HTC 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

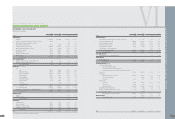

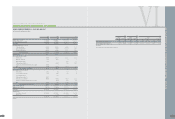

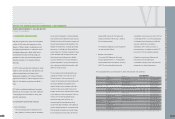

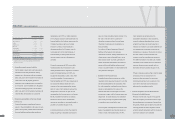

AN OVERVIEW OFTHE COMPANY'S FINANCIAL STATUS

169168

judgment, and any known factors that would

significantly affect the accruals. In addition,

depending on the nature of relevant events, the

accrued marketing expenses are accounted for

as an increase in marketing expenses or as a

decrease in revenues.

> R

e

s

e

rv

e

f

or W

a

rr

a

n

t

y Exp

e

ns

e

s

The Company provides warranty service for one

to two years depending on the contract with

customers. The warranty liability is estimated on

the basis of management's evaluation of the

products under warranty, past warranty

experience, and pertinent factors.

> Bonds P

a

y

a

b

l

e

Bonds are issued at face value and recorded as

bonds payable. Each month's interest expense

is booked at face value multiplied by the stated

interest rate. For bonds sold under repurchase

agreements, interest is calculated at the

repurchase value and recognized as interest

expense by period. The direct and necessary

expenses of issuing convertible bonds are

recorded as issuance expenses and amortized

from the issuance date to the maturity date. On

the conversion of convertible bonds,

unamortized issue costs, interest expense that

is accreted to the date of conversion but need

not be paid, recognized interest premium, and

the par value of the bonds are written off. The

common stock should be valued at the carrying

amount net of the amounts written off, and the

difference of this net amount from the par value

of the common stock is recognized as additional

paid-in capital.

> P

e

ns

i

on P

l

a

n

Under the ROC Labor Standards Law (the

"Law"), which provides for a defined benefit

pension plan, the Company has a pension plan

covering all eligible employees. Based on the

Statement of Financial Accounting Standards

No. 18 - "Accounting for Pensions" issued by the

Accounting Research and Development

Foundation of the ROC, pension cost under the

defined benefit pension plan should be

calculated by the actuarial method. The Labor

Pension Act (the "Act), which provides for a new

defined contribution plan, took effect on July 1,

2005. Employees already covered by the Law

can choose to remain to be subject to the

pension mechanism under the Law or to be

subject to the Act. Under the Act, the rate of an

employer's monthly contribution to the pension

fund should be at least 6% of the employee's

monthly wages, and the contribution should be

recognized as pension expense in the income

statement.

VI

Depreciation is calculated on a straight-line

basis over the estimated service lives of the

assets plus one additional year for salvage

value: buildings(including auxiliary equipments)

- 3 to 50 years; machinery and equipment - 3 to

5 years; office equipment - 3 to 5 years;

transportation equipment - 5 years; and

leasehold improvements - 3 years.

> Goodw

ill

Goodwill is the consideration paid for an

acquisition in excess of the fair value of

identifiable net assets acquired. Before January

1, 2006, goodwill was amortized using the

straight-line method over the estimated life of 10

years. Effective January 1, 2006, based on the

newly revised Statement of Financial Accounting

Standards No. 25 - "Business Combinations -

Accounting Treatment under the Purchase

Method," goodwill is no longer amortized and is

instead tested for impairment annually. If

circumstances show that the fair value of

goodwill has become lower than its carrying

amount, an impairment loss is recognized. A

reversal of this impairment loss is not allowed.

> D

e

f

e

rr

e

d Ch

a

rg

e

s

Deferred charges are telephone installation

charges, computer software costs and deferred

license fees. Installation charges and computer

software are amortized on a straight-line basis

over 3 years, and deferred license fees, over 10

years.

> Ass

e

t

Imp

a

i

rm

e

n

t

If the recoverable amount of an asset is

estimated to be less than its carrying amount,

the carrying amount of the asset is reduced to

its recoverable amount. An impairment loss is

charged to earnings unless the asset is carried

at a revalued amount, in which case the

impairment loss is treated as a deduction to the

unrealized revaluation increment.

If an impairment loss subsequently reverses, the

carrying amount of the asset is increased

accordingly, but the increased carrying amount

may not exceed the carrying amount that would

have been determined had no impairment loss

been recognized for the asset in prior years. A

reversal of an impairment loss is recognized in

earnings, unless the asset is carried at a

revalued amount, in which case the reversal of

the impairment loss is treated as an increase in

the unrealized revaluation increment. A reversal

of an impairment loss on goodwill is disallowed.

> A

cc

ru

e

d M

a

r

k

e

t

i

ng Exp

e

ns

e

s

The Company accrues marketing expenses on

the basis of agreements, management's

FINANCEI CONSOLIDATED REPORT

l