HTC 2012 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

by NT$99,321 thousand (US$3,410 thousand) and a decrease by the same amount in "accumulated earnings." In

addition, the evaluation adjustment made on December 31, 2012 resulted in (a) a decrease in "accumulated earnings"

by NT$93,451 thousand (US$3,208 thousand) due to an increase of "accrued expenses"; (b) decreases in "cost of

revenues" by NT$5,299 thousand (US$182 thousand) and "selling and marketing expenses" by NT$4,843 thousand

(US$166 thousand) and (c) increases in "general and administrative expenses" by NT$557 thousand (US$19

thousand) and "research and developing expenses" by NT$3,715 thousand (US$128 thousand).

g) Under ROC GAAP, deferred charges are classified under other assets. Transition to IFRSs, deferred charges are

classified under "property, plant and equipment", "other intangible assets" and "other assets - other" according to

the nature.

As of January 1, 2012 and December 31, 2012, the Company reclassified NT$410,217 thousand (US$14,083 thousand) and

NT$571,485 thousand (US$19,619 thousand), respectively, of "deferred charges" to "property, plant and equipment"; and

reclassified NT$207,033 thousand (US$7,107 thousand) and NT$162,765 thousand (US$5,588 thousand), respectively,

of "deferred charges" to "other intangible assets" and reclassified NT$146,266 thousand (US$5,021 thousand) and

NT$162,914 thousand (US$5,593 thousand), respectively, of "deferred charges" to "other assets - other".

h) The Company purchased fixed assets and made prepayments, pursuant to the "Rules Governing the Preparation of

Financial Statements by Securities Issuers". Such prepayments are presented as "properties". Transition to IFRSs,

the prepayments are classified under "other assets - other". As of January 1, 2012 and December 31, 2012, the

Company reclassified NT$207,062 thousand (US$7,108 thousand) and NT$232,011 thousand (US$7,965 thousand),

respectively, of "property, plant and equipment" to "other assets - other".

i) Under ROC GAAP, if an investee issues new shares and an investor does not purchase new shares proportionately,

capital surplus and the long-term equity investment accounts should be adjusted for the change in the investor's

holding percentage and interest in the investee’s net assets. By contrast, under IFRSs, a reduction of investor's

ownership interest that results in loss of significant influence on or control over an investee would be treated as a

deemed disposal, with the related gain or loss recognized in profit or loss. An entity may elect not to adjust the

difference retrospectively, and the Company elected to use the exemption from retrospective application. The

IFRSs adjustment resulted in a decrease of capital surplus - long-term equity investments of NT$18,037 thousand

(US$619 thousand) and a corresponding increase of accumulated earnings by related rules.

j) The Company elected to reset the cumulative translation differences to zero at the date of transition to IFRSs, and

the reversal has been used to adjust accumulated earnings as of January 1, 2012. The gain or loss on any subsequent

disposals of any foreign operations should exclude cumulative translation differences that arose before the date of

transition to IFRSs. Therefore, the IFRSs adjustment resulted in a decrease in cumulative translation differences and

an increase in accumulated earnings by NT$32,134 thousand (US$1,103 thousand) each.

(3) Under IFRS 1, an entity that adopts IFRSs for the first time should apply all IFRSs in preparing financial statements

and should make adjustments retrospectively; however, the entity may select to use certain optional exemptions and

mandatory exemptions stated in IFRS 1. The main optional exemptions the Company adopted are as follows:

Business combinations:

The Company elected not to apply IFRS 3 - Business Combination retrospectively to business combinations that

occurred before the date of transition to IFRSs. Thus, in the opening balance sheet, the amount of goodwill generated

from past business combinations remains the same as that shown under R.O.C. GAAP as of December 31, 2011.

Goodwill arising from business combinations and fair value adjustments:

In accordance with IAS 21 - "The Effects of Changes in Foreign Exchange Rates", any goodwill and any fair value adjustment

to the carrying amounts of assets and liabilities arising on the acquisition of a foreign operation should be treated as assets

and liabilities of the foreign operation. Thus, goodwill and those fair value adjustments should be expressed in the foreign

operation's functional currency and should be translated at the closing rate at the end of the reporting period. The Company

elected not to apply IAS 21 retrospectively to goodwill and those fair value adjustments arising from business combinations

that occurred before the date of transition to IFRSs. Thus, goodwill and fair value adjustments that occurred before the date

of transition to IFRSs are expressed in New Taiwan dollars using the historical exchange rates.

