HTC 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

129128

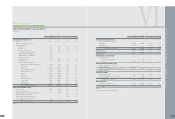

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

20.STOCKHOLDERS' EQUITY

> C

a

p

i

t

a

l

S

t

o

ck

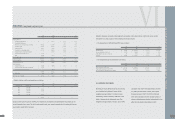

The Company's outstanding common stock as

of January 1, 2005 amounted to NT$2,714,276

thousand, divided into 271,427 thousand shares

at NT$10.00 par value. After the registration of

the conversion of bonds into 4,884 thousand

shares (NT$48,838 thousand) was completed,

these shares were transferred to common

stocks. In the first and second quarters of 2005,

holders of US$45,970 thousand in bonds

requested to convert their holdings into 12,452

thousand shares (NT$124,519 thousand). In

June 2005, the stockholders approved the

transfer of retained earnings amounting to

NT$577,527 thousand and employee bonuses

amounting to NT$105,000 thousand to capital

stock. As a result, the amount of the Company's

outstanding common stock as of December 31,

2005 increased to NT$3,570,160 thousand,

divided into 357,016 thousand common shares

at NT$10.00 par value.

In May 2006, the stockholders approved the

transfer of retained earnings amounting to

NT$714,032 thousand and employee bonuses

amounting to NT$80,000 thousand to capital

stock.

In April 2007, the Company retired 3,624

thousand treasury shares (NT$36,240

thousand, or US$1,118 thousand). Also, in June

2007, the stockholders approved the transfer of

retained earnings amounting to NT$1,298,385

thousand (US$40,036 thousand) and employee

bonuses amounting to NT$105,000 thousand

(US$3,238 thousand) to capital stock. As a

result, the amount of the Company's outstanding

common stock as of December 31, 2007

increased to NT$5,731,337 thousand

(US$176,729 thousand), divided into 573,134

thousand common shares at NT$10.00

(US$0.30) par value.

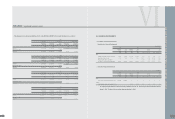

In their meeting on December 11, 2002, the

Company's Board of Directors resolved to issue

7,000 thousand units of employee stock options

in accordance with Article 28.3 of the Securities

and Exchange Law. Each option represents the

right to buy one newly issued common share of

the Company. The exercise price is the closing

price of the Company's common shares on the

option issuance date or the share par value,

whichever is higher. The option holders can

exercise their right for up to 35% of the granted

option units no earlier than two years from the

grant date. After three years from the grant date,

VI

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

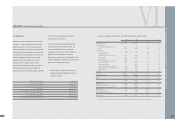

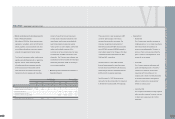

Service cost $ 44,766 $ 5,259 $ 4,930 $ 152

Interest cost 10,042 9,400 8,591 265

Projected return on plan assets ( 5,782) ( 10,320) ( 8,979 ) ( 277)

Amortization of unrecognized net transition obligation, net - - - -

Amortization of net pension benefit 6,154 1,708 2,182 67

Net pension cost $ 55,180 $ 6,047 $ 6,724 $ 207

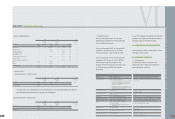

The reconciliation between pension fund status and prepaid pension cost as of December 31, 2005, 2006

and 2007 is as follows:

2005 2006 2007

NT$ NT$ NT$ US$(Note 3)

Present actuarial value of benefit obligation

Vested benefits $ 792 $ - $ - $ -

Non-vested benefits 127,313 153,371 170,751 5,265

Accumulated benefit obligation 128,105 153,371 170,751 5,265

Additional benefits on future salaries 161,127 159,023 145,588 4,489

Projected benefit obligation 289,232 312,394 316,339 9,754

Plan assets at fair value ( 274,197) ( 311,532) ( 348,439 ) ( 10,744)

Funded status 15,035 862 ( 32,100 ) ( 990)

Unrecognized pension loss ( 64,795) ( 74,882) ( 63,087 ) ( 1,945)

Prepaid pension cost $( 49,760) $( 74,020) $( 95,187) $( 2,935)

Assumptions used in actuarially determining the present value of the projected benefit obligation were as

follows:

2005 2006 2007

Weighted-average discount rate 3.25% 2.75% 2.75%

Assumed rate of increase in future compensation 4.75% 4.25% 4.00%

Expected long-term rate of return on plan assets 3.25% 2.75% 2.75%

•The vested benefits as of

D

ece

m

ber 31, 2005, 2006 and 2007 a

m

ounted to

N

T$962 thousand,

N

T$0 thousand and

N

T$0

thousand, respectively.

FINANCEI INDEPENDENT AUDITORS' REPORT

l