HTC 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

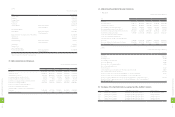

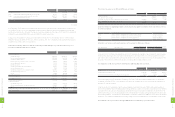

Fair value hedge

The gain or loss from remeasuring the hedging

instrument at fair value and the gain or loss on the

hedged item attributable to the hedged risk are

recognized in profit or loss.

Cash flow hedge

The portion of the gain or loss on the hedging

instrument that is determined to be an effective hedge

is recognized in stockholders' equity. The amount

recognized in stockholders' equity is recognized in

profit or loss in the same year or years during which

the hedged forecast transaction or an asset or liability

arising from the hedged forecast transaction affects

profit or loss. However, if all or a portion of a loss

recognized in stockholders' equity is not expected to

be recovered, the amount that is not expected to be

recovered is reclassified to profit or loss.

Hedge of a net investment in a foreign operation

The portion of the gain or loss on the hedging

instrument that is determined to be an effective hedge

is recognized in stockholders' equity. The amount

recognized in stockholders' equity is recognized in

profit or loss on disposal of the foreign operation.

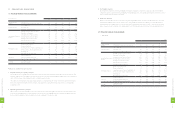

(10) Financial Assets Carried at Cost

Investments in equity instruments with no quoted prices

in an active market and with fair values that cannot be

reliably measured, such as non-publicly traded stocks

and stocks traded in the Emerging Stock Market,

are measured at their original cost. The accounting

treatment for dividends on financial assets carried at cost

is the same as that for dividends on available-for-sale

financial assets. An impairment loss is recognized when

there is objective evidence that the asset is impaired. A

reversal of this impairment loss is disallowed.

(11) Investments Accounted for by the Equity Method

Investments in which the Company holds 20 percent

or more of the investees' voting shares or exercises

significant influence over the investees' operating and

financial policy decisions are accounted for by the

equity method.

The acquisition cost is allocated to the assets acquired

and liabilities assumed on the basis of their fair values

at the date of acquisition, and the acquisition cost in

excess of the fair value of the identifiable net assets

acquired is recognized as goodwill. Goodwill is not

amortized. The fair value of the net identifiable assets

acquired in excess of the acquisition cost is used

to reduce the fair value of each of the non-current

assets acquired (except for financial assets other than

investments accounted for by the equity method,

non-current assets held for sale, deferred income

tax assets, prepaid pension or other postretirement

benefit) in proportion to the respective fair values of

the non-current assets, with any excess recognized as

an extraordinary gain.

Profits from downstream transactions with an equity-

method investee are eliminated in proportion to the

Company's percentage of ownership in the investee;

however, if the Company has control over the investee,

all the profits are eliminated. Profits from upstream

transactions with an equity-method investee are

eliminated in proportion to the Company's percentage

of ownership in the investee.

When the Company subscribes for its investee's

newly issued shares at a percentage different from its

percentage of ownership in the investee, the Company

records the change in its equity in the investee's

net assets as an adjustment to investments, with a

corresponding amount credited or charged to capital

surplus. When the adjustment should be debited to

capital surplus, but the capital surplus arising from

long-term investments is insufficient, the shortage is

debited to retained earnings.

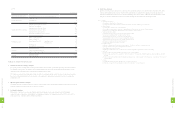

(12) Properties

Properties are stated at cost less accumulated

depreciation. Borrowing costs directly attributable

to the acquisition or construction of properties

are capitalized as part of the cost of those assets.

Major additions and improvements to properties are

capitalized, while costs of repairs and maintenance are

expensed currently.

Assets held under capital leases are initially recognized

as assets of the Company at the lower of their fair value

at the start of the lease or the present value of the

minimum lease payments; the corresponding liability

is included in the balance sheet as obligations under

capital leases. The interest included in lease payments

is expensed when paid.

