HTC 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

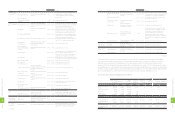

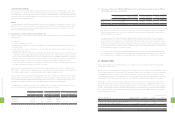

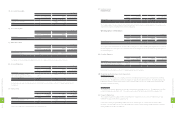

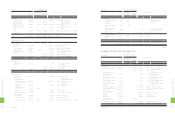

(5) The bonus to employees for 2010 and 2011 approved in the stockholders' meetings on June 15, 2011 and

June 12, 2012, respectively, were as follows:

For 2010 For 2011

Amounts Approved in

Stockholders' Meetings

Amounts Recognized in

Financial Statements

Amounts Approved in

Stockholders' Meetings

Amounts Recognized in

Financial Statements

NT$ NT$ NT$ US$ (Note 3) NT$ US$ (Note 3)

Cash $4,245,853 $7,238,637 $248,503

Stock 4,245,851 - -

$8,491,704 $8,491,704 $7,238,637 $248,503 $7,238,637 $248,503

The number of shares of 4,006 thousand for 2010 was determined by dividing the amount of share bonus by the closing

price (after considering the effect of cash and stock dividends) of the day immediately preceding the stockholders'

meeting. The approved amounts of the bonus to employees were the same as the accrual amounts reflected in the

financial statements for 2010 and 2011.

The employee bonus for 2011 and 2012 should be appropriated at 10% and 5%, respectively, of net income before

deducting employee bonus expenses. If the actual amounts subsequently resolved by the stockholders differ from

the proposed amounts, the differences are recorded in the year of stockholders' resolution as a change in accounting

estimate. If bonus shares are resolved to be distributed to employees, the number of shares is determined by dividing

the amount of bonus by the closing price (after considering the effect of cash and stock dividends) of the shares of the

day immediately preceding the stockholders' meeting.

As of March 18, 2013, the date of the accompanying independent auditors' report, the 2012 earnings appropriation has

not been approved by HTC's Board of directors. Information about earnings appropriation and the bonus to employees,

directors and supervisors is available on the Market Observation Post System website of the Taiwan Stock Exchange.

22. TREASURY STOCK

HTC resolved to transfer 6,000 thousand treasury stocks to employees in June 2011, and the number of shares actually

transferred was 5,875 thousand.

On July 16, 2011, HTC's board of directors passed a resolution to buy back from the open market 10,000 thousand shares for each

of the periods between July 18, 2011 and August 17, 2011 and between August 18, 2011 and September 17, 2011, with the repurchase

price ranging from NT$900 to NT$1,100 per share. When the share price was below the price floor of the range, HTC would

continue to buy back its shares. HTC bought back 20,000 thousand shares for NT$16,086,098 thousand during the repurchase

periods, retired 10,000 thousand shares in December 2011 and completed the capital amendment registration in January 2012.

On December 20, 2011, HTC’s board of directors passed a resolution to buy back 10,000 thousand of its shares from the

open market between December 20, 2011 and February 19, 2012, with the repurchase price ranging from NT$445 (US$15) to

NT$650 (US$22) per share. When the share price was below the price floor of the range, HTC would continue to buy back

its shares. HTC bought back 6,914 thousand shares (bought back 100 thousand shares in 2011 and 6,814 thousand shares in

2012) for NT$3,750,056 thousand (US$128,740 thousand) during the repurchase period. Other treasury stock information

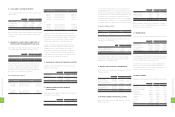

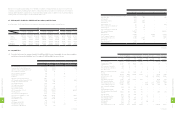

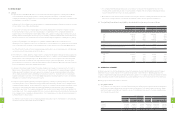

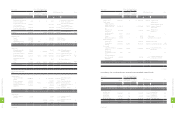

for 2011 and 2012 were as follows:

(In Thousands of Shares)

Purpose of Treasury Stock Number of Shares,

Beginning of Year

Addition

During the Year

Reduction

During the Year

Number of

Shares, End of Year

2011

To maintain the Company's credibility and stockholders' interest - 10,000 10,000 -

