HTC 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

211210

A REVIEW AND ANALYSIS OFTHE COMPANY'S FINANCIAL CONDITION

AND OPERATING RESULTS,AND A LISTING OFRISKS

5 THE COMPANY'S REINVESTMENT POLICY

F

OR THE MOST RECENT

F

ISCAL YEAR

(1) An

a

l

ys

i

s o

f

Equ

i

t

y Inv

e

s

t

m

e

n

t

s

U

nit :

N

T$ thousands

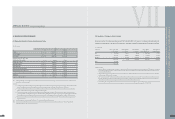

Amount Primary reason for Corrective Other future

Item (Note) Policy profits or losses plans investment plans

H.T.C. (B.V.I.) Corp.

632,042 Financial holding company: indirect Losses by the invested enterprise _ Please refer to (2)

investment in overseas maintenance,

installation, after-sales service, and .

market development companies

Hua-Chuang Automobile 500,000 Telematics Service Platform Operations are in the _ Please refer to (2)

Information Technical Center Co., Ltd expansion stage

High Tech Computer . 560,660 Investment Holding Gains by the invested enterprise _ Please refer to (2)

Aisa Pacific Pte. Ltd

High Tech Computer . 315,771 Provide overseas sales, maintenance, Regular income from providing sales and _ Please refer to (2)

Singapore Pte. Ltd and after-sales services. marketing services to parent company

N

ote: The invest

m

ent a

m

ount for the current fiscal year exceeds five percent of paid-in capital.

(2) Inv

e

s

t

m

e

n

t

P

l

a

nn

i

ng

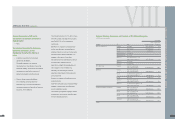

The projected mainland China investment plan

approved by the board of directors calls for HTC to

conduct a capital increase of US$9.6 million at its

mainland-area investment HIGH TECH COMPUTER

(SUZHOU) CO., LTD. through a capital increase at

H.T.C. (B.V.I.) Corp., and to acquire its mainland-area

investment, Wei-Hon Electronics (Shanghai) Ltd., and

establish a plant in Nanhui, Shanghai through a

capital increase at High Tech Computer Asia Pacific

VII

PTE. Ltd with a total investment of US$48 million.

HTC plans to implement these two mainland

investment projects after receiving approval from the

Investment Commission of Taiwan's Ministry of

Economic Affairs. Future investment plans will focus

on developing core business by expanding investment

in related businesses. Our ultimate goal is to reduce

product costs, boost overall product value, enhance

customer service, and improve the company's

operational performance.

3. CASH

F

LOW

(1) An

a

l

ys

i

s o

f

Ch

a

ng

e

i

n C

a

sh

F

l

ow

f

or Th

e

Mos

t

R

e

c

e

n

t

F

i

s

c

a

l

Y

ea

r

U

nit :

N

T$ thousands

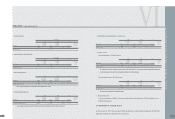

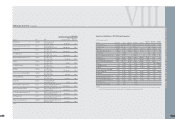

Item

2007 2006

%

Cash Flow Ratio (%)

116 106 9

Cash Flow Adequacy Ratio (%)

291 296 ( 2)

Cash Flow Reinvestment Ratio (%)

47 44 7

Explanation and analysis of change in increase/decrease ratios:

Analysis need not be conducted if the period-on-period change is less than 20 percent for the cash flow rate, cash flow adequacy ratio, and cash re-invest

m

ent rate.

(2) C

a

sh L

i

qu

i

d

i

t

y An

a

l

ys

i

s

f

or Th

e

Com

i

ng Y

ea

r

U

nit :

N

T$ thousands

Remedial measures for

projected cash deficit

Beginning cash Projected whole-year Projected whole-year Projected cash surplus

Financial

balance

cash flow from operating activities

cash outflow (deficit) amount

Investment plan management plan

55,036,232 39,232,609 29,879,137 64,389,704 - -

N

ote:

R

e

m

edial

m

easures for projected cash deficit:

N

ot Applicable

4. THE E

FF

ECT ON

F

INANCIAL OPERATIONS O

F

MATERIAL CAPITAL

EXPENDITURES DURING THE MOST RECENT

F

ISCAL YEAR.

(1) R

e

v

i

e

w

a

nd An

a

l

ys

i

s o

f

M

a

t

e

r

i

a

l

C

a

p

i

t

a

l

Exp

e

nd

i

t

ur

e

s

a

nd

F

und

i

ng Sour

c

e

s

> M

a

t

e

r

i

a

l

c

a

p

i

t

a

l

e

xp

e

nd

i

t

ur

e

u

t

ili

z

a

t

i

on

a

nd

f

und

i

ng sour

c

e

s

U

nit :

N

T$ thousands

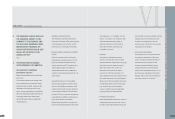

Planned items Actual or projected Actual or projected Total amount of Actual or projected capital utilization

sources of capital date of completion required capital Year 2006 Year 2007 Year 2008 Year 2009 Year 2010

Establishment of plants/offices, and Working capital Year 2008 1,079,918 372,131 587,349 120,438

purchase of machines and facilities

Purchase of machines and equipment Working capital Year 2008 610,329 610,329

Purchase of land for Working capital Year 2010 3,335,000 1,167,250 1,167,250 1,000,500

Taipei R&D headquarters building

> Pro

j

e

c

t

e

d b

e

n

e

f

i

t

s

• Establishment of plants/offices and the R&D building : Provide employees with appropriate and well-

planned working environments to meet company needs for sustainable operation

• Purchase of machines and facilities : To expand production capacity, reduce costs, and further increase

market share and operating income.

SPECIAL N OTESI CASH

F

LOW

l

CAPITAL EXPENDITURES

l

REINVESTMENT

l