 2011.

Operating Segments

On January 1, 2011, the Company adopted the newly issued

SFAS No. 41 - "Operating Segments." The requirements

of the statement are based on the information on the

components of the Company that management uses to make

decisions about operating matters. SFAS No. 41 requires

identification of operating segments on the basis of internal

reports that are regularly reviewed by the Company's chief

operating decision maker in order to allocate resources to

the segments and assess their performance. This statement

supersedes SFAS No. 20 - "Segment Reporting" and resulted

in the Company's compliance with the requirement to

disclose operating segment information.

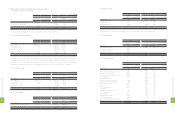

5. CASH AND CASH EQUIVALENTS

Cash and cash equivalents as of December 31, 2011 and 2012

were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Cash on hand $1,000 $1,010 $35

Checking accounts 7,903 4,562 157

Demand deposits 21,844,352 29,544,930 1,014,279

Time deposits 57,019,065 14,956,327 513,451

$78,872,320 $44,506,829 $1,527,922

On time deposits, interest rates ranged from 0.15% to 1.345%

and from 0.20% to 1.05%, as of December 31, 2011 and 2012,

respectively.

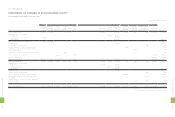

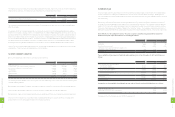

6. FINANCIAL ASSETS AND LIABILITIES AT

FAIR VALUE THROUGH PROFIT OR LOSS

Financial assets and liabilities at fair value through profit or

loss as of December 31, 2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Derivatives - financial

assets

Exchange contracts $256,868 $6,950 $238

The Company entered into derivative transactions in 2011

and 2012 to manage exposures related to exchange rate

fluctuations. The outstanding forward exchange contracts

that did not meet the criteria for hedge accounting as of

December 31, 2011 and 2012 were as follows:

Forward Exchange Contracts

2011

Currency Settlement Period/Date Contract Amount

Buy

USD/CAD 2012.01.11-2012.02.22 USD28,010

USD/RMB 2012.01.04-2012.01.31 USD105,000

Sell

EUR/USD 2012.01.04-2012.03.30 EUR339,000

GBP/USD 2012.01.11-2012.02.22 GBP17,100

2012

Currency Settlement Period/Date

Contract Amount

Sell

EUR/USD 2013.01.11-2013.03.27 EUR146,000

GBP/USD 2013.01.09-2013.03.20 GBP20,700

USD/NTD 2013.01.17-2013.02.20 USD70,000

USD/RMB 2013.01.09-2013.01.30 USD78,000

Buy

USD/RMB 2013.01.09-2013.01.30 USD106,000

USD/JPY 2013.01.09-2013.03.08 USD97,437

USD/CAD 2013.01.09-2013.02.22 USD22,158

USD/NTD 2013.01.07-2013.02.21 USD270,000

Net gain on derivative financial instruments in 2011 was

NT$173,575 thousand, including a realized settlement loss

of NT$83,293 thousand and valuation gain of NT$256,868

thousand, which were classified as exchange loss and

valuation gain, respectively, on financial instruments.

Net gain on derivative financial instruments in 2012 was

NT$356,010 thousand (US$12,222 thousand), including

realized settlement gain of NT$349,060 thousand

(US$11,984 thousand) and valuation gain of NT$6,950

thousand (US$238 thousand), which were classified as

exchange gain and valuation gain on financial instruments,

respectively. Note 25 has more information.

1

6

6

8

FINANCIAL INFORMATION

1

6

7

8

FINANCIAL INFORMATION