HTC 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

All subsidiaries file income tax returns based on the

regulations of their respective local governments.

In addition, there is no material difference in the

accounting principles on income taxes between the

parent company and those of its subsidiaries.

(24) Stock-based Compensation

Employee stock options granted on or after January

1, 2008 are accounted for under SFAS No. 39 -

"Accounting for Share-based Payment." Under the

statement, the value of the stock options granted,

which is equal to the best available estimate of the

number of stock options expected to vest multiplied

by the grant-date fair value, is expensed on a straight-

line basis over the vesting period, with a corresponding

adjustment to capital surplus - employee stock options.

The estimate is revised if subsequent information

indicates that the number of stock options expected to

vest differs from previous estimates.

(25) Treasury Stock

Under SFAS No. 30 - "Accounting for Treasury Stocks,"

when the Company acquires its outstanding shares

that have not been disposed or retired, treasury

stock is stated at cost and shown as a deduction in

stockholders' equity. When treasury shares are sold, if

the selling price is above the book value, the difference

should be credited to the capital surplus - treasury

stock transactions. If the selling price is below the

book value, the difference should first be offset against

capital surplus from the same class of treasury stock

transactions, and the remainder, if any, debited to

retained earnings. The carrying value of treasury stock

is calculated using the weighted-average approach in

accordance with the purpose of the acquisition.

When the Company's treasury stock is retired, the

treasury stock account should be credited, and the

capital surplus - premium on stock account and capital

stock account should be debited proportionately

according to the share ratio. The carrying value of

treasury stock in excess of the sum of its par value

and premium on stock should first be offset against

capital surplus from the same class of treasury stock

transactions, and the remainder, if any, debited to

retained earnings. The sum of the par value and

premium on treasury stock in excess of its carrying

value should be credited to capital surplus from the

same class of treasury stock transactions.

(26) Reclassifications

Certain 2011 accounts have been reclassified to be

consistent with the presentation of the consolidated

financial statements as of and for the year ended

December 31, 2012.

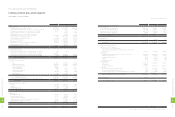

3. TRANSLATION INTO U.S. DOLLARS

The consolidated financial statements are stated in New

Taiwan dollars. The translation of the 2012 New Taiwan

dollar amounts into U.S. dollar amounts are included solely

for the convenience of readers, using the noon buying rate

of NT$29.129 to US$1.00 quoted by Reuters on December 31,

2012. The convenience translation should not be construed

as representations that the New Taiwan dollar amounts have

been, could have been, or could in the future be, converted

into U.S. dollars at this or any other exchange rate.

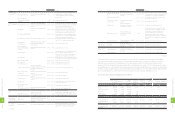

4. ACCOUNTING CHANGES

(1) Financial Instruments

On January 1, 2011, the Company adopted the newly

revised SFAS No. 34 - "Financial Instruments: Recognition

and Measurement." The main revisions include (1) finance

lease receivables are now covered by SFAS No. 34; (2)

the scope of the applicability of SFAS No. 34 to insurance

contracts is amended; (3) loans and receivables originated

by the Company are now covered by SFAS No. 34; (4)

additional guidelines on impairment testing of financial

assets carried at amortized cost when a debtor has

financial difficulties and the terms of obligations have been

modified; and (5) accounting treatment by a debtor for

modifications in the terms of obligations. This accounting

change had no material effect on the Company's

consolidated financial statements as of and for the year

ended December 31, 2011.

(2) Operating Segments

On January 1, 2011, the Company adopted the newly

issued SFAS No. 41 - "Operating Segments." The

requirements of the statement are based on the

information on the components of the Company that

management uses to make decisions about operating

matters. SFAS No. 41 requires identification of operating

segments on the basis of internal reports that are

regularly reviewed by the Company's chief operating

decision maker in order to allocate resources to the

segments and assess their performance. This statement

supersedes SFAS No. 20 - "Segment Reporting"

and resulted in the Company's compliance with the

requirement to disclose operating segment information.