To transfer shares to the Company's employees 9,786 10,100 5,875 14,011

9,786 20,100 15,875 14,011

2012

To transfer shares to the Company's employees 14,011 6,814 - 20,825

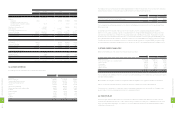

Long-term equity investments

As of January 1, 2011, the capital surplus from long-term equity-method investments was NT$18,411 thousand. When

the Company did not subscribe for the new shares issued by an equity-method investee, Huada Digital Corporation,

in September 2011, the Company's total investment carrying value and capital surplus decreased by NT$374 thousand

each in 2011. As a result, the capital surplus from long-term equity-method investments as of December 31, 2012 was

NT$18,037 thousand (US$619 thousand).

Merger

The additional paid-in capital from a merger with IA Style (Note 14) was NT$24,710 thousand as of January 1, 2011. In

December 2011, the retirement of treasury stock caused a decrease of NT$287 thousand in additional paid-in capital

from the foregoing merger. As a result, the additional paid-in capital from a merger as of December 31, 2012 was

NT$24,423 thousand (US$838 thousand).

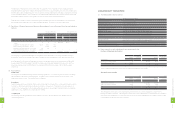

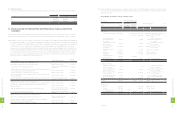

(4) Appropriation of Retained Earnings and Dividend Policy

Under HTC’s Articles of Incorporation, if HTC has earnings after the annual final accounting, it shall be allocated in the

following order:

a. To pay taxes

b. To cover accumulated losses, if any

c. To appropriate 10% legal reserve unless the total legal reserve accumulated has already reached the amount of HTC's

authorized capital

d. To pay remuneration to directors and supervisors at 0.3% maximum of the balance after deducting the amounts

under the above items (a) to (c)

e. To pay bonus to employees at 5% minimum of the balance after deducting the amounts under the above items (a) to (c),

or such balance plus the unappropriated retained earnings of previous years. However, the bonus may not exceed the

limits on employee bonus distributions as set out in the Regulations Governing the Offering and Issuance of Securities

by Issuers. Where bonus to employees is allocated by means of new share issuance, the employees to receive bonus

may include the affiliates' employees who meet specific requirements prescribed by the board of directors.

f. For any remainder, the board of directors should propose allocation ratios based on the dividend policy set forth in

HTC's Articles and propose them at the stockholders' meeting.

Legal reserve should be appropriated until it has reached a company's paid-in capital. This reserve may be used to

offset a deficit. Under the revised Company Law issued on January 4, 2012, when the legal reserve has exceeded 25%

of a company's paid-in capital, the excess may be transferred to capital or distributed in cash.

As part of a high-technology industry and as a growing enterprise, HTC considers its operating environment, industry

developments, and long-term interests of stockholders as well as its programs to maintain operating efficiency and

meet its capital expenditure budget and financial goals in determining the stock or cash dividends to be paid. HTC's

dividend policy stipulates that at least 50% of total dividends may be distributed as cash dividends.

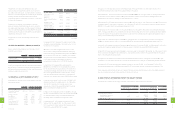

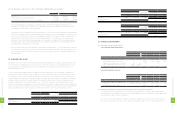

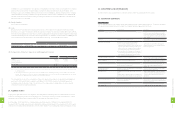

The appropriations of earnings for 2010 and 2011 were approved in the stockholders' meetings on June 15, 2011 and

June 12, 2012, respectively. The appropriations and dividends per share were as follows:

For 2010 For 2011

Appropriation

of Earnings

Dividends Per

Share Appropriation of Earnings Dividends Per Share

NT$ NT$ NT$ US$ (Note 3) NT$ US$ (Note 3)

Legal reserve $- $- $6,197,580 $212,763 $- $-

Special reserve 580,856 - (580,856) (19,941) - -

Cash dividends 29,891,089 37.00 33,249,085 1,141,443 40.00 1.37

Stock dividends 403,934 0.50 - - - -

2

2

4

8

FINANCIAL INFORMATION

2

2

5

8

FINANCIAL INFORMATION