Depreciation is provided on a straight-line basis over

estimated useful lives in accordance with the tax law

and regulations in the Republic of China: buildings

and structures (including auxiliary equipment) - 3

to 50 years; machinery, computer and equipment

- 3 to 5 years; furniture and fixtures - 3 to 5 years;

transportation equipment - 5 years; and leasehold

improvements - 3 years.

Revenue is measured at the fair value of the

consideration received or receivable and represents

amounts agreed between the Company and the

customers for goods sold in the normal course of

business, net of sales discounts and volume rebates.

For trade receivables due within one year from

the balance sheet date, as the nominal value of the

consideration to be received approximates its fair

value and transactions are frequent, fair value of the

consideration is not determined by discounting all

future receipts using an imputed rate of interest.

An allowance for doubtful accounts is provided on

the basis of a review of the collectability of accounts

receivable. This review is made by an aging analysis

of the outstanding receivables and assessing the

value of the collaterals provided by customers.

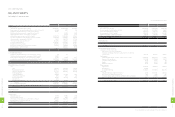

On January 1, 2011, the Company adopted the third-time

revised Statement of Financial Accounting Standards

("SFAS") No. 34 - "Financial Instruments: Recognition

and Measurement." One of the main revisions is that the

impairment of receivables originated by the Company

should be covered by SFAS No. 34. Accounts

receivable are assessed for impairment at the end of

each reporting period and considered impaired when

there is objective evidence that, as a result of one or

more events that occurred after the initial recognition of

the accounts receivable, the estimated future cash flows

of the asset have been affected. Objective evidence of

impairment could include:

• Significant financial diculty of the debtor;

• Accounts receivable becoming overdue; or

• It becoming probable that the debtor will undergo

bankruptcy or financial reorganization.

Accounts receivable that are assessed as not

impaired individually are further assessed for

impairment on a collective basis. Objective evidence

of impairment for a portfolio of accounts receivable

could include the Company's past experience of

collecting payments and an increase in the number of

delayed payments, as well as observable changes in

national or local economic conditions that correlate

with defaults on receivables.

The amount of impairment loss recognized is the

difference between the asset carrying amount and

the present value of estimated future cash flows,

after taking into account the related collaterals and

guarantees, discounted at the receivable's original

effective interest rate.

The carrying amount of the accounts receivable

is reduced through the use of an allowance

account. When accounts receivable are considered

uncollectible, they are written off against the allowance

account. Recoveries of amounts previously written

off are credited to the allowance account. Changes

in the carrying amount of the allowance account are

recognized as bad debt in profit or loss.

(7) Inventories

Inventories consist of raw materials, supplies, finished

goods and work-in-process and are stated at the lower

of cost or net realizable value. Inventory write-downs

are made by item, except where it may be appropriate

to group similar or related items. Net realizable value

is the estimated selling price of inventories less all

estimated costs of completion and costs necessary to

make the sale. Inventories are recorded at weighted-

average cost on the balance sheet date.

(8) Held-to-maturity Financial Assets

Held-to-maturity financial assets are carried at

amortized cost using the effective interest method.

Held-to-maturity financial assets are initially measured

at fair value plus transaction costs that are directly

attributable to the acquisition. Profit or loss is

recognized when the financial assets are derecognized,

impaired, or amortized. All regular way purchases or

sales of financial assets are accounted for using a trade

date basis.

An impairment loss is recognized when there is

objective evidence that the investment is impaired.

The impairment loss is reversed if an increase in

the investment's recoverable amount is due to an

event that occurred after the impairment loss was

recognized; however, the adjusted carrying amount of

the investment may not exceed the carrying amount

that would have been determined had no impairment

loss been recognized for the investment in prior years.

(9) Hedge Accounting

Derivatives that are designated and effective as

hedging instruments are measured at fair value, with

subsequent changes in fair value recognized either in

profit or loss, or in stockholders' equity, depending on

the nature of the hedging relationship.

Hedge accounting recognizes the offsetting effects

on profit or loss of changes in the fair values of the

hedging instrument and the hedged item as follows:

1

6

2

8

FINANCIAL INFORMATION

1

6

3

8

FINANCIAL INFORMATION