HTC 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

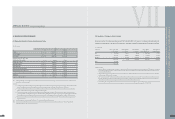

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

191190

> Th

e

i

n

c

om

e

t

a

x

e

s

i

n 2005, 2006

a

nd 2007 w

e

r

e

a

s

f

o

ll

ows

:

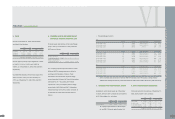

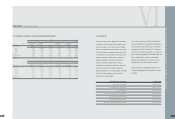

2005 2006 2007

NT$ NT$ NT$ US$ (Note 3)

Current income tax $ 630,079 $ 1,849,052 $ 3,497,798 $ 107,857

Increase in deferred income tax assets ( 254,088) ( 172,381) ( 309,485) ( 9,543)

Underestimation of prior year's income tax 210 31,704 125,911 3,882

Income tax $ 376,201 $ 1,708,375 $ 3,314,224 $ 102,196

The integrated income tax information of HTC is as follows:

2005 2006 2007

NT$ NT$ NT$ US$ (Note 3)

Balance of imputation credit account $ 101,702 $ 481,742 $ 1,857,935 $ 57,291

Unappropriated earnings generated from 1998 14,152,255 31,991,090 41,403,867 1,276,715

Expected creditable ratio (including income tax payable) 5.08% 7.00% 10.56% 10.56%

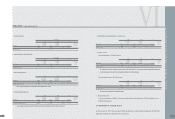

24. EARNINGS PER SHARE

Earnings per share (EPS) before tax and after tax are calculated by dividing net income by the weighted

average number of common shares outstanding, which includes the deduction of the effect of treasury stock

during each year. The weighted average number of shares used in EPS calculation was 573,414 thousand

shares in 2005; 577,919 thousand shares in 2006; and 573,299 thousand shares in 2007. The EPS in 2005 and

2006 were calculated after the average number of shares outstanding was adjusted retroactively for the effect of

stock dividend distribution in 2007.

VI

> D

e

t

a

il

s o

f

t

h

e

t

a

x

c

r

e

d

i

t

c

a

rry

f

orw

a

rds

a

r

e

a

s

f

o

ll

ows

:

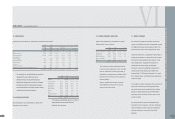

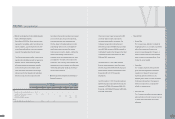

2005 2006 2007

Credit Grant Year Validity Period NT$ NT$ NT$ US$ (Note 3)

Unrealized marketing expenses $ - $ 245,772 $ 757,691 $ 23,364

2002 2002-2006 $ 56,405 $ - $ - $ -

2003 2003-2007 58,500 - - -

2004 2004-2008 - - 6,965 215

2005 2005-2009 263,331 - 6,479 200

2006 2006-2010 - 9,574 15,475 477

2007 2007-2011 - - 18,565 572

$ 378,236 $ 9,574 $ 47,484 $ 1,464

> D

e

t

a

il

o

f

t

h

e

l

oss

c

a

rry

f

orw

a

rds

a

r

e

a

s

f

o

ll

ows

:

2005 2006 2007

Loss Year Validity Period NT$ NT$ NT$ US$ (Note 3)

2005 2006-2010 $ - $ - $ 95 $ 3

2006 2007-2011 - 31,474 50,703 1,564

2007 2008-2012 - - 50,372 1,553

$ - $ 31,474 $ 101,170 $ 3,120

Based on the Income Tax Act of the ROC, the investment research and development tax credits can be carried

forward for four years. The total credits used in each year cannot exceed half of the estimated income tax

provision, except in the last year.

Valuation allowance is based on management's evaluation of the amount of tax credits that can be carried

forward for four years, based on the Company's financial forecasts.

FINANCEI CONSOLIDATED REPORT

l