HTC 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123122

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

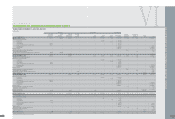

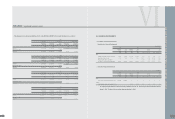

11.PREPAYMENTS

Prepayments as of December 31, 2005, 2006 and

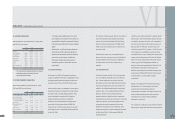

2007 referred to the following items:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Royalty (Note 28) $ 274,489 $1,631,513 $1,232,901 $ 38,017

Software and hardware maintenance

22,984 80,517 76,732 2,366

Service 83,352 50,606 32,241 994

Travel 16,034 47,298 6,542 202

Molding equipment 57,700 40,088 158,280 4,881

Materials purchases 2,820 1,479 1,838 57

Others 16,882 29,618 28,793 888

$ 474,261 $1,881,119 $1,537,327 $ 47,405

12.

F

INANCIAL ASSETS CARRIED

AT COST

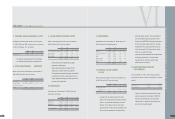

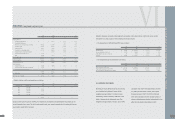

Financial assets carried at cost as of December 31,

2005, 2006 and 2007 were as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Hua-Chuang Automobile Information

Technical Center Co., Ltd.

$ - $ - $500,000 $15,418

Answer Online, Inc. 1,192 1,192 1,192 37

$ 1,192 $ 1,192 $501,192 $15,455

•In January 2007, the Co

m

pany acquired 10% equity

interest in

H

ua-Chuang Auto

m

obile Infor

m

ation Technical

Center Co.,

L

td. for

N

T$500,000 thousand

(

U

S

$15,418

thousand

)

. The Co

m

pany also signed a joint venture

agree

m

ent with Yulon

G

roup, the

m

ain stockholder of

H

ua-

Chuang.

U

nder the agree

m

ent, the Co

m

pany and Yulon

G

roup

m

ay, between January 1, 2010 and

D

ece

m

ber 31,

2011, sub

m

it written requests to each other for Yulon

G

roup to buy back

N

T$300,000 thousand at original price,

so

m

e of

H

ua-Chuang

'

s shares bought by the Co

m

pany.

•In March 2004, the Co

m

pany

m

erged with IA

S

tyle, Inc.

(

N

ote 1

)

and acquired 1.82% equity interest in Answer

O

nline, Inc. as a result of the

m

erger.

•These unquoted equity instru

m

ents were not carried at fair

value because their fair value could not be reliably

m

easured; thus, the Co

m

pany accounted for these

invest

m

ents by the cost

m

ethod.

13.BOND INVESTMENTS WITH NO

ACTIVE MARKET

As of December 31, 2007, the Company had the

following investment in bonds not quoted in an active

market:

NT$ US$(Note 3)

Bond investment $ 33,030 $ 1,019

Less current portion (33,030) (1,019)

$ - $ -

•The above 12-

m

onth bond invest

m

ent, with 6% annual

interest, was acquired by the Co

m

pany for

N

T$33,030

thousand

(

U

S

$1,000 thousand

)

. The unquoted debt

instru

m

ent was not carried at fair value because its fair

value could not be reliably

m

easured.

VI

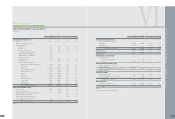

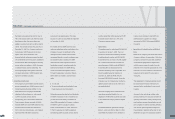

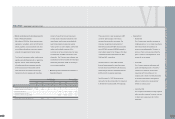

7.AVAILABLE-

F

OR-SALE

F

INANCIAL ASSETS

Available-for-sale financial assets as of December

31, 2005, 2006 and 2007 consisted of an investment

in VIA Technologies, Inc., as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

VIA Technologies, Inc. $ 836 $ 1,733 $ 784 $ 24

•The Co

m

pany

'

s original invest

m

ent in VIA Technologies,

Inc. was

N

T$1,971 thousand,

m

ade in

D

ece

m

ber 1999.

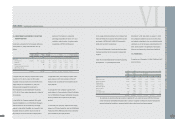

8.NOTES AND ACCOUNTS RECEIVABLE

Notes and accounts receivable as of December 31,

2005, 2006 and 2007 were as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Notes receivable $ 99,087 $ 58,930 $ 3,058 $ 94

Accounts receivable 14,221,725 18,320,329 19,215,152 592,511

Less allowance for doubtful

accounts (8,910) (2,350) (271,285) (8,365)

$14,311,902 $18,376,909 $18,946,925 $ 584,240

9.OTHER CURRENT

F

INANCIAL ASSETS

Other current financial assets as of December 31,

2005, 2006 and 2007 were as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Other receivables from related parties

$ 3,004 $ 130,990 $ 171,901 $ 5,301

Interest receivables 15,566 24,854 50,444 1,555

Other receivables 20,230 22,676 47,625 1,469

Agency payments 16,194 189,977 14,081 434

$ 54,994 $ 368,497 $ 284,051 $ 8,759

•

O

ther receivables fro

m

related parties were agency

pay

m

ents fro

m

related parties.

•Agency pay

m

ents were pri

m

arily royalty and other

prepay

m

ents on behalf of vendors and custo

m

ers.

•

O

ther receivables were pri

m

arily overseas value-added tax

receivables fro

m

custo

m

ers, co

m

pensation fro

m

service

charges, prepay

m

ent for e

m

ployees

'

travel expenses and

proceeds of sales of properties.

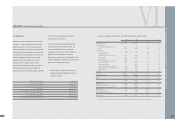

10.INVENTORIES

Inventories as of December 31, 2005, 2006 and

2007 were as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Finished goods $ 625,943 $ 753,426 $ 405,952 $ 12,518

Work-in-process 1,801,220 1,207,886 1,641,460 50,615

Raw materials 2,997,117 3,914,242 4,988,289 153,817

5,424,280 5,875,554 7,035,701 216,950

Less valuation allowance (586,727) (891,663) (916,288) (28,254)

$ 4,837,553 $ 4,983,891 $ 6,119,413 $ 188,696

FINANCEI INDEPENDENT AUDITORS' REPORT

l