Share-based payment transactions:

The Company elected to use the exemption from the retrospective application of IFRS 2 - "Share-based Payment" to all

equity instruments that were granted and vested before the date of transition to IFRSs.

Employee benefits:

The Company elected to recognize all cumulative actuarial gains and losses on employee benefits in accumulated

earnings at the date of transition to IFRSs.

Cumulative translation dierences:

The Company elected to reset the cumulative translation differences to zero at the date of transition to IFRSs, and the

reversal has been used to offset accumulated earnings as of December 31, 2011. Thus, the gain or loss on any subsequent

disposal of foreign operations should exclude translation differences that arose before the date of transition to IFRSs.

The foregoing optional exemptions that the Company plans to elect are subject to changes arising from the

management's consideration and assessment; thus, the actual results may vary.

(4) Special reserve at the date of transition to IFRSs

Under order VI-1010012865 issued by FSC on April 6, 2012, on the first-time adoption of IFRSs, if an entity elects to

use the exemption application specified in IFRS 1 and transfers its unrealized revaluation increment and cumulative

translation differences to retained earnings, the entity has to appropriate the sum of the increment and the differences

to special reserve. However, if the retained earnings arising from IFRSs adjustment at the first-time adoption is

insufficient, special reserve should be appropriated at the same amount by which retained earnings increased as a

result of the IFRSs adjustment. On the subsequent usage, disposal or reclassification of the related assets, the special

reserve can be reversed proportionately.

The Company elected to reset the cumulative translation differences of NT$32,134 thousand (US$1,103 thousand) to

zero and credited NT$32,134 thousand (US$1,103 thousand) to retained earnings. However, the Company's total IFRSs

adjustments, at the first-time adoption of IFRSs, resulted in a decrease in retained earnings by NT$74,837 thousand

(US$2,569 thousand). Thus, no special reserve was appropriated.

(5)

The Company has prepared the above assessments in compliance with (a) the 2010 version of the IFRSs translated by the

ARDF and issued by the FSC and (b) the Guidelines Governing the Preparation of Financial Reports by Securities Issuers

amended and issued by the FSC on December 22, 2011. These assessments may be changed as the International Accounting

Statements Board ("IASB") continues to issue or amend standards, and as the FSC may issue new rules governing the

adoption of IFRSs by companies with shares listed on the TWSE or traded on the Taiwan GreTai Securities Market or

Emerging Stock Market. Actual results may differ from these assessments. New and revised standards, amendments or

interpretations that have been issued by IASB and approved but are not yet effected by the FSC are as follows:

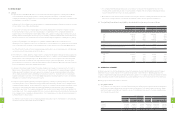

Standards or Interpretations Content Effective Date by IASB

IFRSs (Amendments) Improvements to 2010 IFRS July 1, 2010 and January 1, 2011

IFRSs (Amendments) Improvements to 2009 IFRS, which amend IAS 39 (see note below) January 1, 2009 and January 1, 2010

IFRS 1 (Amendment) Limited exemption from comparative IFRS 7 disclosures for first-

time adopters July 1, 2010

IFRS 1 (Amendment) Severe hyperinflation and removal of fixed dates for first-time

adopters July 1, 2011

IFRS 7 (Amendment) Disclosures - transfers of financial assets July 1, 2011

IFRS 9 (Amendment) Financial instruments January 1, 2015

IAS 12 (Amendment) Deferred tax: Recovery of underlying assets January 1, 2012

IAS 39 (Amendment) Eligible hedged items (see note below) Effective for a fiscal year ending on

or after June 30, 2009

Note: In the ROC, although the amendment to IAS 39 that was issued by the IASB in 2009 has not yet been effected by the FSC, the Taiwan

International Financial Reporting Standards ("TIFRS") is in compliance with the 2009 version of the IAS 39.

2

4

8

8

FINANCIAL INFORMATION

2

4

9

8

FINANCIAL INFORMATION