HTC 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

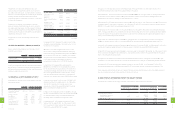

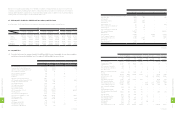

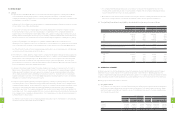

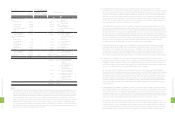

2012

Amount (Numerator) Shares

(Denominator)

(In Thousands)

EPS (In Dollars)

Before

Income Tax

After

Income Tax

Before

Income Tax

After

Income Tax

NT$ NT$ NT$ NT$

Basic EPS $16,925,103 $16,780,968 831,980 $20.34 $20.17

Bonus to employees - - 3,748

Diluted EPS $16,925,103 $16,780,968 835,728 $20.25 $20.08

2012

Amount (Numerator) Shares

(Denominator)

(In Thousands)

EPS (In Dollars)

Before

Income Tax

After

Income Tax

Before

Income T

ax

After

Income Tax

US$ (Note 3) US$ (Note 3) US$ (Note 3) US$ (Note 3)

Basic EPS $581,040 $576,092 831,980 $0.70 $0.69

Bonus to employees - - 3,748

Diluted EPS $581,040 $576,092 835,728 $0.70 $0.69

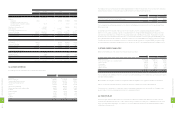

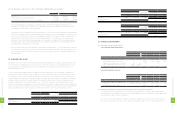

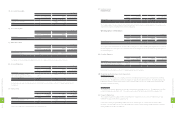

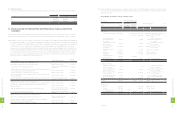

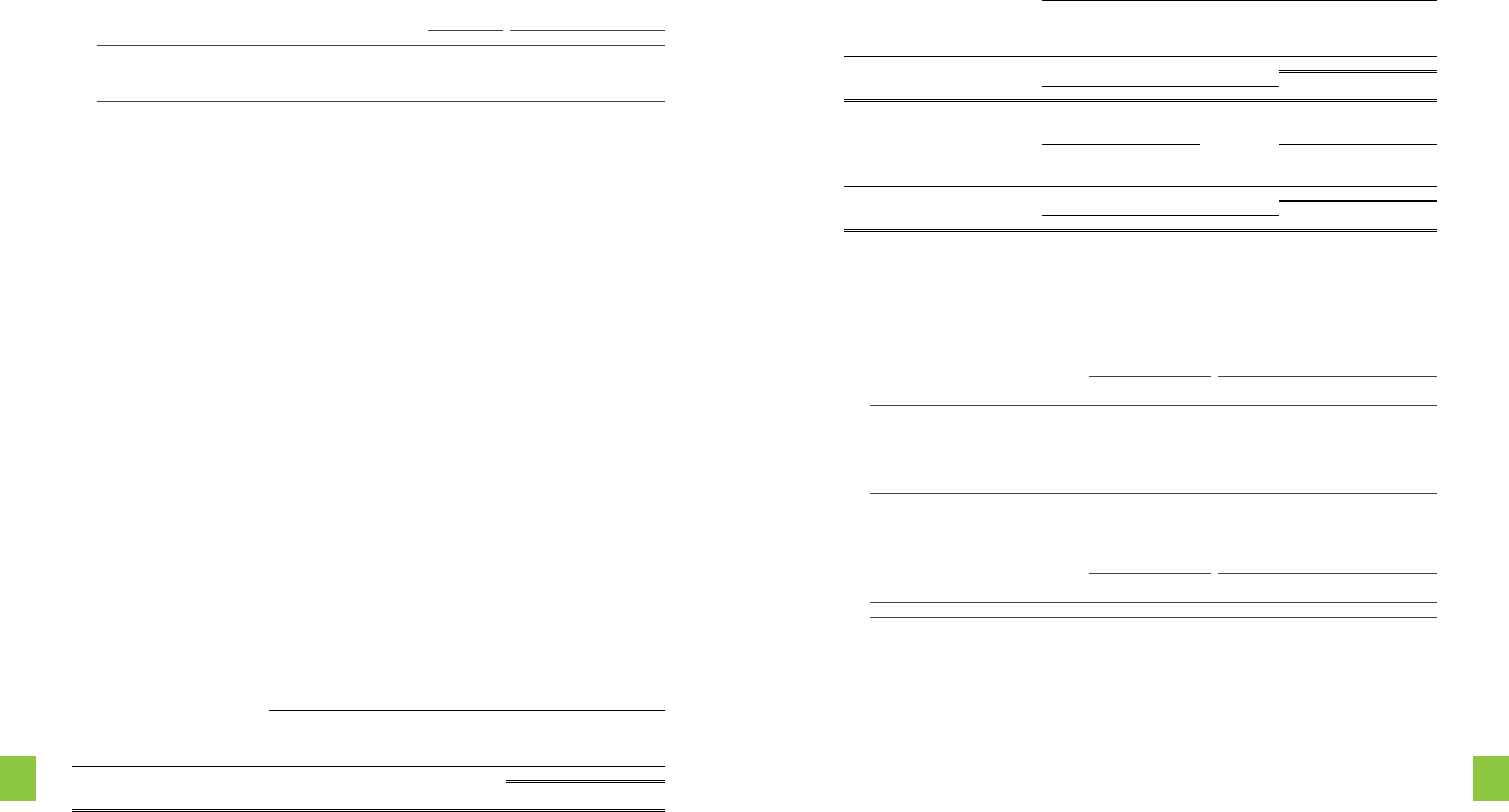

26. FINANCIAL INSTRUMENTS

(1) Fair Value of Financial Instruments

a. Non-derivative financial instruments

December 31

2011 2012

Carrying Amount Fair Value Carrying Amount Fair Value

NT$ NT$ NT$ US$ (Note 3) NT$ US$ (Note 3)

