HTC 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

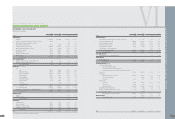

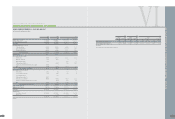

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

171170

When treasury stocks are sold and the selling

price is above the book value, the difference

should be credited to the capital surplus -

treasury stock transactions. If the selling price is

below the book value, the difference should first

be offset against capital surplus from the same

class of treasury stock transactions, and any

remainder should be debited to retained

earnings. The carrying value of treasury stocks

should be calculated using the weighted-

average method.

When the Company's treasury stock is retired,

the treasury stock account should be credited,

and the capital surplus - premium on stock

account and capital stock account should be

debited proportionately according to the share

ratio. The difference should be credited to

capital surplus or debited to capital surplus

and/or retained earnings.

>

F

or

e

i

gn Curr

e

n

c

i

e

s

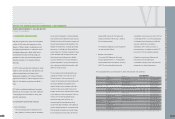

The financial statements of foreign operations

are translated into New Taiwan dollars at the

following exchange rates:

a. Assets and liabilities - at exchange rates

prevailing on the balance sheet date;

b. Stockholders' equity - at historical exchange

rates;

c. Dividends - at the exchange rate prevailing on

the dividend declaration date; and

d. Income and expenses - at average exchange

rates for the year.

Exchange differences arising from the translation

of the financial statements of foreign operations

are recognized as a separate component of

stockholders' equity. Such exchange differences

are recognized as gain or loss in the year in

which the foreign operations are disposed of.

Nonderivative foreign-currency transactions are

recorded in New Taiwan dollars at the rates of

exchange in effect when the transactions occur.

Exchange differences arising from the settlement

of foreign-currency assets and liabilities are

recognized as gain or loss.

At the balance sheet date, foreign-currency

monetary assets and liabilities are revalued at

prevailing exchange rates, and the exchange

differences are recognized as gain or loss.

At the balance sheet date, foreign-currency

nonmonetary assets (such as equity instruments)

and liabilities that are measured at fair value are

revalued at prevailing exchange rates, with the

exchange differences recognized as follows:

VI

> In

c

om

e

T

a

x

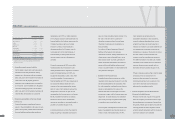

The Company adopted Statement of Financial

Accounting Standards No. 22 - "Accounting for

Income Taxes," which requires an asset and

liability approach to financial accounting and

reporting for income tax. Deferred income tax

assets and liabilities are computed annually for

differences between the financial statement and

tax bases of assets and liabilities that will result

in taxable or deductible amounts in the future

based on enacted tax laws and rates applicable

to the periods in which the differences are

expected to affect taxable income. Valuation

allowances are provided for deferred tax assets

that are not certain to be realized. Income tax

expense or benefit is the tax payable or

refundable for the period plus or minus the

change during the period in deferred tax assets

and liabilities.

Adjustment of prior years' income tax is added

to current income tax expense in the year the

adjustment is made.

Income tax of 10% on unappropriated earnings

is expensed in the year of stockholder approval,

which is the year right after the year of earnings

generation.

All subsidiaries file income tax returns based on

the regulations of their respective local

governments. In addition, there is no material

difference in the accounting principles on

income taxes between the parent company and

those of its subsidiaries.

> S

t

o

ck

-B

a

s

e

d Emp

l

oy

ee

Comp

e

ns

a

t

i

on P

l

a

ns

When the grant date of stock-based employee

compensation plans is on or after January 1,

2004, the Company applies the accounting

guidelines for stock-based compensation issued

by the Accounting

Research and Development Foundation of the

ROC. Under these guidelines, the fair value of

option compensation is recorded initially as an

asset. This asset is expensed ratably over the

service period, which is generally the period

over which the options vest.

> Tr

ea

sury S

t

o

ck

The Company adopted the Statement of

Financial Accounting Standards No. 30 -

"Accounting for Treasury Stocks," which

requires the treasury stock held by the

Company to be accounted for by the cost

method. The cost of treasury stock is shown as

a deduction to arrive at stockholders' equity,

while gain or loss from selling treasury stock is

treated as an adjustment to capital surplus.

FINANCEI CONSOLIDATED REPORT

l