HTC 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

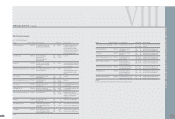

207206

VII

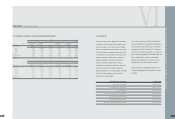

A REVIEW AND ANALYSIS OFTHE COMPANY'S FINANCIAL CONDITION

AND OPERATING RESULTS,AND A LISTING OFRISKS

1.

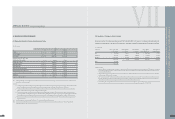

F

INANCIAL CONDITION

U

nit :

N

T$ thousands

Difference

Item

2007 2006

Amount

%

current assets

83,172,719 61,810,772 21,361,947 35

long-term investments

2,899,109 824,481 2,074,628 252

Properties

3,715,901 2,909,624 806,277 28

other assets

656,817 449,300 207,517 46

Total assets

90,444,546 65,994,177 24,450,369 37

current liabilities

34,368,139 23,421,319 10,946,820 47

Long-term liabilities

-- 0 0

other liabilities

628 640 ( 12) ( 2)

Total liabilities

34,368,767 23,421,959 10,946,808 47

Capital stock

5,731,337 4,364,192 1,367,145 31

Capital surplus

4,415,845 4,452,688 ( 36,843) ( 1)

Retained earnings

45,920,120 33,988,785 11,931,335 35

Equity adjustments

8,477 10,548 ( 2,071) ( 19)

Treasury stock

0( 243,995) 243,995 (100)

Total stockholders' equity

56,075,779 42,572,218 13,503,561 32

N

ote: Explanations of the

m

ain reasons for and the i

m

pact of any

m

aterial changes

(

a change fro

m

the previous period of 20 percent or

m

ore and a

m

ounting to at least

N

T$10

m

illion

)

in

H

TC

'

s

assets, liabilities, and shareholders

'

equity in the

m

ost recent two fiscal years, and the plan for related future

m

easures.

Explanation:

(

1

)

The increase in current assets for the period was pri

m

arily due to an increase in current-period operating revenue and profits and the corresponding increase in bank deposits.

(

2

)

The increase in long-ter

m

invest

m

ents for the current period was pri

m

arily due to the establish

m

ent and develop

m

ent of overseas sales locations, and new invest

m

ents in

H

TC Asia

Pacific,

H

TC A

m

erica,

H

TC Europe and the

S

hanghai

m

aintenance facilities.

(

3

)

The increase in fixed assets for the current period was pri

m

arily due to the co

m

pletion and initial use during the current period of the plants and office buildings

H

TC engaged others

to build on its own land.

(

4

)

Increases for other assets in the current period were pri

m

arily due to increases in deferred inco

m

e tax assets, resulting fro

m

increased allocations to warranty reserves and

m

arketing

fees payable based on an increase in revenues for the period.

(

5

)

The increase in current liabilities for the period was pri

m

arily due to increases in

m

arketing fees payable and warranty reserves resulting fro

m

own-brand and teleco

m

provider brand

business growth. Although there was a one-ti

m

e

N

T$1.67 billion royalty reserve reversal in the current year,

m

arketing fees payable and warranty reserves increased by

N

T$2.2 billion

and

N

T$2.1 billion respectively fro

m

the previous period, which also increased current liabilities for the period.

(

6

)

The increase in capital stock for the period was pri

m

arily due to a capital increase out of undistributed earnings and e

m

ployee bonuses in the current period. In 2007

H

TC retired all

treasury stock, a total of 3,624,000 shares.

(

7

)

The increase in retained earnings for the period was pri

m

arily due to a net basic inco

m

e inflow in the current period.

A REVIEW AND A NALYSIS OF THE C OMPANY'S

FINANCIAL CO NDITIO N AND OPERATIN G RESULTS,

AND A LISTIN G OF RISKS