Assets

Available-for-sale financial assets - current $736,031 $736,031 $37,902 $1,301 $37,902 $1,301

Held-to-maturity financial assets - current - - 101,459 3,483 101,436 3,482

Available-for-sale financial assets - non-current 279 279 197 7 197 7

Held-to-maturity financial assets - non-current 204,597 203,783 - - - -

Financial assets carried at cost - non-current 3,408,654 3,408,654 4,304,907 147,788 4,304,907 147,788

b. Derivative financial instruments

December 31

2011 2012

Carrying Amount Fair Value Carrying Amount Fair Value

NT$ NT$ NT$ US$ (Note 3) NT$ US$ (Note 3)

Assets

Financial assets at fair value through profit or

loss - current $256,868 $256,868 $6,950 $238 $6,950 $238

Hedging derivative assets - current - - 204,519 7,021 204,519 7,021

(2) Methods and Assumptions Used in Determining Fair Values of Financial Instruments

The financial instruments listed above don’t include cash and cash equivalents, receivables, other current financial

assets, payables, accrued expenses and other current financial liabilities, which have carrying amounts that approximate

their fair values because of their short maturities.

For other non-current financial assets or liabilities, their fair values are based on the present value of future cash flows

discounted at the average interest rates for time deposits with maturities similar to those of the financial instruments.

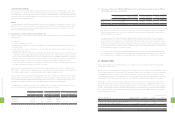

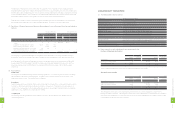

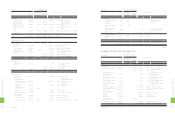

(6) The imputation credit account (“ICA”) information in 2011 and 2012 were as follows:

2011 2012

NT$ NT$ US$ (Note 3)

Balance of ICA $2,523,575 $5,966,033 $204,814

Unappropriated earnings generated from 1998 75,762,315 53,677,474 1,842,750

Actual/estimated creditable ratio (including income tax payable) 15.99%

(Actual ratio)

13.53%

(Estimated ratio)

13.65%

(Estimated ratio)

The actual creditable ratios for distribution of earnings of 2011 was 15.99% and estimated creditable ratios for

distribution of earnings of 2012 was 13.53%. In the calculation of the expected creditable ratio for 2012, the income

taxes payable as of December 31, 2012 was included.

Under Income Tax Act, for payment of profit-seeking enterprise income tax for the year of 1998 and the years thereafter,

a profit-seeking enterprise may, when making surplus earning distribution, cause its shareholders or association/society

members to deduct from the gross amount of tax payable as declared in their respective annual consolidated income

tax return for the current year the amount of income tax payable by them on the dividend or the surplus earning

distributed to them by the said profit-seeking enterprise. The imputation credit allocated to shareholders is based on

its balance as of the date of the dividend distribution. The estimated creditable ratio for 2012 may change when the

actual distribution of the imputation credit is made.

HTC's income tax returns through 2009 had been examined by the tax authorities. The income tax returns of CGC and

HTC Investment Corporation for the years through 2010 have been examined and approved by the tax authorities. The

income tax returns of HTC I Investment Corporation for the years through 2011 have been examined and approved by

the tax authorities.

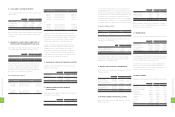

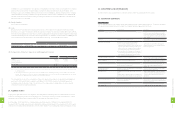

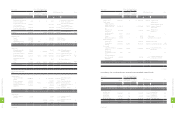

25. EARNINGS PER SHARE

Earnings per share ("EPS") before tax and after tax are calculated by dividing net income by the weighted average number

of common shares outstanding which includes the deduction of the effect of treasury stock during each year. EPS in 2011

were calculated after the average number of shares outstanding that was adjusted retroactively for the effect of stock

dividend distribution in 2012.

The Accounting Research and Development Foundation issued Interpretation 2007-052, which requires companies to

recognize bonuses paid to employees, directors and supervisors as compensation expenses beginning January 1, 2008.

These bonuses were previously recorded as appropriations from earnings. If the Company may settle to settle the bonus

to employees by cash or shares, the Company should presume that the entire amount of the bonus will be settled in shares

and the resulting potential shares should be included in the weighted average number of shares outstanding used in the

calculation of diluted EPS, if the shares have a dilutive effect. The number of shares is estimated by dividing the entire

amount of the bonus by the closing price of the shares at the balance sheet date. The dilutive effects of the potential shares

needs to be included in the calculation of diluted EPS until the stockholders resolve the number of shares to be distributed to

employees at their meeting in the following year. The related EPS information of HTC for 2011 and 2012 is as follows:

2011

Amount (Numerator) Shares

(Denominator)

(In Thousands)

EPS (In Dollars)

Before

Income Tax

After

Income Tax

Before

Income Tax

After

Income Tax

NT$ NT$ NT$ NT$

Basic EPS $69,849,671 $61,975,796 845,319 $82.63 $73.32

Bonus to employees - - 16,527

Diluted EPS $69,849,671 $61,975,796 861,846 $81.05 $71.91

2

3

0

8

FINANCIAL INFORMATION

2

3

1

8

FINANCIAL INFORMATION