HTC 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105104

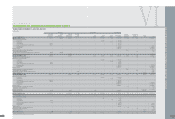

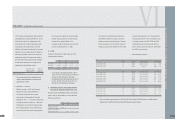

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

VI

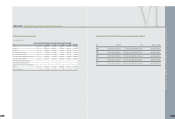

2005 2006 2007

Before After Before After Before After

Income Tax Income Tax Income Tax Income Tax Income Tax Income Tax

NT$ NT$ NT$ NT$ NT$ US$ (Note 3) NT$ US$(Note 3)

BASIC EARNINGS PER SHARE (Note 24) $ 21.20 $ 20.55 $ 46.65 $ 43.69 $ 56.08 $ 1.73 $ 50.48 $ 1.56

DILUTED EARNINGS PER SHARE (Note 24) $ 21.02 $ 20.37 $ 46.11 $ 43.18 $ 56.08 $ 1.73 $ 50.48 $ 1.56

(

Concluded

)

The acco

m

panying notes are an integral part of the financial state

m

ents.

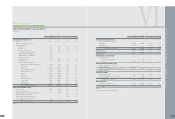

H I G H T E C H C O M P U T E R C O R P.

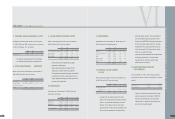

STATEMENTS O

F

INCOME

YEARS ENDED DECEMBER 31, 2005, 2006 AND 2007

(In Thousands, Except Earnings Per Share)

2005 2006 2007

NT$ NT$ NT$ US$ (Note 3)

REVENUES (Notes 2 and 26) $ 72,768,522 $ 104,816,548 $ 118,579,958 $ 3,656,490

COST OF REVENUES (Notes 22 and 26) 54,758,040 70,779,066 72,880,172 2,247,307

GROSS PROFIT 18,010,482 34,037,482 45,699,786 1,409,183

UNREALIZED PROFIT FROM INTERCOMPANY TRANSACTIONS (15,077) (164,011 ) (175,075 ) (5,399)

REALIZED PROFIT FROM INTERCOMPANY TRANSACTIONS 6,289 15,077 164,011 5,057

REALIZED GROSS PROFIT 18,001,694 33,888,548 45,688,722 1,408,841

OPERATING EXPENSES (Notes 22 and 26)

Selling ad marketing 2,111,023 3,721,640 9,871,469 304,393

General and administrative 650,877 660,515 927,680 28,606

Research and development 2,399,315 2,954,427 3,866,148 119,215

Total operating expenses 5,161,215 7,336,582 14,665,297 452,214

OPERATING INCOME 12,840,479 26,551,966 31,023,425 956,627

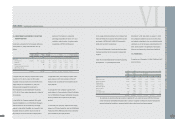

NONOPERATING INCOME AND GAINS

Interest income 145,042 438,982 816,136 25,166

Gain on equity-method investments - - 103,997 3,207

Gain on sale of properties 5,372 41,361 2,120 65

Gain on physical inventory 2,074 - - -

Foreign exchange gain (Note 2) - 603,127 658,247 20,298

Valuation gain on financial assets (Notes 2, 4 and 6) 60,085 - - -

Other 65,487 150,866 230,408 7,105

Total nonoperating income and gains 278,060 1,234,336 1,810,908 55,841

NONOPERATING EXPENSES AND LOSSES

Interest expense 19,821 298 241 7

Losses on equity-method investments (Notes 2 and 14) 35,112 12,554 - -

Losses on disposal of properties 2,521 3,377 662 20

Loss on physical inventory - 2,032 409 13

Foreign exchange loss (Note 2) 299,005 - - -

Provision for loss on inventories 584,174 729,310 487,479 15,032

Valuation loss on financial liabilities (Notes 2, 4 and 6) - 76,470 96,256 2,968

Other 21,967 4,383 97,989 3,022

Total nonoperating expenses and losses 962,600 828,424 683,036 21,062

INCOME BEFORE INCOME TAX 12,155,939 26,957,878 32,151,297 991,406

INCOME TAX (Notes 2 and 23) (373,995) (1,710,551 ) (3,212,435 ) (99,058)

NET INCOME $ 11,781,944 $ 25,247,327 $ 28,938,862 $ 892,348

(

Continue

)