HTC 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

209208

A REVIEW AND ANALYSIS OFTHE COMPANY'S FINANCIAL CONDITION

AND OPERATING RESULTS,AND A LISTING OFRISKS

(2) An

a

l

ys

i

s o

f

Ch

a

ng

e

i

n Gross In

c

om

e

Gross income for the current period grew by NT$11,662,304,000, or 34 percent. Analyses and explanations of

variations in sales prices, cost prices, the sales mix, and sales volume for primary product lines are as follows:

U

nit :

N

T$ thousands

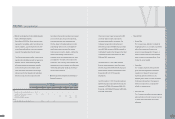

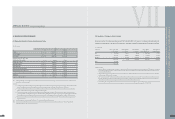

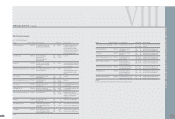

Product Type Variance of gross Profit Variance Owing to Variance Owing to Variance Owing to Variance Owing to

in 2007 and 2006 Price Difference Cost Difference Product Mix Difference Quantity Difference

PDA

( 1,192,598) 49,632 48,248 ( 1,347,990) 57,512

Smart Phone

1,126,101 744,985 400,401 ( 244,423) 225,138

PDA Phone

10,229,421 ( 797,346) 3,902,653 6,238,526 885,588

10,162,924 ( 2,729) 4,351,302 4,646,113 1,168,238

Others

1,499,380

11,662,304

Explanation of variances

1.

S

ales price variances: In the current period, due to the product

m

ix, sales prices for handheld co

m

puters were higher, and due to a lower proportion of

O

EM s

m

art phones, sales prices for

the non-

O

EM portion were so

m

ewhat higher, resulting in positive price variances. More price-based

m

arketing subsidies were granted for wireless handheld co

m

puters based on price,

resulting in a negative price variance.

2. Cost price variances: Aggressive control of

m

aterials costs and fixed

m

ass production cost allocation yielded lower per-unit costs for handheld co

m

puters, s

m

art phones, and wireless

handheld co

m

puters, resulting in positive cost variances.

3.

S

ales

m

ix variances: The period-on-period sales

m

ix variance for products other than wireless handheld co

m

puters was negative. This was pri

m

arily due to a significant increase in the

proportion of high gross-profit-

m

argin sales of wireless handheld co

m

puters, resulting in a corresponding drop in the proportions of other products. Thus the sales

m

ix variance for

wireless handheld co

m

puters was positive, but negative for other products, yielding an overall positive for sales

m

ix variance.

4. Volu

m

e variance: There was a slight increase in sales volu

m

e over the sa

m

e ti

m

e in the previous period. Extrapolation of a corresponding increase in sales volu

m

e based on the sales

m

ix

proportions fro

m

the previous period resulted in a positive volu

m

e variance. In su

mm

ary, gross inco

m

e for the current period increased by

N

T$11,662,304,000.

VII

2. BUSINESS PER

F

ORMANCE

(1) Op

e

r

a

t

i

ng R

e

su

l

t

s

:

Comp

a

r

a

t

i

v

e

An

a

l

ys

i

s T

a

b

l

e

U

nit :

N

T$ thousands

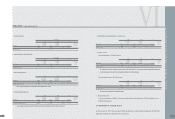

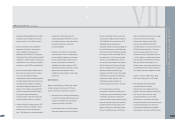

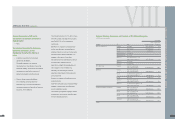

Year

Item

2007 2006

Difference %

REVENUES

118,579,958 104,816,548 13,763,410 13

COST OF REVENUES

72,880,172 70,779,066 2,101,106 3

GROSS PROFIT

45,699,786 34,037,482 11,662,304 34

(UNREALIZED) REALIZED PROFIT FROM

INTERCOMPANY TRANSACTIONS

( 11,064) ( 148,934) 137,870 ( 93)

REALIZED GROSS PROFIT

45,688,722 33,888,548 11,800,174 35

OPERATING EXPENSES

14,665,297 7,336,582 7,328,715 100

OPERATING INCOME

31,023,425 26,551,966 4,471,459 17

NONOPERATING INCOME AND GAINS

1,810,908 1,234,336 576,572 47

NONOPERATING EXPENSES AND LOSSES

683,036 828,424 ( 145,388) ( 18)

Income from continuing operations before income tax

32,151,297 26,957,878 5,193,419 19

INCOME TAX

( 3,212,435) ( 1,710,551) ( 1,501,884) 88

Income from continuing operations

28,938,862 25,247,327 3,691,535 15

N

ote 1: Analysis and explanation of the percentage of increase/decrease for the

m

ost recent two fiscal years

(

when the change in gross inco

m

e is 20 percent or

m

ore, a separate discrepancy

analysis

(

Table 2

)

shall also be prepared

)

:

Explanation:

(

1

)

The period-on-period increase in operating revenue and operating expenses was due to serial launches of products with new functions, resulting in continuous growth in operating

revenue. The operating revenue growth rate was higher than the operating expenses growth rate due to an increase in the proportion of non-

O

EM business.

(

2

)

The period-on-period decrease in unrealized profits a

m

ong affiliated co

m

panies was pri

m

arily due to relatively stable inventory levels at subsidiaries during the current period,

relative to the larger changes of the previous period, resulting in lower unrealized profits.

(

3

)

The period-on-period increase in operating expenses was pri

m

arily due to a significant increase in allocations for after-sales service costs, expansion of sales locations and

personnel, and

m

arketing and advertising fees in response to own-brand and teleco

m

provider brand business growth. The rate of growth in net operating profit was slightly higher

than in operating revenue due to setting aside a portion of gross inco

m

e for invest

m

ent in quality upgrades for own-brand global operations,

m

arketing, and after-sales service.

(

4

)

The increase in non-operating revenue and profits was pri

m

arily due to an increase in ti

m

e deposits and interest inco

m

e; there were also increased foreign exchange gains due to

appreciation of the Euro.

N

ote 2:

R

eason for change of the co

m

pany

'

s principal line of business:

H

TC has not changed its principal line of business.

N

ote 3: The sales volu

m

e forecast for the co

m

ing fiscal year, its basis and potential i

m

pact on future co

m

pany finances and operations, and responsive

m

easures. Please refer to the

S

hareholders

'

R

eport for the sales volu

m

e forecast and its basis.

SPECIAL N OTESI BUSINESS PER

F

ORMANCE

l