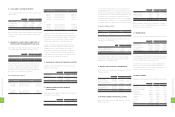

extent that an impairment loss on the same revalued

asset was previously charged to earnings. Any excess

amount is treated as an increase in the unrealized

revaluation increment.

For the purpose of impairment testing, goodwill is

allocated to each of the relevant cash-generating

units ("CGUs") that are expected to benefit from the

synergies of the acquisition. A CGU to which goodwill

has been allocated is tested for impairment annually

or whenever there is an indication that the CGU may

be impaired. If the recoverable amount of the CGU

becomes less than its carrying amount, the impairment

is allocated to first reduce the carrying amount of the

goodwill allocated to the CGU and then to the other

assets of the CGU pro rata on the basis of the carrying

amount of each asset in the CGU. A reversal of an

impairment loss on goodwill is disallowed.

For long-term equity investments on which the

Company has significant influence but over which it has

no control, the carrying amount (including goodwill) of

each investment is compared with its own recoverable

amount for the purpose of impairment testing.

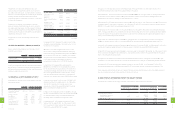

(18) Accrued Marketing Expenses

The Company accrues marketing expenses on the

basis of agreements and any known factors that would

significantly affect the accruals. In addition, depending

on the nature of relevant events, the accrued marketing

expenses are accounted for as an increase in marketing

expenses or as a decrease in revenues.

(19) Warranty Provisions

The Company provides warranty service for one year

to two years. The warranty liability is estimated on the

basis of evaluation of the products under warranty,

past warranty experience, and pertinent factors.

(20) Provisions for Contingent Loss on Purchase

Orders

The provision for contingent loss on purchase orders

is estimated after taking into account the effects

of changes in the product market, evaluating the

foregoing effects on inventory management and

adjusting the Company's purchases.

(21) Product-related Costs

The cost of products consists of costs of goods sold

(materials, labor and allocated manufacturing cost),

inventory write-downs (or reversal of these write-

downs), warranty expenses and contingent loss on

purchase orders.

(22) Pension Plan

Pension cost under a defined benefit plan is determined

by actuarial valuations. Contributions made under a

defined contribution plan are recognized as pension

cost during the year in which employees render services.

Curtailment or settlement gains or losses on the

defined benefit plan are recognized as part of the net

pension cost for the year.

(23) Income Tax

The Company applies the intra-year and inter-year

allocation methods to its income tax, whereby (1)

a portion of income tax expense is allocated to the

cumulative effect of changes in accounting principles

or charged or credited directly to stockholders' equity;

and (2) deferred income tax assets and liabilities are

recognized for the tax effects of temporary differences,

unused loss carryforwards and unused tax credits.

Valuation allowances are provided to the extent, if any,

that it is more likely than not that deferred income

tax assets will not be realized. A deferred tax asset

or liability is classified as current or non-current in

accordance with the classification of the related

asset or liability for financial reporting. However, if a

deferred income tax asset or liability does not relate

to an asset or liability in the financial statements, it is

classified as current or non-current on the basis of the

expected length of time before it is realized or settled.

If the Company can control the timing of the reversal

of a temporary difference arising from the difference

between the book value and the tax basis of a long-

term equity investment in a foreign subsidiary or joint

venture and if the temporary difference is not expected

to reverse in the foreseeable future and will, in effect,

exist indefinitely, then a deferred tax liability or asset is

not recognized.

Tax credits for purchases of machinery, equipment and

technology, research and development expenditures,

and personnel training expenditures are recognized

using the flow-through method.

Adjustments of prior years' tax liabilities are added to

or deducted from the current year's tax provision.

According to the Income Tax Law, an additional tax

at 10% of unappropriated earnings is provided for as

income tax in the year the stockholders approve the

retention of these earnings.

2

1

2

8

FINANCIAL INFORMATION

2

1

3

8

FINANCIAL INFORMATION